- United States

- /

- Construction

- /

- NasdaqCM:LMB

Investors Appear Satisfied With Limbach Holdings, Inc.'s (NASDAQ:LMB) Prospects As Shares Rocket 27%

Limbach Holdings, Inc. (NASDAQ:LMB) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The annual gain comes to 113% following the latest surge, making investors sit up and take notice.

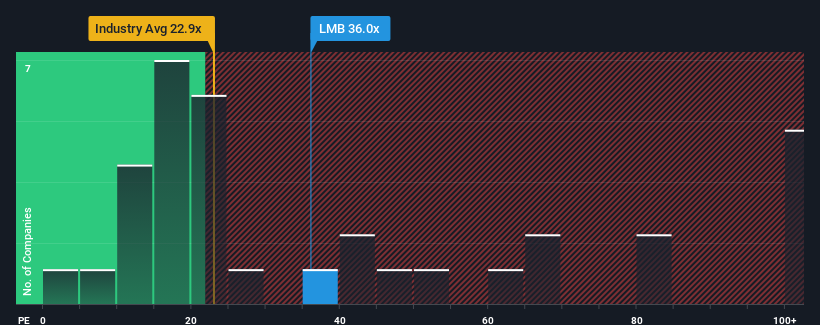

After such a large jump in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 16x, you may consider Limbach Holdings as a stock to avoid entirely with its 36x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

We check all companies for important risks. See what we found for Limbach Holdings in our free report.Limbach Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Limbach Holdings

How Is Limbach Holdings' Growth Trending?

In order to justify its P/E ratio, Limbach Holdings would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 43% last year. The strong recent performance means it was also able to grow EPS by 296% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 18% each year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader market.

In light of this, it's understandable that Limbach Holdings' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Limbach Holdings' P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Limbach Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Limbach Holdings with six simple checks on some of these key factors.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives