- United States

- /

- Construction

- /

- NasdaqCM:LMB

How Analyst Optimism and Insider Buying Are Reshaping Limbach Holdings' (LMB) Investment Outlook

Reviewed by Sasha Jovanovic

- In recent days, Limbach Holdings garnered renewed attention as analysts maintained positive recommendations and insiders increased their share purchases, signaling elevated confidence in the company's outlook.

- Industry analysts cite continued optimism about Limbach's long-term performance, reinforced by insider buying and a consensus of outperform ratings from multiple firms.

- With insider buying activity strengthening analyst sentiment, we will explore how this renewed confidence shapes Limbach Holdings’ investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Limbach Holdings Investment Narrative Recap

To hold Limbach Holdings, investors need to believe in the company’s shift to recurring Owner Direct Relationship (ODR) revenue and its ability to grow earnings while integrating acquisitions like Pioneer Power. The recent reaffirmation of positive analyst ratings and ongoing insider share purchases may bolster sentiment, but these developments do not materially change the most immediate catalyst, upcoming Q3 earnings, or reduce the short-term risk of integration challenges and margin pressure from recent M&A activity.

Among Limbach’s recent announcements, the scheduled release of third-quarter results on November 4 stands out. This event will allow investors to assess whether revenue growth, margin trends, and integration progress are tracking with the company’s upgraded 2025 guidance, providing concrete evidence amid optimism from analysts and insiders.

However, investors should also be aware that even with strong insider and analyst confidence, there remains a risk around integration of acquisitions and its impact on margins if ...

Read the full narrative on Limbach Holdings (it's free!)

Limbach Holdings is projected to reach $922.5 million in revenue and $70.5 million in earnings by 2028. This outlook is based on an anticipated 18.6% annual revenue growth and a $35.2 million increase in earnings from the current $35.3 million.

Uncover how Limbach Holdings' forecasts yield a $137.25 fair value, a 46% upside to its current price.

Exploring Other Perspectives

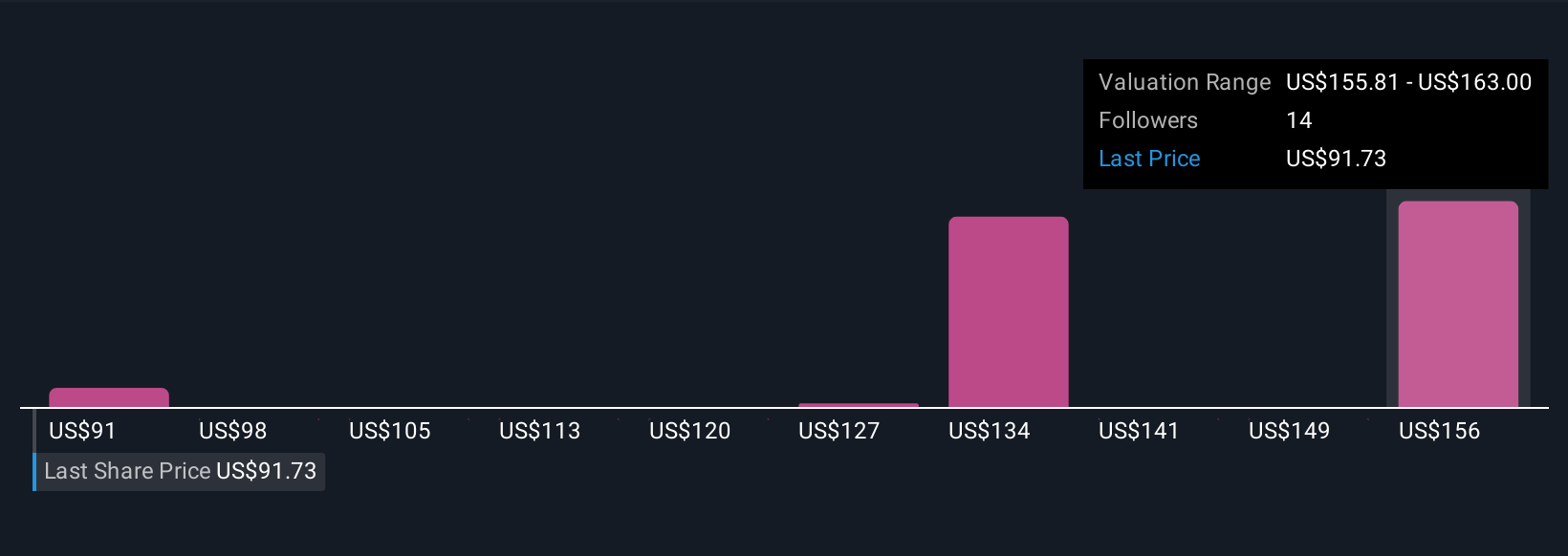

Seven member-generated fair value estimates from the Simply Wall St Community span from US$91.10 to US$163. While most analysts highlight recurring revenue as a catalyst, these sharply different perspectives show how varied investor confidence in Limbach’s future can be.

Explore 7 other fair value estimates on Limbach Holdings - why the stock might be worth just $91.10!

Build Your Own Limbach Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Limbach Holdings research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Limbach Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Limbach Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives