- United States

- /

- Construction

- /

- NasdaqCM:LMB

Does Margin Expansion at Limbach Holdings (LMB) Signal a Lasting Shift in Its Growth Narrative?

Reviewed by Sasha Jovanovic

- Limbach Holdings recently reported improved operating margins and profitability, driven by effective cost structure adjustments and stronger earnings performance.

- This operational progress has enhanced the company's profile at a time when investors are closely watching small-cap firms with increased resilience in their business models.

- We'll explore how Limbach's refined cost structure and margin gains could impact the company's growth narrative and outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Limbach Holdings Investment Narrative Recap

To be a shareholder in Limbach Holdings, you likely see value in its shift to high-margin recurring service contracts and commitment to disciplined cost management. The recent news of improved operating margins supports this view, but integration risks linked to its largest acquisition, Pioneer Power, remain the key short-term concern. The news does not materially change this risk, since ongoing margin improvement still depends on successful integration and sustained revenue growth.

The most relevant recent announcement is Limbach's raised 2025 revenue guidance, now set at US$650 million to US$680 million. This outlook aligns with improved execution on cost structure but also puts focus on whether the company can maintain margin gains while managing the demands of integrating new acquisitions. Contrast this with...

Read the full narrative on Limbach Holdings (it's free!)

Limbach Holdings' narrative projects $922.5 million revenue and $70.5 million earnings by 2028. This requires 18.6% yearly revenue growth and a $35.2 million earnings increase from $35.3 million today.

Uncover how Limbach Holdings' forecasts yield a $137.25 fair value, a 54% upside to its current price.

Exploring Other Perspectives

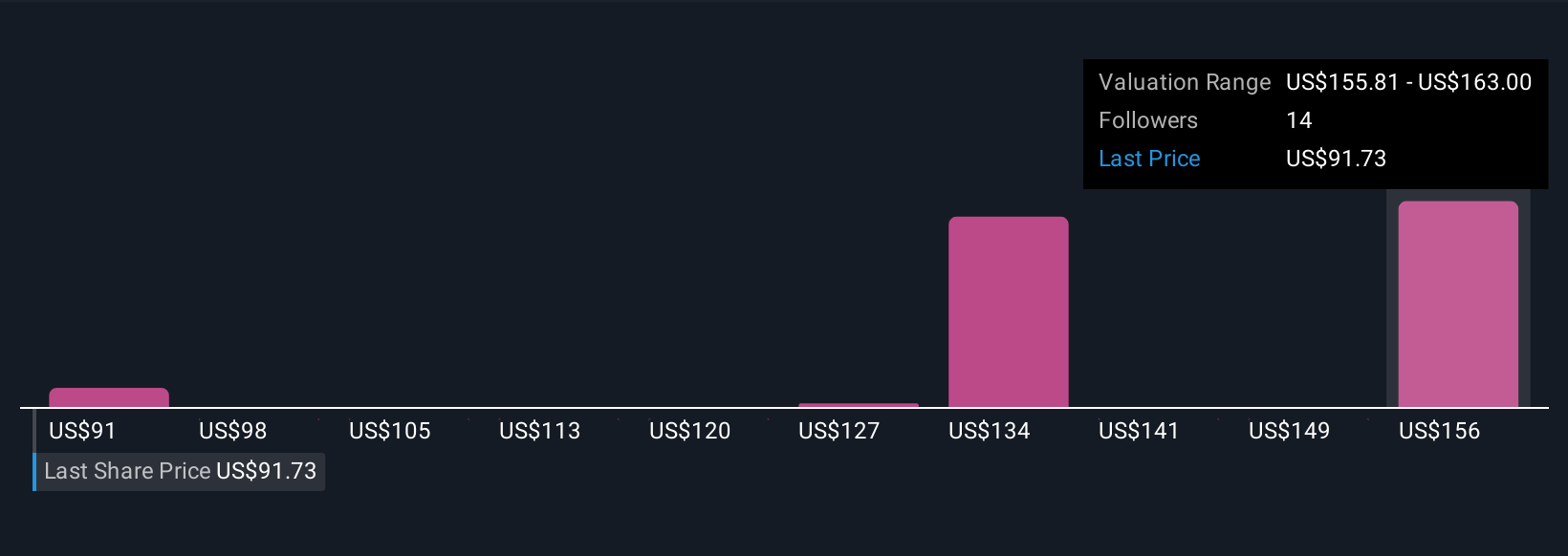

Six different Simply Wall St Community fair value estimates range from US$91.10 to US$163, reflecting wide differences in growth forecasts and market sentiment. Some expect recurring service revenue growth to boost long-term returns, while others remain cautious about the success of recent acquisitions and integration efforts; you can weigh these contrasts to form your own view.

Explore 6 other fair value estimates on Limbach Holdings - why the stock might be worth just $91.10!

Build Your Own Limbach Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Limbach Holdings research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Limbach Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Limbach Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives