- United States

- /

- Machinery

- /

- NasdaqCM:LIQT

Take Care Before Jumping Onto LiqTech International, Inc. (NASDAQ:LIQT) Even Though It's 28% Cheaper

Unfortunately for some shareholders, the LiqTech International, Inc. (NASDAQ:LIQT) share price has dived 28% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 37% share price drop.

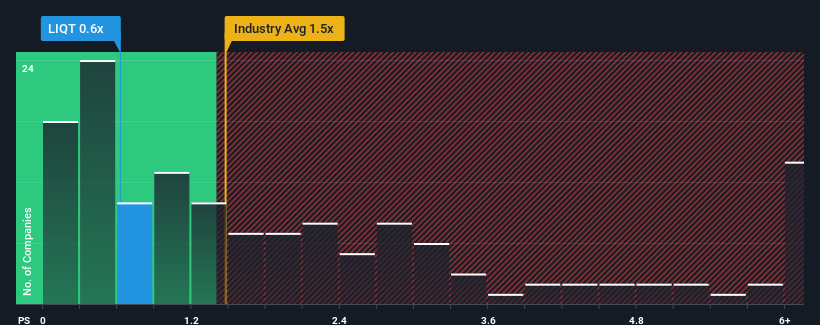

Following the heavy fall in price, it would be understandable if you think LiqTech International is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.6x, considering almost half the companies in the United States' Machinery industry have P/S ratios above 1.5x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for LiqTech International

How LiqTech International Has Been Performing

With revenue growth that's superior to most other companies of late, LiqTech International has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LiqTech International.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like LiqTech International's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The solid recent performance means it was also able to grow revenue by 12% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 25% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.6%, which is noticeably less attractive.

With this in consideration, we find it intriguing that LiqTech International's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

LiqTech International's recently weak share price has pulled its P/S back below other Machinery companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

LiqTech International's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

And what about other risks? Every company has them, and we've spotted 4 warning signs for LiqTech International you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LIQT

LiqTech International

A clean technology company, engages in the development, design, production, marketing, and sale of automated filtering systems, ceramic silicon carbide liquid applications, and diesel particulate air filters in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Adequate balance sheet slight.

Market Insights

Community Narratives