- United States

- /

- Aerospace & Defense

- /

- OTCPK:LILM.F

Lilium N.V.'s (NASDAQ:LILM) last week's 11% decline must have disappointed individual investors who have a significant stake

Key Insights

- Lilium's significant individual investors ownership suggests that the key decisions are influenced by shareholders from the larger public

- The top 7 shareholders own 50% of the company

- Insiders own 19% of Lilium

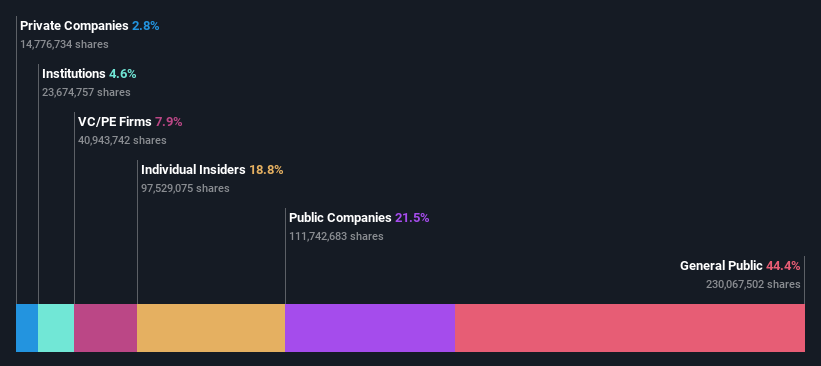

A look at the shareholders of Lilium N.V. (NASDAQ:LILM) can tell us which group is most powerful. We can see that individual investors own the lion's share in the company with 44% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And last week, individual investors endured the biggest losses as the stock fell by 11%.

In the chart below, we zoom in on the different ownership groups of Lilium.

See our latest analysis for Lilium

What Does The Institutional Ownership Tell Us About Lilium?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

Since institutions own only a small portion of Lilium, many may not have spent much time considering the stock. But it's clear that some have; and they liked it enough to buy in. So if the company itself can improve over time, we may well see more institutional buyers in the future. We sometimes see a rising share price when a few big institutions want to buy a certain stock at the same time. The history of earnings and revenue, which you can see below, could be helpful in considering if more institutional investors will want the stock. Of course, there are plenty of other factors to consider, too.

Lilium is not owned by hedge funds. Tencent Holdings Limited is currently the company's largest shareholder with 22% of shares outstanding. Atomico Investment Holdings Limited is the second largest shareholder owning 7.9% of common stock, and Hans-Adam II. von und zu Liechtenstein holds about 7.0% of the company stock.

We did some more digging and found that 7 of the top shareholders account for roughly 50% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Lilium

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Lilium N.V.. Insiders own US$94m worth of shares in the US$499m company. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

The general public, who are usually individual investors, hold a 44% stake in Lilium. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

With an ownership of 7.9%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Public Company Ownership

It appears to us that public companies own 22% of Lilium. We can't be certain but it is quite possible this is a strategic stake. The businesses may be similar, or work together.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Lilium is showing 5 warning signs in our investment analysis , and 3 of those are potentially serious...

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:LILM.F

Lilium

Engages in the research and development of electric vertical takeoff and landing aircrafts and jet for use in high-speed air transport system for people and goods.

Medium-low with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives