- United States

- /

- Construction

- /

- NasdaqGS:LGN

Legence (LGN): Assessing Valuation After Recent Share Price Momentum and Revenue Growth

Reviewed by Simply Wall St

See our latest analysis for Legence.

Legence’s 1-month share price return of 14% highlights building momentum, especially with a year-to-date gain now sitting at 18%. This upward shift signals a renewed sense of optimism around the company as investors respond to recent growth and operational progress.

If this recent rally has you watching for the next breakout, consider expanding your search and discover fast growing stocks with high insider ownership

With shares rallying and growth metrics on the rise, the key question now is whether Legence is trading at a bargain or if the market has already factored in its future potential, which could leave little room for upside.

Price-to-Sales of 1x: Is it justified?

Legence is currently valued at a price-to-sales ratio of 1x, which places its valuation beneath both its industry and peer averages. With a last close price of $36.12 and peers commanding higher sales multiples, the company looks attractively priced based on revenue.

The price-to-sales (P/S) ratio measures how much investors are willing to pay per dollar of sales. This is a particularly useful metric for companies that are unprofitable, like Legence. In cyclical sectors such as construction, revenue-based multiples can reveal relative market optimism or skepticism where earnings are volatile or negative.

For Legence, the 1x P/S ratio stands out against the US Construction industry average of 1.4x and the peer group’s average of 2x. This direct comparison with the sector shows the market is discounting Legence's shares more heavily than those of its competitors, possibly leaving room for revaluation if performance improves.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 1x (UNDERVALUED)

However, sustained net losses and ongoing sector volatility remain key risks. These factors could quickly reverse current optimism if not addressed in upcoming quarters.

Find out about the key risks to this Legence narrative.

Another View: Discounted Cash Flow Perspective

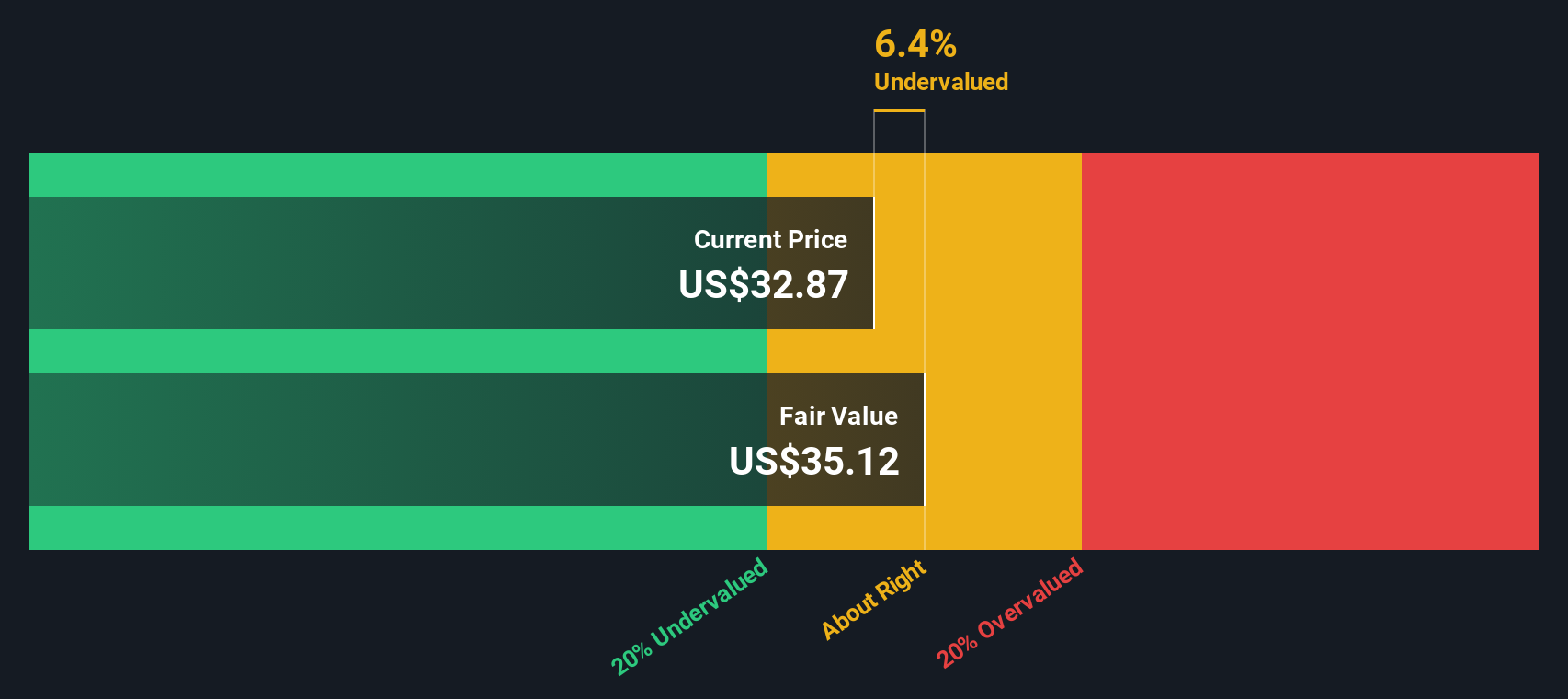

While Legence’s current share price trades below peers based on sales, our DCF model points to a different story. According to this method, Legence’s recent price of $36.12 sits slightly above our fair value estimate of $35.04, which suggests the market may be pricing in more optimism than fundamentals support.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Legence for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Legence Narrative

If you have a different take or want to dig into the numbers yourself, you can easily build your own perspective on Legence in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Legence.

Looking for more investment ideas?

Don't let fresh opportunities pass you by. Experience the power of the Simply Wall Street Screener and get ahead with original stock ideas tailored for forward-thinking investors.

- Capture the explosive growth potential in artificial intelligence by starting with these 27 AI penny stocks. See which companies are making real breakthroughs in this transformative sector.

- Unlock hidden value and spot stocks trading below their intrinsic worth when you tap into these 876 undervalued stocks based on cash flows for real-time opportunities that others might miss.

- Maximize your portfolio’s income stream by securing steady returns through these 17 dividend stocks with yields > 3%, which features companies committed to rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LGN

Legence

Provides engineering, installation, and maintenance services for mission-critical systems in buildings in United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives