- United States

- /

- Machinery

- /

- NasdaqGS:LECO

Lincoln Electric (LECO): Valuation Snapshot Following Dividend Boost and Management Confidence

Reviewed by Simply Wall St

Lincoln Electric Holdings (LECO) just announced a 5.3% increase to its quarterly cash dividend, now at $0.79 per share or $3.16 annually. This move indicates management’s confidence in the company’s financial momentum.

See our latest analysis for Lincoln Electric Holdings.

Lincoln Electric’s upbeat dividend news comes as the company enjoys sustained momentum, with its share price up nearly 31% year-to-date and a one-year total shareholder return of 26.7%. This builds on strong multi-year gains and reflects investors’ confidence in the company’s steady growth and commitment to rewarding shareholders.

If you’re interested in finding more standouts with strong fundamentals and capable leadership, now’s an ideal moment to discover fast growing stocks with high insider ownership

But with shares surging and expectations running high, investors have to ask: Is Lincoln Electric still trading at an attractive value, or has the market already priced in its future growth potential?

Most Popular Narrative: 6.9% Undervalued

Compared to Lincoln Electric’s last close at $241.81, the most popular narrative suggests a fair value that stands distinctly higher. The narrative highlights current optimism but also hints there is more at play beneath this headline number.

“Bullish analysts view Lincoln Electric as extremely well positioned to capitalize on global automation trends, supporting sustained revenue growth. There is strong belief that the company stands at the center of the electrification movement, which is expected to drive increased demand for its solutions across multiple industries.”

Do you want to see what analyst assumptions are powering this premium? The math behind this narrative leans on rising earnings, ambitious profit targets, and big bets on industry transformation. Wondering which forecasts tip the scales in favor of Lincoln Electric’s current value? Discover the full details that could surprise even seasoned investors.

Result: Fair Value of $259.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if international demand remains sluggish or if Lincoln Electric relies too much on price hikes rather than true sales growth, these bullish assumptions could be tested.

Find out about the key risks to this Lincoln Electric Holdings narrative.

Another View: What Do Market Multiples Suggest?

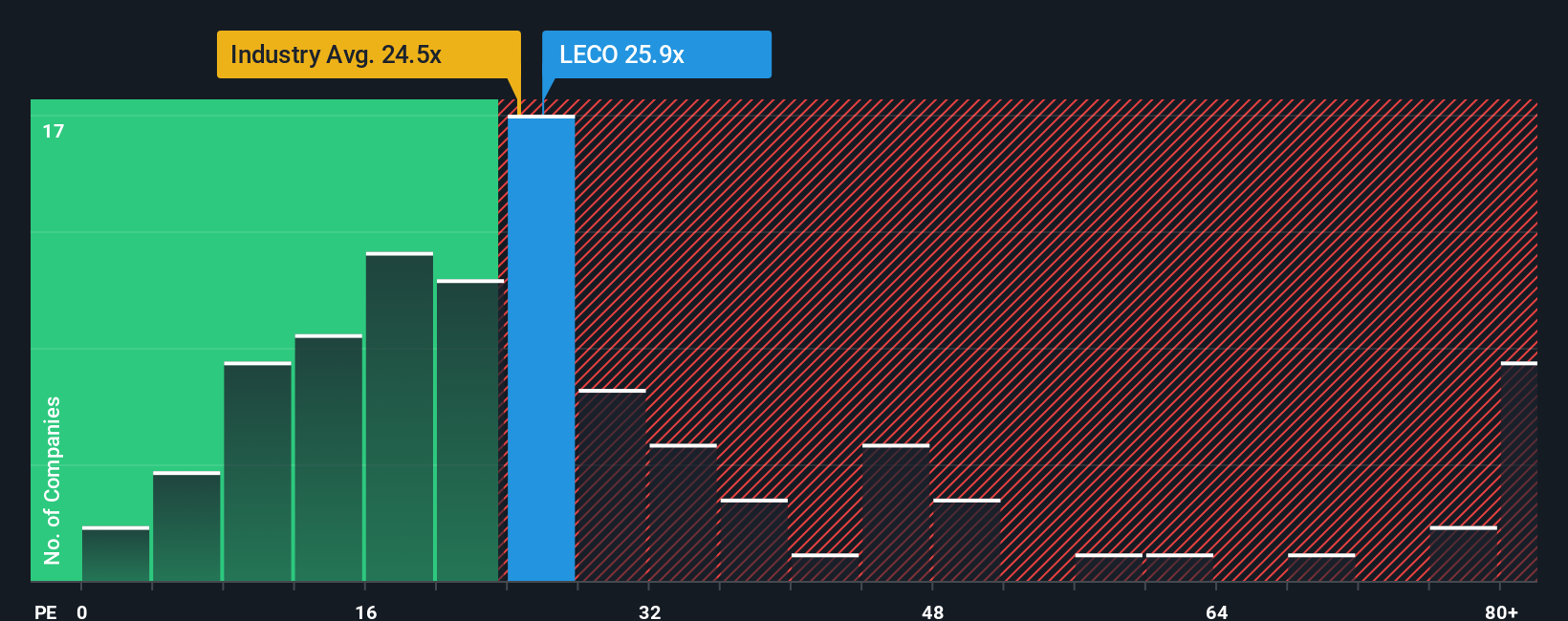

Looking through the lens of price-to-earnings, Lincoln Electric trades at 26.5 times earnings, a premium compared to the industry’s average of 24.6x and peer average of 27.5x. However, the fair ratio sits at 24x, a level the market could easily revert to. Does this leave the stock exposed if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lincoln Electric Holdings Narrative

If you see things differently or want to dig deeper yourself, you can assemble your own Lincoln Electric narrative in just a few minutes. Do it your way

A great starting point for your Lincoln Electric Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines while others act. Put the powerful Simply Wall Street Screener to work and pinpoint investment opportunities that align with your strategy.

- Uncover opportunities with strong yields by investing in companies that reward you with income. Check out these 17 dividend stocks with yields > 3%.

- Spot the trendsetters at the forefront of artificial intelligence by tapping into these 27 AI penny stocks and see which companies are pushing the limits of what’s possible.

- Capitalize on tomorrow’s technological leaps by unlocking your access to top players in the quantum computing space with these 28 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LECO

Lincoln Electric Holdings

Through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives