- United States

- /

- Machinery

- /

- NasdaqGS:LECO

Lincoln Electric (LECO): Evaluating Valuation After 30th Consecutive Annual Dividend Increase

Reviewed by Kshitija Bhandaru

Lincoln Electric Holdings (LECO) just announced a 5.3% increase to its quarterly cash dividend, now at $0.79 per share. This marks the company’s 30th consecutive year of raising its dividend payout.

See our latest analysis for Lincoln Electric Holdings.

Lincoln Electric’s commitment to raising its dividend comes as a result of impressive stock performance. With its share price up almost 29% so far this year and a 22% total return over the past twelve months, momentum has certainly been building. This reflects strong investor confidence in both the company’s growth outlook and its steady approach to rewarding shareholders.

If you’re looking for other opportunities among companies with similar momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The central question for investors now is whether Lincoln Electric’s impressive run leaves room for further upside, or if the recent momentum means the market has already priced in future growth potential.

Most Popular Narrative: 7% Undervalued

With the narrative fair value set at $256.30, about 7% above the recent closing price of $238.31, there is fresh debate over whether Lincoln Electric’s growth levers have been fully priced in. The latest forward-looking narrative lays out which business trends are expected to drive future value and what might challenge it.

The ongoing stabilization and strong quoting activity in automation, coupled with increased reshoring incentives and labor shortages, position Lincoln Electric to benefit from a pending wave of investment in advanced welding and automation solutions as trade policy clarity and government stimulus increase. This should drive higher equipment order volumes and accelerate revenue growth when customers resume deferred capital spending.

Want to know the story behind this valuation? One central financial assumption pushes this stock’s future value higher, with analyst projections that could surprise you. Get the full details on the drivers behind the pricing power and future profit expectations. Don’t miss the numbers shaping this debate.

Result: Fair Value of $256.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if customer demand remains weak or trade policy uncertainty persists, Lincoln Electric’s expected revenue and margin gains could encounter significant challenges.

Find out about the key risks to this Lincoln Electric Holdings narrative.

Another View: Comparing Valuation Multiples

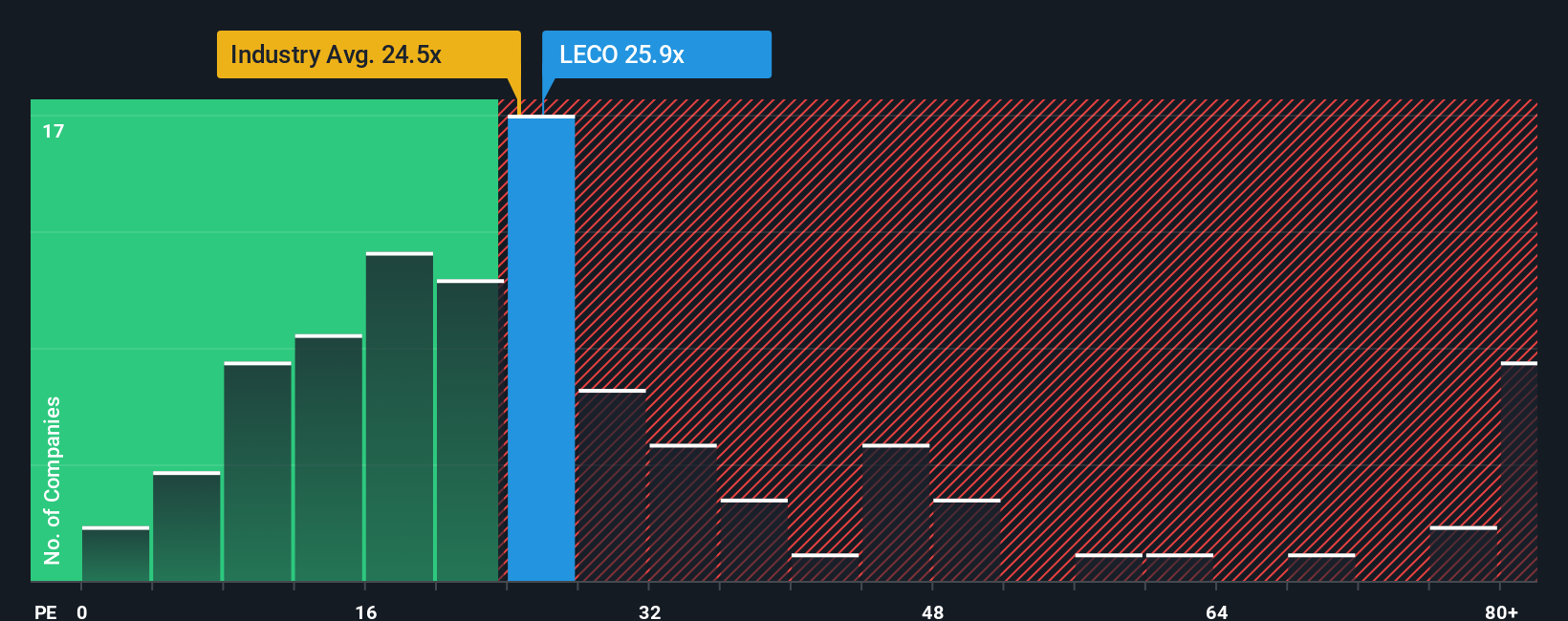

While some investors see Lincoln Electric as undervalued by narrative fair value, its price-to-earnings ratio of 26.2x stands above both the US Machinery industry average of 24.1x and the fair ratio of 23.6x. This premium suggests the market is betting on stronger future growth. However, does paying up now mean added risks if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lincoln Electric Holdings Narrative

If you’d like a different perspective or want to dig into the numbers on your own, creating your own analysis is simple and takes just a few minutes. Do it your way

A great starting point for your Lincoln Electric Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take advantage of new opportunities and set yourself up for smarter investing. Your next big winner might be waiting. Don’t let it slip past you.

- Capture steady income potential with these 20 dividend stocks with yields > 3%, where you’ll find top companies offering yields above 3% for reliable annual returns.

- Tap into the momentum of the most promising trends by reviewing these 24 AI penny stocks that are powering advancements in artificial intelligence and technology.

- Seize hidden value with these 876 undervalued stocks based on cash flows, pinpointing stocks currently priced below their fundamental worth based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LECO

Lincoln Electric Holdings

Through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives