- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions (NasdaqGS:KTOS) Reports Increased Q1 Earnings And Confirms 2025 Guidance

Reviewed by Simply Wall St

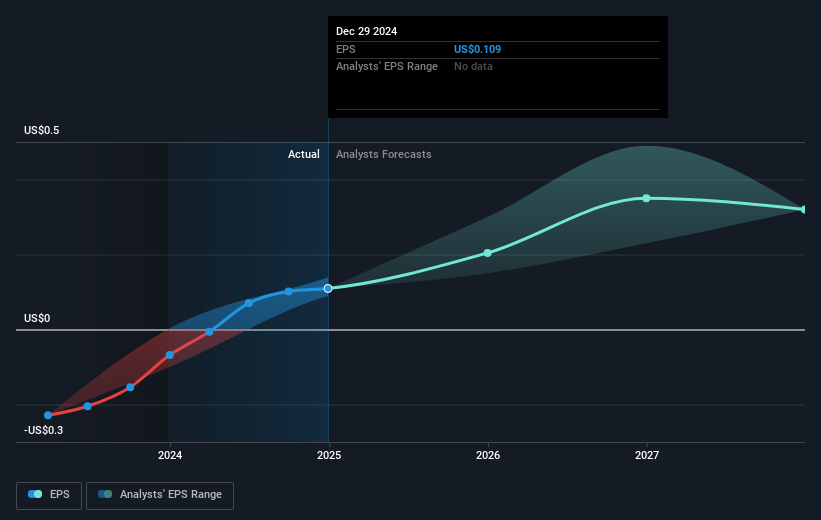

Kratos Defense & Security Solutions (NasdaqGS:KTOS) recently announced promising first quarter results with a revenue increase to USD 303 million and net income rising to USD 5 million, fostering a supportive environment for its stock price, which climbed 28% last month. The company's expanded guidance for the second quarter and full year reflected optimism that may have bolstered investor confidence amid a generally positive market driven by easing U.S.-UK trade tensions. Notably, the expansion of automated truck systems and a recent $30 million air defense contract potentially supported the surge in Kratos' share price, countering the broader market's more modest 1% growth.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments surrounding Kratos Defense & Security Solutions, including their substantial revenue and net income growth, have set a positive tone for investor sentiment. This progress, coupled with expanded guidance and new contracts, suggests a promising future trajectory for the company. Over the past three years, Kratos' total return, including share price and dividends, reached a substantial 180.19%. This demonstrates a significant outperformance compared to a generally positive market environment over the same period.

In the previous year, Kratos outpaced both the broader U.S. market and the US Aerospace & Defense industry, which recorded returns of 7.7% and 19.4%, respectively. This suggests that the company's strategic initiatives and external market conditions have potentially contributed to sustained investor confidence. The anticipated growth in defense budgets and new contracts like the MACH-TB hypersonic contract may have positive implications for future revenue and earnings forecasts.

Today's share price of US$34.42 is slightly below the analyst consensus price target of US$34.82, presenting a 1.1% potential upside. This modest gap implies that analysts on average regard the company as fairly valued, albeit with room for potential reassessment based on forthcoming performance outcomes and market conditions. In summary, while short-term gains have been encouraging, Kratos' long-term strategies and industry positioning remain pivotal to its future growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives