- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense & Security Solutions (KTOS): Revisiting Valuation After a Sharp Multi-Year Share Price Surge

Reviewed by Simply Wall St

Kratos Defense and Security Solutions (KTOS) has been on many radar screens after its dramatic share price run this year, prompting investors to ask whether the current pullback is a buying opportunity or a warning sign.

See our latest analysis for Kratos Defense & Security Solutions.

After an exceptional run earlier in the year, the recent 30 day share price return of minus 19.33 percent looks more like a breather than a breakdown. This is especially the case with the year to date share price return still up 175.89 percent and the three year total shareholder return above 680 percent, suggesting longer term momentum remains firmly intact.

If Kratos has sharpened your interest in the defense space, it could be worth comparing it with other names using our screener for aerospace and defense stocks.

With rapid revenue and earnings growth, a surging multi year share price and a stock still trading well below analyst targets, the key question now is simple: is Kratos undervalued, or is the market already pricing in future gains?

Most Popular Narrative Narrative: 27.1% Undervalued

Compared with the last close at $72.78, the most followed narrative points to a fair value near $99.80, implying substantial upside if its assumptions hold.

Multi domain modernization (integrated land, sea, air, space, and cyber operations) underpins recurring demand for flexible, software defined, and integrated platforms such as those in Kratos' OpenSpace, satellite communications, and hypersonic franchises. This diversification positions Kratos for increased earnings stability, margin expansion, and long term EPS growth, as higher value, proprietary solutions take a larger share of the product mix.

Want to see how ambitious growth, rising margins and a lofty future earnings multiple all connect to that price? The narrative’s numbers may surprise you.

Result: Fair Value of $99.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy upfront investment and reliance on government budgets mean contract delays or shifting priorities could quickly challenge the current upside narrative.

Find out about the key risks to this Kratos Defense & Security Solutions narrative.

Another Take on Valuation

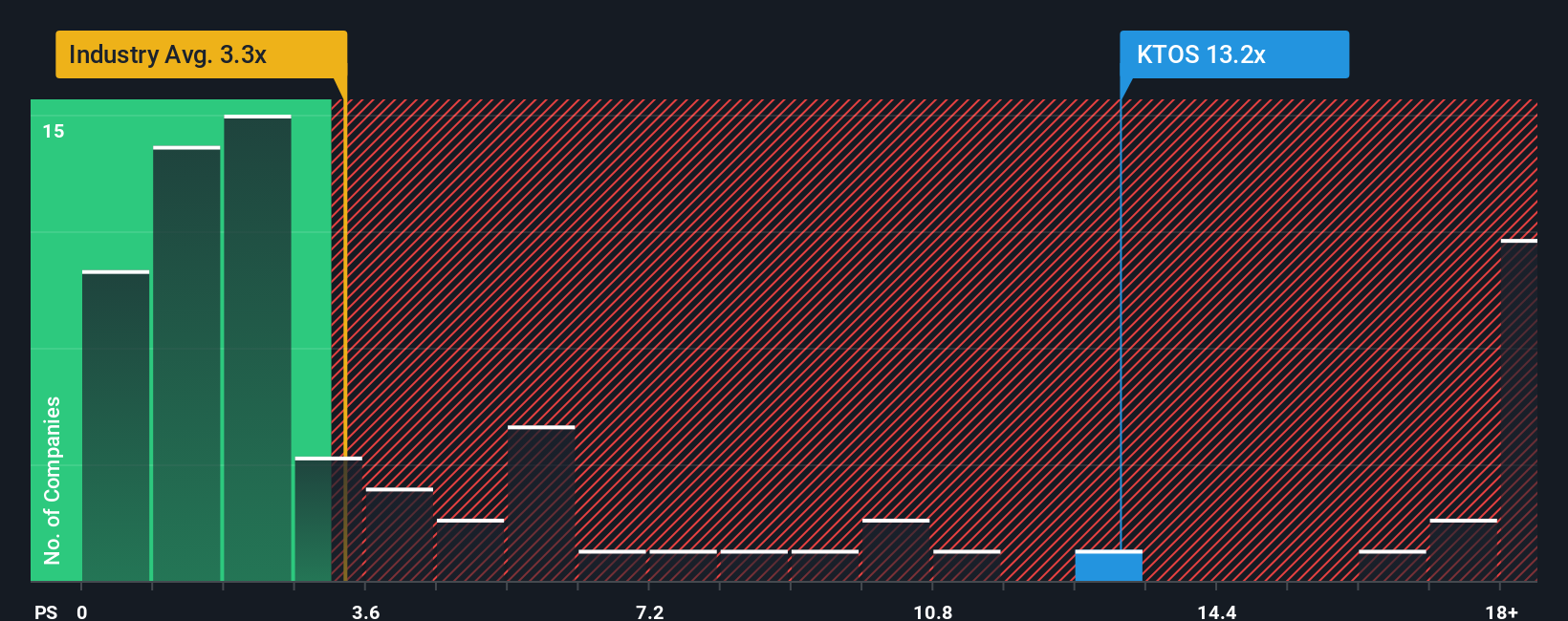

On simple sales based metrics, the picture flips. Kratos trades on a price to sales ratio of 9.6 times, more than three times the US Aerospace and Defense average of 3 times, the peer average of 3.6 times, and well above a fair ratio of 2.6 times. That kind of gap can signal real downside risk if sentiment cools. How much optimism are you comfortable paying for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kratos Defense & Security Solutions Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Kratos Defense & Security Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider your next smart idea with the Simply Wall St Screener, where data-backed opportunities are available for investors who act early.

- Target potential bargains trading below intrinsic value by scanning these 910 undervalued stocks based on cash flows, grounded in future cash flow expectations and quality fundamentals.

- Explore opportunities in AI by reviewing these 26 AI penny stocks, which focuses on companies associated with long term structural trends.

- Assess your income stream by evaluating these 14 dividend stocks with yields > 3%, which highlights yields supported by sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026