- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Kratos Defense (KTOS): Evaluating Valuation After Mighty Hornet IV UAV Unveiling and Global Market Expansion

Reviewed by Kshitija Bhandaru

Kratos Defense & Security Solutions (KTOS) just made headlines, and for good reason: the company teamed up with Taiwan’s National Chung-Shan Institute of Science and Technology (NCSIST) to unveil the Mighty Hornet IV Attack UAV. This is not just any new drone; it is a major upgrade of the MQM-178, boasting high-speed capabilities and adaptability for scenarios like loitering munitions. The big reveal is set for the Taipei Aerospace & Defense Technology Exhibition (TADTE). Perhaps most significant for investors is that Kratos now has an agreement to market the UAV internationally, powered by recent easing of U.S. export controls for military drones.

Shares of Kratos rose 2.6% on the day of the announcement, a move that stands out in a year where momentum has built up for the stock. Over the past year, KTOS has surged over 250%, with particularly sharp gains in recent months, reflecting optimism about both the company’s technology pipeline and new market opportunities. The broader context is compelling: demand for affordable, versatile military tech keeps climbing, and Kratos’s focus on AI-driven drones positions it strongly in this landscape.

Now that the market has reacted quickly to this milestone, it is fair to wonder whether there is still an opportunity here, or if the stock’s run has already accounted for future upside.

Most Popular Narrative: 13.4% Overvalued

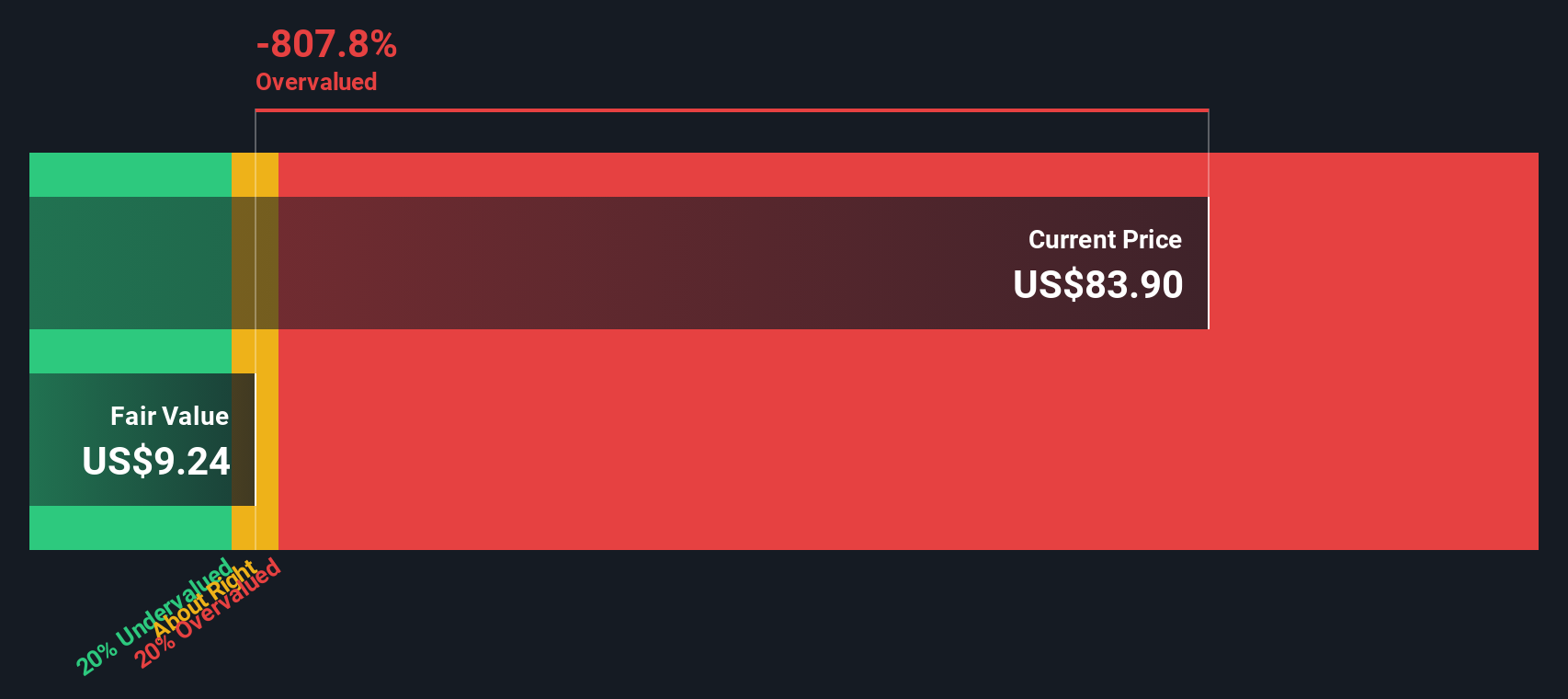

According to the most widely followed narrative, Kratos Defense & Security Solutions is currently valued above its estimated fair value, reflecting high optimism about its growth prospects and industry positioning.

Kratos' early investments in serial production of tactical drones (e.g., Valkyrie) and rapid scaling in missile propulsion and microelectronics put it ahead of competitors as demand for unmanned and autonomous solutions escalates globally. With sole-source and first-to-market positions, Kratos is poised for significant incremental revenue and higher-margin growth as large contracts come online, particularly as international orders (with premium margins) ramp up.

What is behind the bold price target? Analysts are betting big on accelerating growth, fatter margins, and future cash flows that will surprise many. Want to see which financial projections power this “premium” valuation and just how aggressive the analysts are being? Dig into the full narrative for details that could shift your outlook on KTOS.

Result: Fair Value of $71.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent high R&D spending and shifting government budgets could challenge Kratos’s growth trajectory. These factors may potentially invalidate the aggressively optimistic analyst view.

Find out about the key risks to this Kratos Defense & Security Solutions narrative.Another View: What Does Our DCF Model Say?

While market multiples point to a rich valuation for Kratos, our SWS DCF model tells a similar story. The shares are still pricing in a lot of growth, raising the question of whether the real value could be even lower than it appears.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kratos Defense & Security Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kratos Defense & Security Solutions Narrative

If these assessments do not quite fit your perspective or if you would rather dive into the numbers firsthand, you can easily shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kratos Defense & Security Solutions.

Looking for more investment ideas?

Missing out on today’s top opportunities could cost you tomorrow. Take action and target tomorrow’s winners before the crowd rushes in with Simply Wall Street’s powerful tools.

- Spot high-potential companies making bold moves in AI by jumping straight to AI penny stocks shaping the industry’s next wave of innovation.

- Boost your portfolio’s resilience by locking in reliable payouts with dividend stocks with yields > 3% offering income above 3% from industry leaders.

- Catch tomorrow’s market favorites early with undervalued stocks based on cash flows to find stocks the market may have overlooked. Value investors are watching these closely.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives