- United States

- /

- Building

- /

- NasdaqGS:ROCK

Undiscovered Gems In The US Market For May 2025

Reviewed by Simply Wall St

As the U.S. market experiences a surge following a significant tariff agreement between the U.S. and China, major indices like the Dow Jones and Nasdaq have seen substantial gains, reflecting renewed investor optimism. In this buoyant environment, identifying stocks that are undervalued or overlooked can offer unique opportunities for growth, particularly as companies adapt to shifting trade dynamics and economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Innovex International | 1.49% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Qudian | 6.38% | -68.48% | -57.47% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Karat Packaging (NasdaqGS:KRT)

Simply Wall St Value Rating: ★★★★★★

Overview: Karat Packaging Inc. manufactures and distributes single-use disposable products in various materials for restaurant and foodservice settings, with a market cap of $606.30 million.

Operations: Karat Packaging generates its revenue primarily from the manufacturing and supply of a diverse range of single-use products, amounting to $430.64 million. The company's net profit margin is 8.5%, indicating its profitability relative to total revenue.

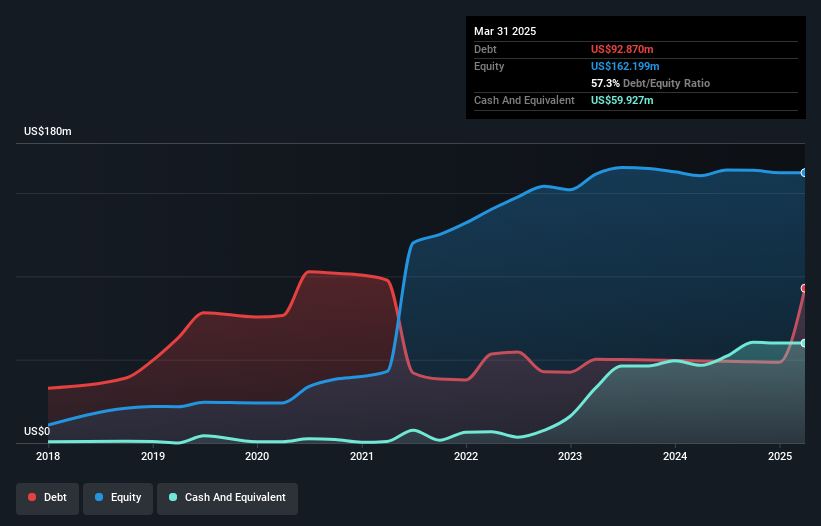

Karat Packaging, a nimble player in the packaging sector, is making strategic moves to bolster its supply chain and operational efficiency. With earnings growth of 2% over the past year, it outpaces its industry peers. The company trades at 32% below estimated fair value and has reduced its debt-to-equity ratio from 318% to a more manageable 57.3% over five years. Recent first-quarter results show sales climbing to US$103.62 million from US$95.61 million last year, with net income rising slightly to US$6.41 million. Despite challenges like tariff uncertainties and rising expenses, Karat's focus on eco-friendly products and distribution expansion could drive future growth.

Gibraltar Industries (NasdaqGS:ROCK)

Simply Wall St Value Rating: ★★★★★★

Overview: Gibraltar Industries, Inc. operates in the residential, renewable energy, agtech, and infrastructure sectors globally and has a market capitalization of approximately $1.73 billion.

Operations: Gibraltar Industries generates revenue primarily from its Residential segment at $777.40 million, followed by Renewables at $277.57 million, Agtech at $163.82 million, and Infrastructure at $87.48 million.

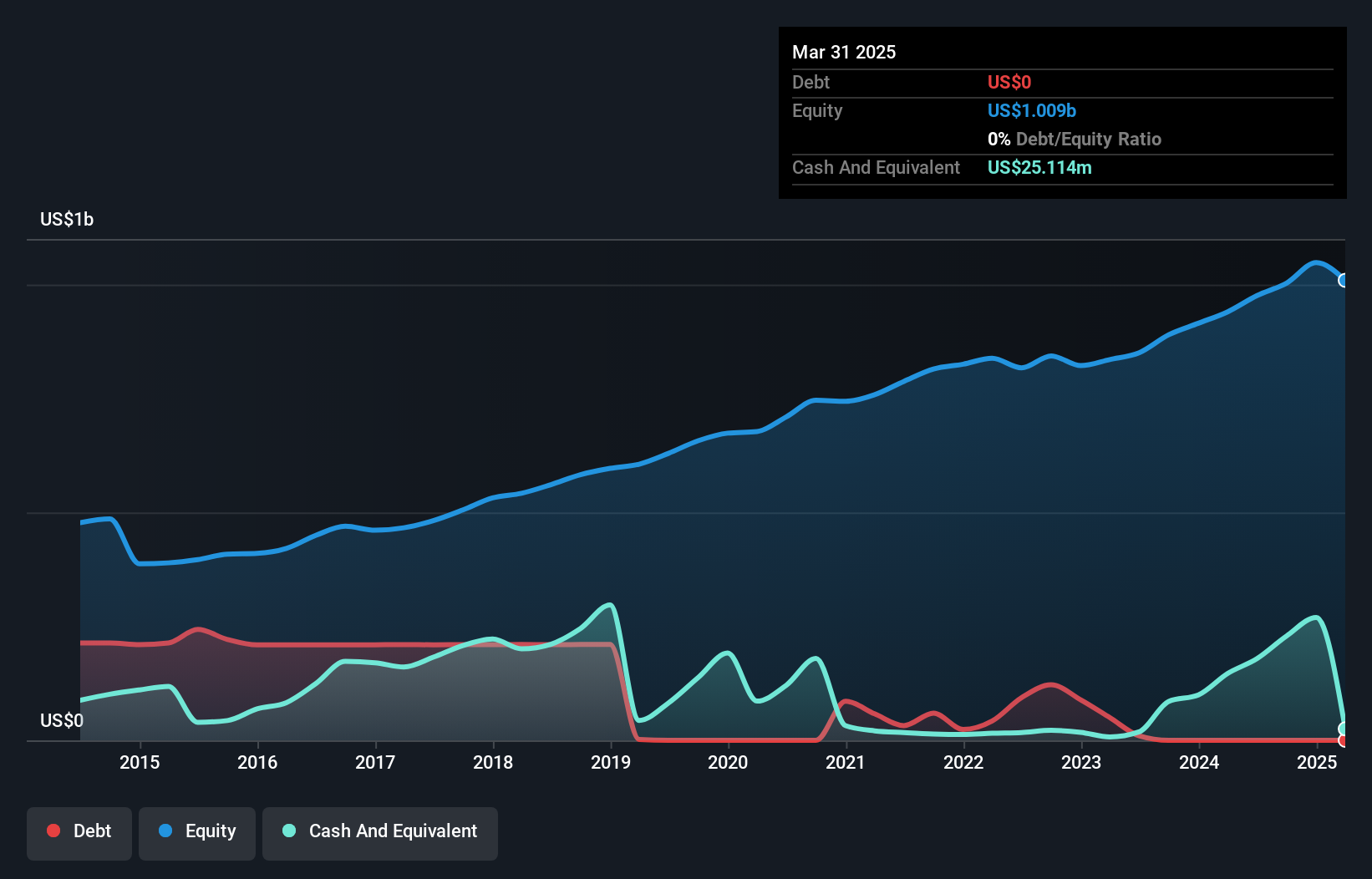

Gibraltar Industries, a nimble player in the building products sector, is navigating a mixed landscape. With earnings growth of 16.7% last year and trading at 27.6% below fair value, it shows promise despite recent insider selling. The company remains debt-free and boasts high-quality earnings while outperforming its industry peers with superior growth rates. Recent strategic moves include acquisitions like Lane Supply and focus on renewables and Agtech segments, which are expected to drive future revenue increases from $1.31 billion in 2024 to between $1.40 billion and $1.45 billion this year, alongside projected GAAP EPS of $4.25 to $4.50 for 2025.

Star Bulk Carriers (NasdaqGS:SBLK)

Simply Wall St Value Rating: ★★★★★☆

Overview: Star Bulk Carriers Corp. is a shipping company that operates dry bulk carrier vessels for the global transportation of dry bulk cargoes, with a market capitalization of approximately $1.81 billion.

Operations: The company generates revenue primarily from its dry bulk vessels, amounting to $1.27 billion. Its net profit margin is a key financial metric to consider when evaluating its performance.

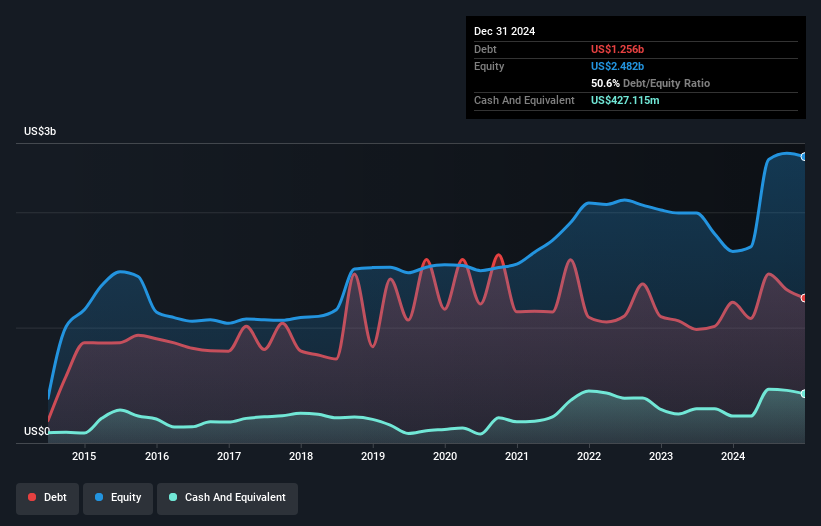

Star Bulk Carriers, a notable player in dry bulk shipping, has been making waves with strategic fleet upgrades and energy-saving initiatives. Over the past year, earnings surged by 75.5%, outpacing the industry's -1.5% performance. The company's debt to equity ratio improved from 75.1% to 50.6% over five years, reflecting prudent financial management. Trading at a significant discount of 76% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent share buybacks totaling $13.5 million indicate confidence in future prospects despite potential risks like high debt levels and volatile trade impacting net margins if economic conditions shift unfavorably.

Key Takeaways

- Access the full spectrum of 280 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Gibraltar Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROCK

Gibraltar Industries

Manufactures and provides products and services for the residential, renewable energy, agtech, and infrastructure markets in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives