- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ISSC

Do Innovative Solutions and Support's (NASDAQ:ISSC) Earnings Warrant Your Attention?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Innovative Solutions and Support (NASDAQ:ISSC). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Innovative Solutions and Support

How Fast Is Innovative Solutions and Support Growing Its Earnings Per Share?

In the last three years Innovative Solutions and Support's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, Innovative Solutions and Support's EPS soared from US$0.19 to US$0.29, over the last year. That's a impressive gain of 52%.

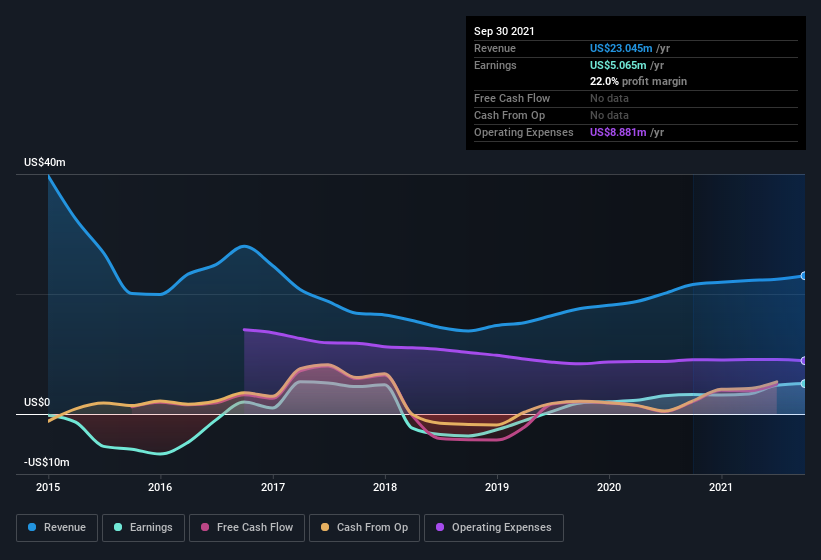

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Innovative Solutions and Support shareholders can take confidence from the fact that EBIT margins are up from 13% to 17%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. For finer detail, click on the image.

Since Innovative Solutions and Support is no giant, with a market capitalization of US$109m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Innovative Solutions and Support Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Innovative Solutions and Support shares worth a considerable sum. Indeed, they hold US$35m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 32% of the company, demonstrating a degree of high-level alignment with shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. I discovered that the median total compensation for the CEOs of companies like Innovative Solutions and Support with market caps under US$200m is about US$569k.

Innovative Solutions and Support offered total compensation worth US$408k to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Innovative Solutions and Support To Your Watchlist?

For growth investors like me, Innovative Solutions and Support's raw rate of earnings growth is a beacon in the night. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the takeaway for me is that Innovative Solutions and Support is worth keeping an eye on. Even so, be aware that Innovative Solutions and Support is showing 1 warning sign in our investment analysis , you should know about...

Although Innovative Solutions and Support certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ISSC

Innovative Solutions and Support

A systems integrator, designs, develops, manufactures, sells, and services flight guidance, autothrottles, and cockpit display systems in the United States and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives