- United States

- /

- Construction

- /

- NasdaqGM:IESC

IES Holdings, Inc. (NASDAQ:IESC) Stock's 28% Dive Might Signal An Opportunity But It Requires Some Scrutiny

IES Holdings, Inc. (NASDAQ:IESC) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 88%, which is great even in a bull market.

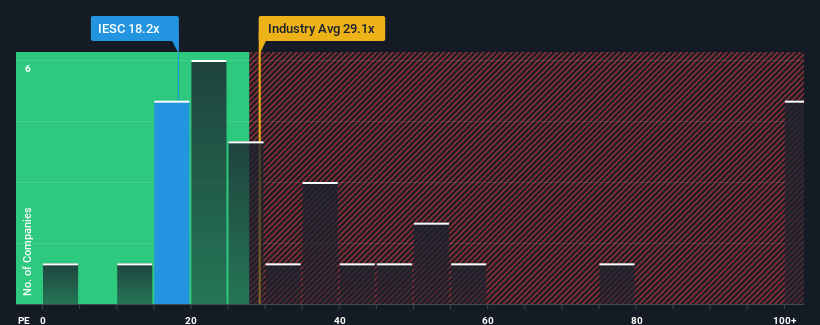

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about IES Holdings' P/E ratio of 18.2x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been quite advantageous for IES Holdings as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for IES Holdings

Is There Some Growth For IES Holdings?

There's an inherent assumption that a company should be matching the market for P/E ratios like IES Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 105% last year. Pleasingly, EPS has also lifted 232% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 14% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that IES Holdings' P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

With its share price falling into a hole, the P/E for IES Holdings looks quite average now. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that IES Holdings currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with IES Holdings.

Of course, you might also be able to find a better stock than IES Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:IESC

IES Holdings

Designs and installs integrated electrical and technology systems, and provides infrastructure products and services in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives