- United States

- /

- Machinery

- /

- NasdaqCM:HYFM

Benign Growth For Hydrofarm Holdings Group, Inc. (NASDAQ:HYFM) Underpins Its Share Price

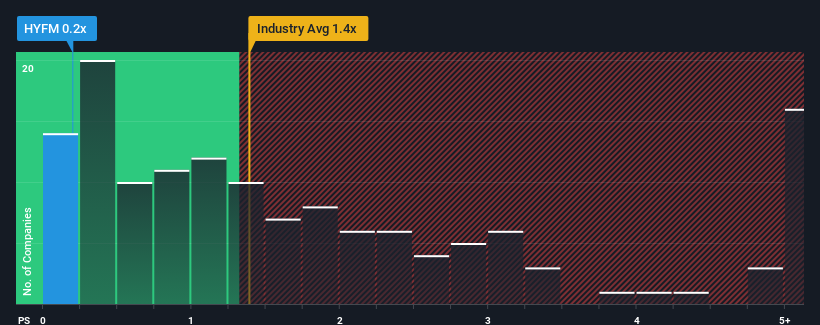

When you see that almost half of the companies in the Machinery industry in the United States have price-to-sales ratios (or "P/S") above 1.4x, Hydrofarm Holdings Group, Inc. (NASDAQ:HYFM) looks to be giving off some buy signals with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Hydrofarm Holdings Group

What Does Hydrofarm Holdings Group's P/S Mean For Shareholders?

Hydrofarm Holdings Group hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Hydrofarm Holdings Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Hydrofarm Holdings Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 39% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 22% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 6.2% during the coming year according to the three analysts following the company. That's not great when the rest of the industry is expected to grow by 1.1%.

With this in consideration, we find it intriguing that Hydrofarm Holdings Group's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Hydrofarm Holdings Group's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Hydrofarm Holdings Group's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Hydrofarm Holdings Group's poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You always need to take note of risks, for example - Hydrofarm Holdings Group has 3 warning signs we think you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hydrofarm Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HYFM

Hydrofarm Holdings Group

Manufactures and distributes controlled environment agriculture (CEA) equipment and supplies in the United States and Canada.

Adequate balance sheet and fair value.