- United States

- /

- Machinery

- /

- NasdaqGS:HURC

Here's Why It's Unlikely That Hurco Companies, Inc.'s (NASDAQ:HURC) CEO Will See A Pay Rise This Year

Hurco Companies, Inc. (NASDAQ:HURC) has not performed well recently and CEO Michael Doar will probably need to up their game. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 11 March 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Check out our latest analysis for Hurco Companies

Comparing Hurco Companies, Inc.'s CEO Compensation With the industry

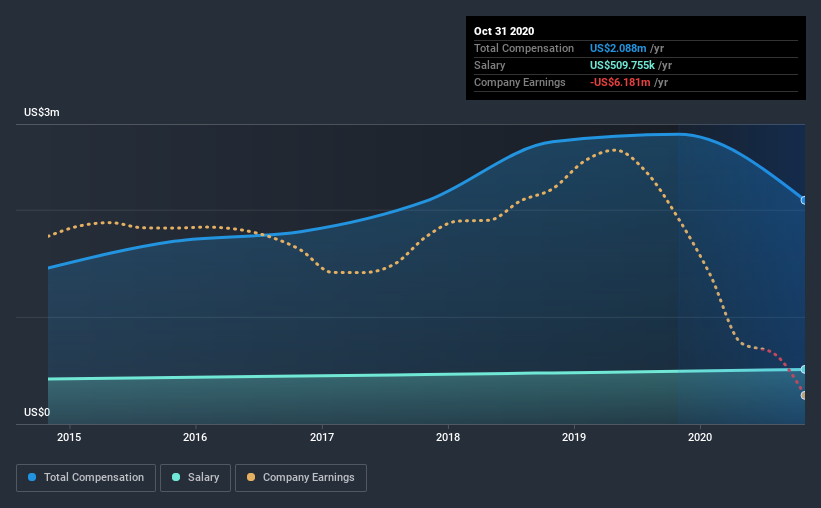

According to our data, Hurco Companies, Inc. has a market capitalization of US$200m, and paid its CEO total annual compensation worth US$2.1m over the year to October 2020. Notably, that's a decrease of 23% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$510k.

On examining similar-sized companies in the industry with market capitalizations between US$100m and US$400m, we discovered that the median CEO total compensation of that group was US$944k. Accordingly, our analysis reveals that Hurco Companies, Inc. pays Michael Doar north of the industry median. What's more, Michael Doar holds US$4.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$510k | US$492k | 24% |

| Other | US$1.6m | US$2.2m | 76% |

| Total Compensation | US$2.1m | US$2.7m | 100% |

Talking in terms of the industry, salary represented approximately 17% of total compensation out of all the companies we analyzed, while other remuneration made up 83% of the pie. It's interesting to note that Hurco Companies pays out a greater portion of remuneration through salary, compared to the industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Hurco Companies, Inc.'s Growth

Over the last three years, Hurco Companies, Inc. has shrunk its earnings per share by 46% per year. Its revenue is down 35% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Hurco Companies, Inc. Been A Good Investment?

With a three year total loss of 22% for the shareholders, Hurco Companies, Inc. would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Hurco Companies (of which 1 is concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Hurco Companies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hurco Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:HURC

Hurco Companies

An industrial technology company, designs, manufactures, and sells computerized machine tools to companies in the metal cutting industry worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives