- United States

- /

- Machinery

- /

- NasdaqGM:HLMN

Hillman’s Debt Reduction and Cash Flow Gains Might Change The Case For Investing In HLMN

Reviewed by Sasha Jovanovic

- Earlier this week, Conestoga Capital Advisors highlighted Hillman Solutions Corp. as a resilient provider of hardware and protective solutions, citing a 6.2% increase in net sales in the second quarter of 2025 and progress in cost efficiencies and debt reduction despite mixed retail conditions.

- Hillman's ability to generate improved free cash flow through disciplined inventory and working capital management has boosted investor confidence and underlines its operational adaptability in a challenging market.

- We'll examine how Hillman's progress in reducing debt and enhancing cash flow could shape its future investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hillman Solutions Investment Narrative Recap

To be a Hillman Solutions shareholder, you need to believe that steady demand for hardware and protective solutions, supported by ongoing cost discipline and inventory management, can offset margin pressures and customer concentration risks. The recent recognition of Hillman’s improved free cash flow and debt reduction is encouraging, but it does not materially alter the key short-term catalyst, capturing resilient retail demand, nor does it fully resolve the ongoing risk of reliance on major retail partners.

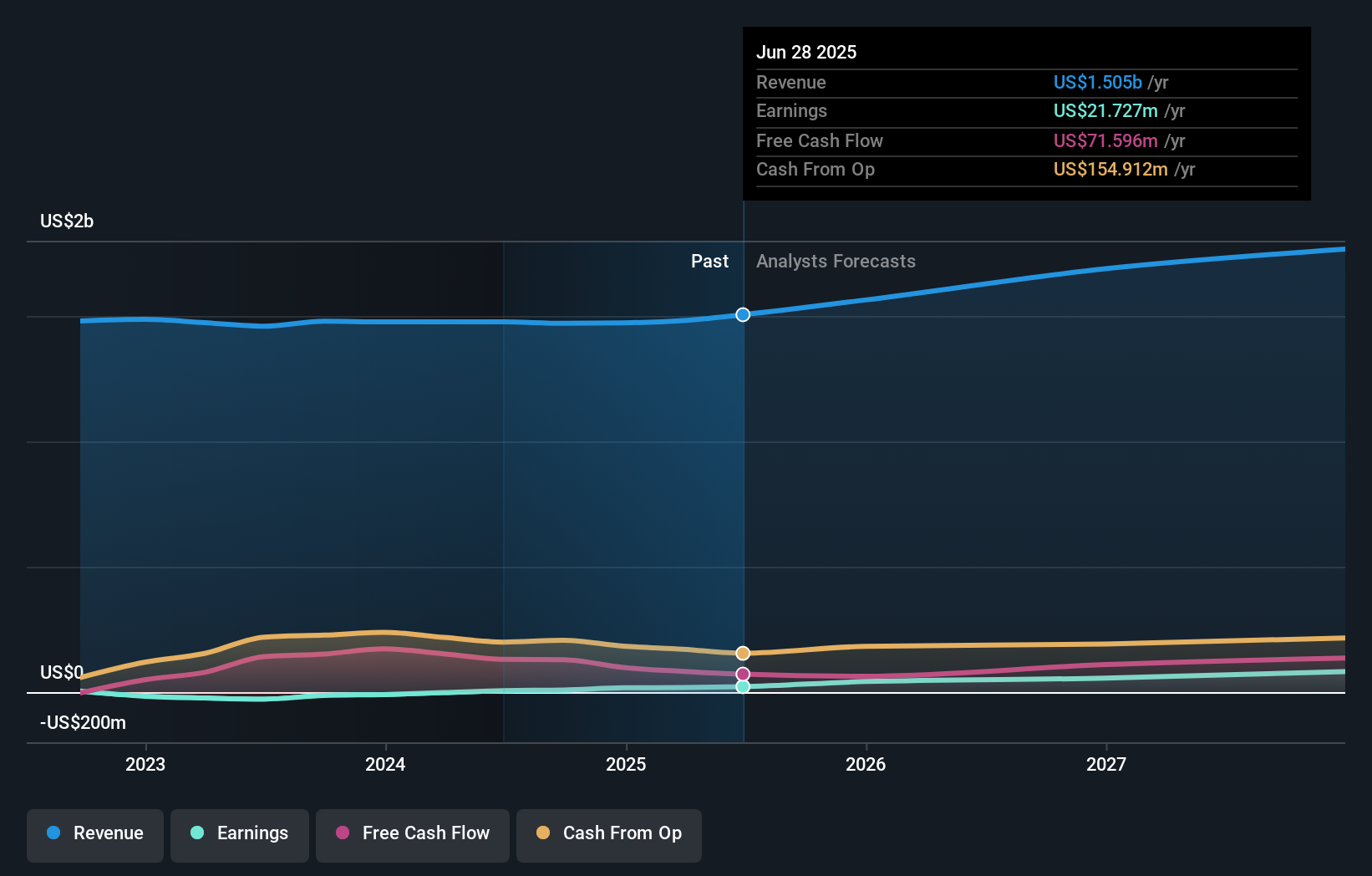

Among recent announcements, Hillman’s raised full-year sales guidance to US$1.535 billion–US$1.575 billion stands out, directly connecting to the growth catalysts highlighted in analyst commentary such as operational efficiency, e-commerce expansion, and capture of recurring revenue from home repair and remodeling. This guidance reinforces the company’s efforts to navigate retail headwinds and capital allocation priorities that support investor confidence.

On the other hand, investors should remain alert to the risk that Hillman’s concentration among large retail partners could...

Read the full narrative on Hillman Solutions (it's free!)

Hillman Solutions' narrative projects $1.8 billion in revenue and $102.9 million in earnings by 2028. This requires 5.9% yearly revenue growth and an $81.2 million earnings increase from $21.7 million today.

Uncover how Hillman Solutions' forecasts yield a $12.31 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Two private investors in the Simply Wall St Community estimate Hillman’s fair value between US$12.31 and US$14.48 per share. Yet, core risks like heavy reliance on big retail partners continue to shape debate about the company’s future earnings and resilience. Explore a variety of viewpoints for a fuller understanding.

Explore 2 other fair value estimates on Hillman Solutions - why the stock might be worth as much as 52% more than the current price!

Build Your Own Hillman Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hillman Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hillman Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hillman Solutions' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hillman Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HLMN

Hillman Solutions

Provides hardware-related products and related merchandising services in the United States, Canada, Mexico, Latin America, and the Caribbean.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives