- United States

- /

- Machinery

- /

- NasdaqGM:HLMN

Hillman Solutions (HLMN): Evaluating Valuation After Cost Management and Sales Growth Draw Investor Interest

Reviewed by Simply Wall St

Hillman Solutions (HLMN) has caught the attention of investors following recent comments from Conestoga Capital Advisors, which highlighted the company's success in boosting free cash flow and reducing debt in a tough retail climate.

See our latest analysis for Hillman Solutions.

After a year marked by solid operational improvements and a 6.2% bump in net sales, Hillman’s recent momentum is starting to show in its share price, which has climbed 15.6% over the past 90 days. However, the one-year total shareholder return remains down 10.6%, even as renewed investor confidence hints at a shift in sentiment and potential upside ahead.

If you’re looking to uncover other companies where growth and insider conviction go hand in hand, now’s a great moment to discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst targets despite improving fundamentals, the question is whether Hillman Solutions is an undervalued pick at current levels or if the market has already anticipated its next stage of growth.

Most Popular Narrative: 22.9% Undervalued

With Hillman Solutions closing at $9.49 and a most-watched narrative placing fair value at $12.31, shares appear meaningfully discounted as expectations hinge on continued operational strengthening. This sets the backdrop for a closer look into the foundation of that higher target.

Hillman's expansion in omni-channel retailing and e-commerce integration, boosting direct-to-store delivery capabilities and proprietary digital inventory management, positions the company to capture a wider addressable market and increase efficiency, which should positively impact both revenue and margins.

Want the inside story behind this premium valuation? The projection banks on an ambitious roadmap for margin growth and rapid operational gains. The key ingredients are locked behind the numbers, shaping a bullish outlook most investors might overlook. Uncover which game-changing forecasts drive this optimistic view. The full narrative breaks it down.

Result: Fair Value of $12.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued softness in core market demand and heavy reliance on large retail partners could challenge Hillman’s optimistic outlook and put pressure on its long-term growth assumptions.

Find out about the key risks to this Hillman Solutions narrative.

Another View: High Price Compared to Industry Ratios

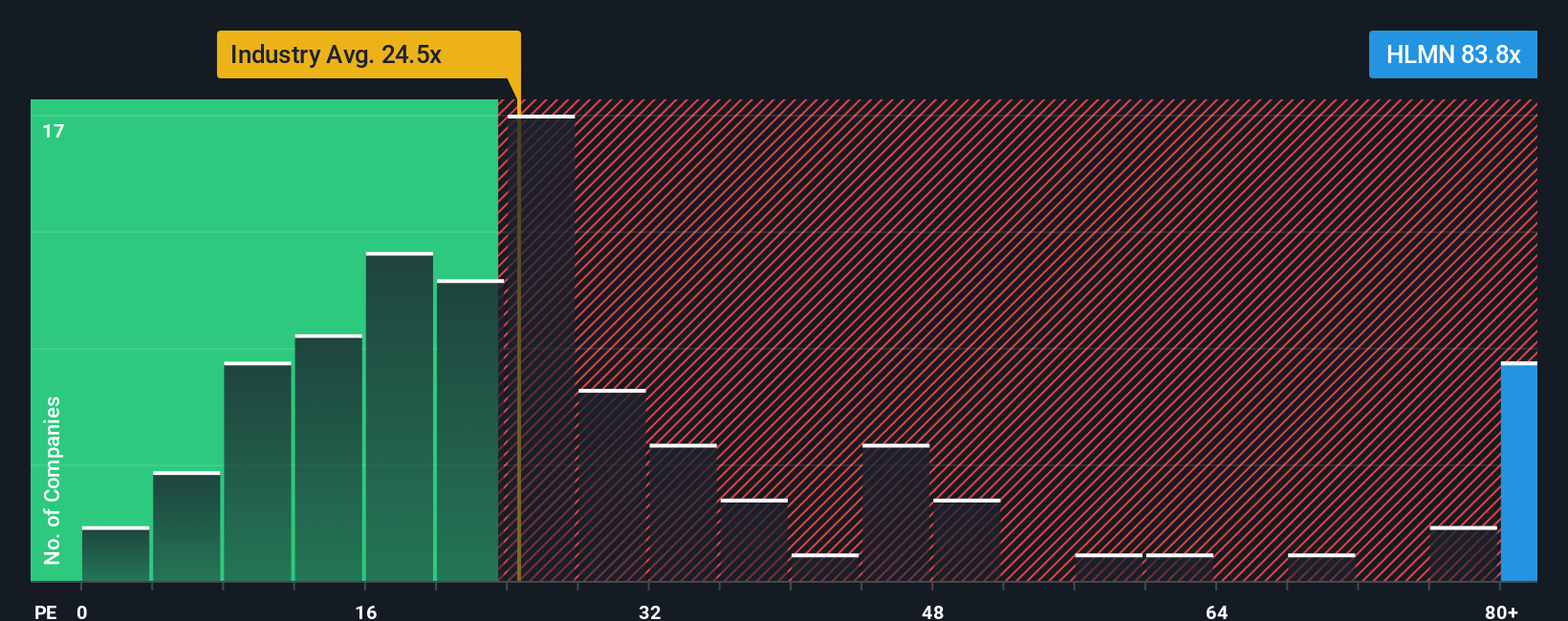

While analysts see Hillman Solutions as undervalued on growth and cash flow, today's price-to-earnings ratio stands at 86.3x, which is well above the Machinery industry average (24.1x), peers (30.3x), and its own fair ratio of 35.5x. This large gap could signal valuation risk if expectations do not play out as hoped. Will confidence in Hillman’s future justify paying so much more than the broader sector?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hillman Solutions Narrative

If you think the numbers tell a different story or want to dig deeper, you can piece together your perspective in just minutes, Do it your way

A great starting point for your Hillman Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity slip away when unique growth stories are just a click away. Chase smart investments with these handpicked ideas worth your attention:

- Capture the potential of artificial intelligence by scanning these 24 AI penny stocks, pushing automation and innovation into new industries.

- Target real value by reviewing these 874 undervalued stocks based on cash flows, which analysts believe the market is overlooking despite strong cash flows.

- Boost your portfolio income by checking out these 17 dividend stocks with yields > 3%, offering high yields for steady returns and compounding gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hillman Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HLMN

Hillman Solutions

Provides hardware-related products and related merchandising services in the United States, Canada, Mexico, Latin America, and the Caribbean.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives