- United States

- /

- Machinery

- /

- NasdaqCM:GTEC

Not Many Are Piling Into Greenland Technologies Holding Corporation (NASDAQ:GTEC) Stock Yet As It Plummets 26%

Greenland Technologies Holding Corporation (NASDAQ:GTEC) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 21% in that time.

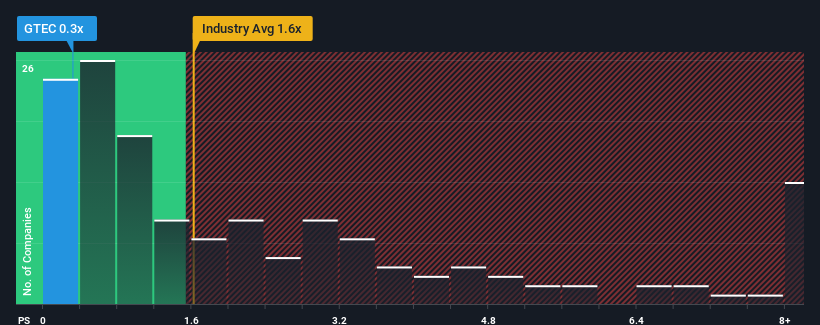

After such a large drop in price, Greenland Technologies Holding may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.3x, considering almost half of all companies in the Machinery industry in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Greenland Technologies Holding

How Has Greenland Technologies Holding Performed Recently?

Recent revenue growth for Greenland Technologies Holding has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Greenland Technologies Holding.How Is Greenland Technologies Holding's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Greenland Technologies Holding's is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. This isn't what shareholders were looking for as it means they've been left with a 12% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 45% during the coming year according to the lone analyst following the company. With the rest of the industry predicted to shrink by 0.2%, that would be a fantastic result.

In light of this, it's quite peculiar that Greenland Technologies Holding's P/S sits below the majority of other companies. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From Greenland Technologies Holding's P/S?

The southerly movements of Greenland Technologies Holding's shares means its P/S is now sitting at a pretty low level. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Greenland Technologies Holding's analyst forecasts has shown that it could be trading at a significant discount in terms of P/S, as it is expected to far outperform the industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Greenland Technologies Holding, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GTEC

Greenland Technologies Holding

Designs, develops, manufactures, and sells components and products for material handling industries worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives