- United States

- /

- Electrical

- /

- NasdaqCM:FTCI

Investors Appear Satisfied With FTC Solar, Inc.'s (NASDAQ:FTCI) Prospects As Shares Rocket 34%

FTC Solar, Inc. (NASDAQ:FTCI) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

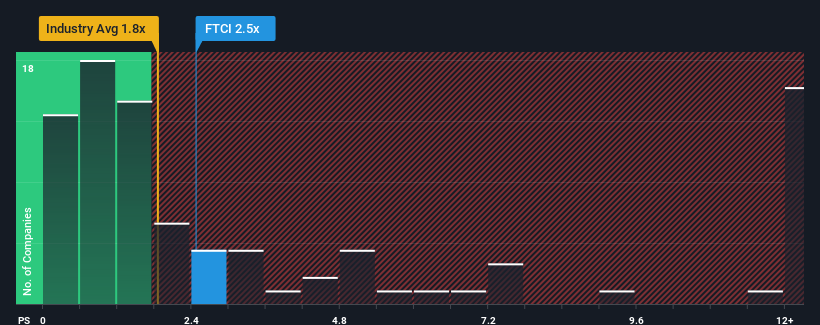

Since its price has surged higher, given close to half the companies operating in the United States' Electrical industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider FTC Solar as a stock to potentially avoid with its 2.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for FTC Solar

What Does FTC Solar's Recent Performance Look Like?

FTC Solar could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying to much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on FTC Solar will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, FTC Solar would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 55% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 132% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 70% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 33% per year, which is noticeably less attractive.

With this information, we can see why FTC Solar is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On FTC Solar's P/S

FTC Solar shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into FTC Solar shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with FTC Solar, and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FTCI

FTC Solar

Engages in the manufacture and service of solar tracker systems in the United States, Asia, Europe, the Middle East, North Africa, South Africa, and Australia.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives