- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

FTAI Aviation (FTAI): Valuation in Focus After Analyst Reaffirms Positive Outlook and Institutional Support

Reviewed by Simply Wall St

FTAI Aviation (FTAI) shares moved higher after BTIG analyst Andre Madrid reiterated a positive view on the stock. The reaffirmed rating highlighted institutional confidence in FTAI’s strategic positioning and vertically integrated business model.

See our latest analysis for FTAI Aviation.

FTAI Aviation’s recent string of positive news and strategic agreements, such as the new Perpetual Power Program with Finnair, seems to be supporting the stock’s momentum. Investors are responding to both growth potential and renewed institutional confidence. Over the past year, the total shareholder return stands at an impressive 23.4%, while a breakout 56.6% share price return in the last 90 days highlights growing optimism about the company’s long-term prospects and resilience.

If FTAI’s performance has you looking for your next investing idea, now’s a great time to discover fast growing stocks with high insider ownership

With institutional analysts signaling continued optimism, the question for investors now is whether FTAI Aviation’s strong performance still leaves room for upside or if the market has already fully priced in its future growth.

Most Popular Narrative: 19.6% Undervalued

With the most widely followed narrative assigning a fair value of $214.20 for FTAI Aviation, the current price of $172.16 stands notably below this target, capturing the attention of both bulls and skeptics. The following viewpoint reveals a catalyst driving the narrative's optimism about future fundamentals.

Significant operational leverage is expected from FTAI's ramp in vertical integration, as evidenced by recent acquisitions (for example, Pacific Aerodynamic) and in-house repair/production capabilities. These moves are driving cost efficiencies, increased margin per shop visit, and expanded gross/EBITDA margins. All of these factors are likely to boost future EPS growth.

What’s really powering this high fair value? Hint: it is a bold blend of profit growth, rising margins, and a valuation multiple that will surprise many. Get the inside scoop on which projections set this target. The full narrative lays out all the key assumptions behind the headline number.

Result: Fair Value of $214.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a faster shift to new engine technologies or struggles with the asset-light model could undermine long-term growth and challenge today's bullish outlook.

Find out about the key risks to this FTAI Aviation narrative.

Another View: A Look Through Market Multiples

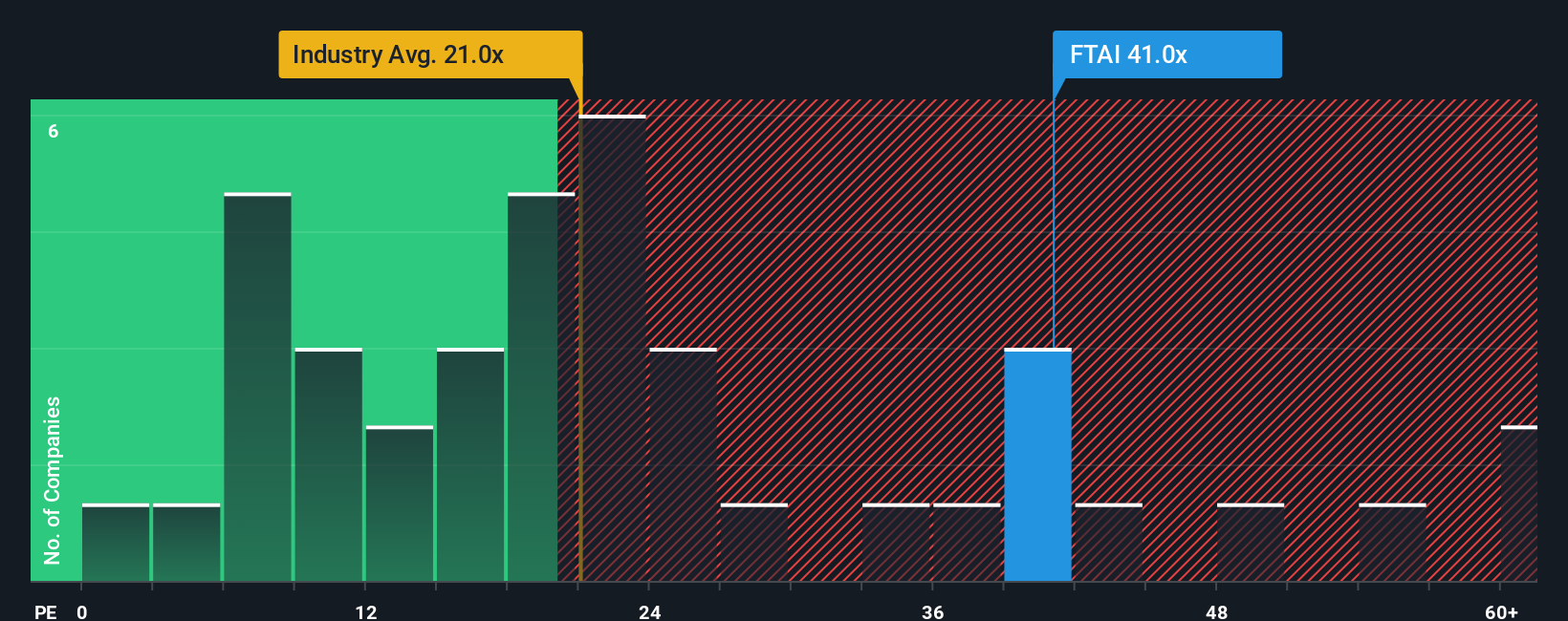

While the headline valuation suggests FTAI Aviation may be undervalued, our market-based approach offers a note of caution. FTAI trades at a price-to-earnings ratio of 42.4 times, which is nearly double the US Trade Distributors industry average of 21.6 times and significantly higher than its peer group at 18 times. Even when compared to its own fair ratio of 64.5 times, there is an argument that high expectations are reflected in the price. Could the market be pricing in more future growth than is realistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FTAI Aviation Narrative

If you’re eager to dive into the numbers and uncover your own insights, you can quickly develop a personalized perspective in just a few minutes. Do it your way

A great starting point for your FTAI Aviation research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There are smart opportunities waiting beyond FTAI Aviation. Check out these curated stock screens. Your next great investment could be just a click away.

- Uncover untapped potential by browsing these 871 undervalued stocks based on cash flows that may be priced below their true worth and primed for upside.

- Boost your income strategy as you target these 17 dividend stocks with yields > 3% with attractive yields above 3% for powerful portfolio growth.

- Stay ahead of technological change by tapping into these 26 AI penny stocks positioned at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives