- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

FTAI Aviation (FTAI) Reports US$165 Million Net Income Turnaround

Reviewed by Simply Wall St

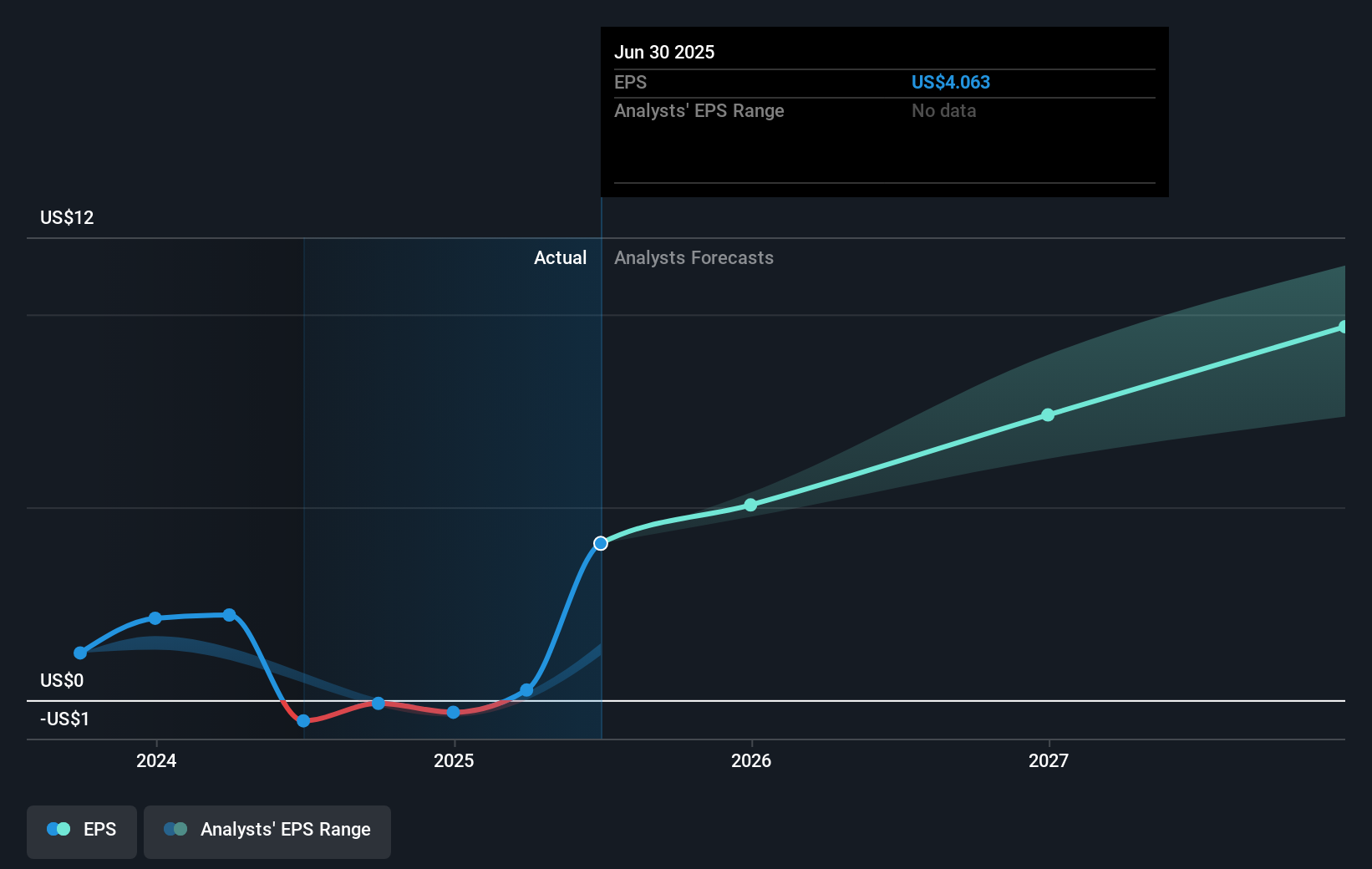

FTAI Aviation (FTAI) recently experienced a significant 36% price increase in the last quarter. This notable move came alongside several key developments. The company reported a strong turnaround in its second-quarter earnings, posting USD 165 million in net income compared to a net loss a year earlier, which likely boosted investor confidence. Furthermore, being added to prominent indices like the Russell 1000 might have increased visibility among institutional investors. Market trends also favored stocks broadly, as major U.S. indices saw gains spurred by expected interest rate cuts and stable inflation readings. FTAI's advancements might have complemented these wider market dynamics.

Be aware that FTAI Aviation is showing 2 warning signs in our investment analysis.

The recent developments surrounding FTAI Aviation, particularly the impressive 36% share price increase in the last quarter, could have significant implications for the company's future performance. The positive news around its substantial second-quarter earnings turnaround and inclusion in key indices like the Russell 1000 is likely to bolster investor confidence and may positively influence revenue projections and earnings forecasts. Additionally, the overall positive market trends, driven by expectations of interest rate cuts and stable inflation, may further support the company's growth trajectory.

Looking at the longer-term performance, FTAI's shares have delivered a very large total return over a five-year period. This exceptional growth provides a solid context for evaluating the company's current financial position. Relative to the industry, FTAI notably exceeded the US Trade Distributors industry, which saw a 22.5% return over the past year. Such comparisons highlight FTAI's strong performance and market positioning.

The current share price of US$168.12 stands in relation to an analyst consensus price target of US$183.22, indicating a discount of about 8.99%. This price movement, along with the company's robust forecasted revenue and earnings growth, may suggest potential upside if the company continues to execute effectively amid its growth initiatives and risk landscape. However, it is prudent for investors to consider both the potential opportunities and risks, ensuring they align with their investment strategy and risk tolerance.

Dive into the specifics of FTAI Aviation here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives