- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

Broad Analyst Upgrades and Rising Market Share Might Change the Case for Investing in FTAI Aviation (FTAI)

Reviewed by Sasha Jovanovic

- In recent days, FTAI Aviation received a broad wave of positive analyst coverage, with multiple top investment banks upgrading their outlook and highlighting the company's improving fundamentals. Industry observers point to FTAI Aviation's substantial revenue growth, operational transformation, and rising market share as material reasons for renewed confidence among analysts.

- This heightened analyst optimism, particularly the recognition of FTAI's progress toward a capital-light, high-margin business model, has put the company's long-term prospects and valuation in sharper focus.

- We'll explore how this consolidated analyst support, driven by FTAI's revenue growth and operational shift, reshapes the company's investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

FTAI Aviation Investment Narrative Recap

To be a shareholder in FTAI Aviation right now, you need to believe in the resilience and profitability of maintaining and leasing legacy aircraft engines, backed by the company’s capital-light, high-margin shift and operational improvements. The recent analyst upgrades and growing confidence signal strong momentum for the anticipated Q3 results, but they do not materially change the most important short-term catalyst: continued demand from airlines extending the life of mid-life engines amid aircraft delivery delays. However, the main risk remains FTAI’s high concentration in legacy engine platforms, which could be challenged by advances in propulsion technology or market shifts.

Among the recent announcements, Barclays raising its price target for FTAI Aviation by 30% to US$195 stands out as directly tied to the positive analyst sentiment, reinforcing the idea that industry-wide supply chain constraints and new engine delays are currently sustaining demand for the company’s core services. This surge in optimism highlights investor interest in the durability of earnings and margins, but it also draws attention to how quickly market dynamics can change in aerospace.

By contrast, investors should be aware that any rapid shift to next-generation engines or new regulatory mandates could leave FTAI’s core business vulnerable...

Read the full narrative on FTAI Aviation (it's free!)

FTAI Aviation's outlook anticipates $3.7 billion in revenue and $1.1 billion in earnings by 2028. This projection requires 19.8% annual revenue growth and an increase of $683.5 million in earnings from the current $416.5 million.

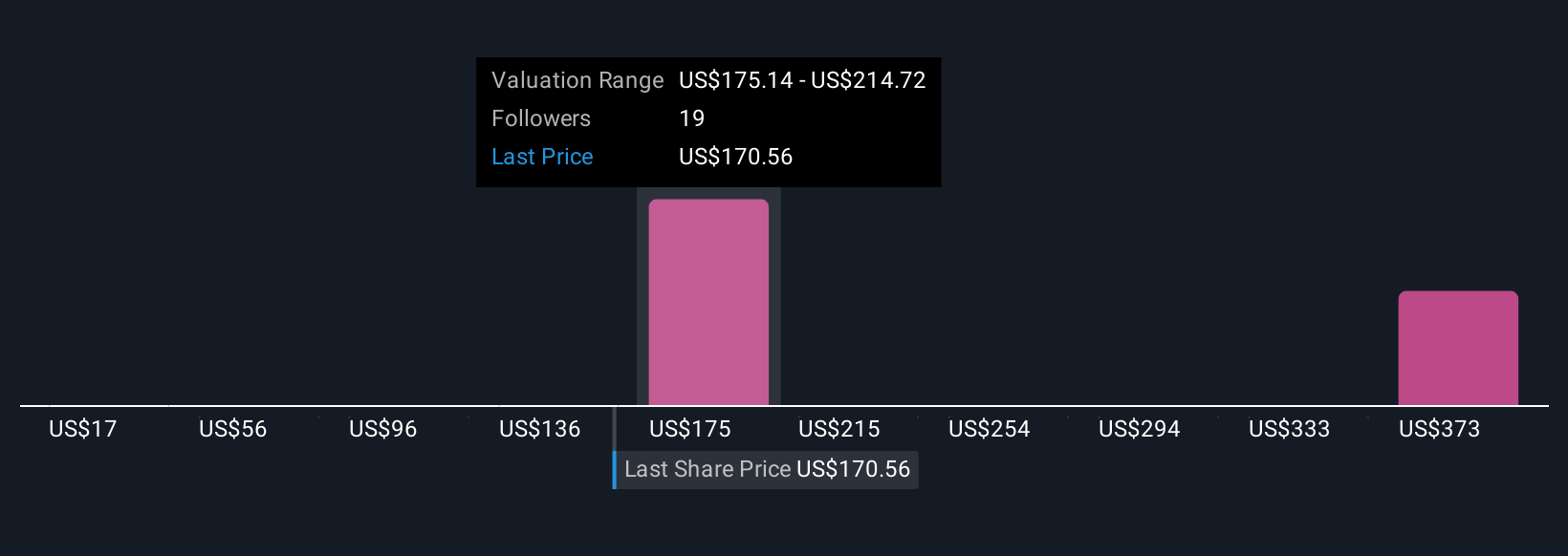

Uncover how FTAI Aviation's forecasts yield a $191.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

With four fair value estimates from the Simply Wall St Community ranging from US$16.83 to US$426.99, perspectives vary widely. Many focus on the company’s exposure to legacy engine platforms and how new propulsion technologies could reshape industry economics.

Explore 4 other fair value estimates on FTAI Aviation - why the stock might be worth less than half the current price!

Build Your Own FTAI Aviation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTAI Aviation research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FTAI Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTAI Aviation's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives