- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:FLY

Why Firefly Aerospace (FLY) Is Down 18.6% After Revenue Guidance and Legal Scrutiny Reveal Investor Concerns

Reviewed by Sasha Jovanovic

- Firefly Aerospace recently provided full-year 2025 revenue guidance of US$150 million to US$158 million, while also facing heightened legal scrutiny following a class action lawsuit alleging misleading statements in its IPO disclosures and recent operational challenges.

- The company simultaneously amended its credit agreement to boost financial flexibility and address liquidity needs, highlighting the intersection of financial maneuvering and investor concerns.

- We’ll explore how legal uncertainties and questions about operational readiness shape the evolving investment narrative for Firefly Aerospace.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Firefly Aerospace's Investment Narrative?

For someone considering Firefly Aerospace as a potential investment, it comes down to believing in the company’s ability to move past near-term setbacks and realize long-term ambition in commercial and government space contracts. The very recent combination of higher 2025 revenue guidance, a substantial credit facility boost, and new NASA wins initially looked like strong catalysts, until legal challenges cast a shadow over the business. The class action lawsuit alleging Firefly misrepresented its business prospects during its IPO has taken some urgency, especially after both disappointing Q2 results and the failed Alpha Flight 7 launch hit shares hard, causing a steep drop far below the IPO price. These issues have shifted the risk profile from typical early-stage losses and high growth expectations to material questions about transparency, reliability of guidance, and operational readiness. Whether these legal concerns further impact contracts or customer confidence could become the most important short-term swing factor for shareholders, potentially outweighing improvements in revenue outlook or financing flexibility.

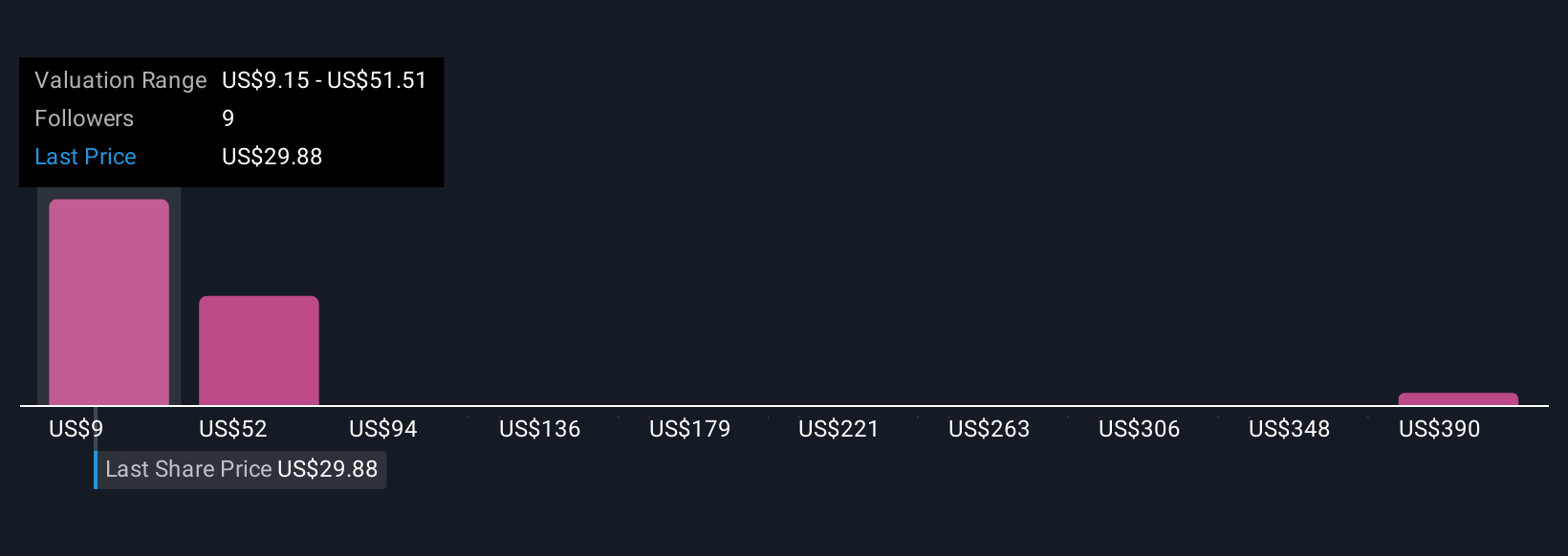

But consider this: questions over public disclosures now hover as one of the biggest investor risks. Despite retreating, Firefly Aerospace's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 8 other fair value estimates on Firefly Aerospace - why the stock might be a potential multi-bagger!

Build Your Own Firefly Aerospace Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Firefly Aerospace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Firefly Aerospace research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Firefly Aerospace's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FLY

Firefly Aerospace

Operates as a space and defense technology company and provides mission solutions for national security, government, and commercial customers.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives