- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:FLY

The Bull Case For Firefly Aerospace (FLY) Could Change Following FAA Clearance and Lockheed Martin Launch Deal

Reviewed by Simply Wall St

- Firefly Aerospace has been cleared by the FAA to resume launches of its Alpha small-lift rocket after addressing the cause of a launch failure earlier this year through enhanced thermal protection and flight adjustments.

- This clearance allows Firefly to proceed with its next Alpha Flight 7 mission, part of a multi-launch agreement with Lockheed Martin that could include up to 25 launches across five years.

- We'll look at how renewed FAA launch approval and the Lockheed Martin contract shape Firefly Aerospace's investment narrative moving forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Firefly Aerospace's Investment Narrative?

For someone considering Firefly Aerospace, the key story starts with belief in its ability to capture lasting value from commercial space launches, lunar services and high-profile government contracts. The FAA’s recent green light to resume Alpha rocket flights, after technical setbacks this year, is more than just a technical milestone, it brings the Lockheed Martin multi-launch deal back into play, maintaining Firefly’s near-term commercial pipeline. This clearance addresses one of the major short-term risks that had threatened disruption to both revenue growth and future NASA missions, improving the near-term outlook. While financial data still shows Firefly is unprofitable and holding under a year’s cash runway, rapid revenue growth projections and new contracts provide a clear catalyst investors will watch closely. However, any renewed operational setbacks or funding gaps could quickly become critical threats amid ongoing expansion efforts.

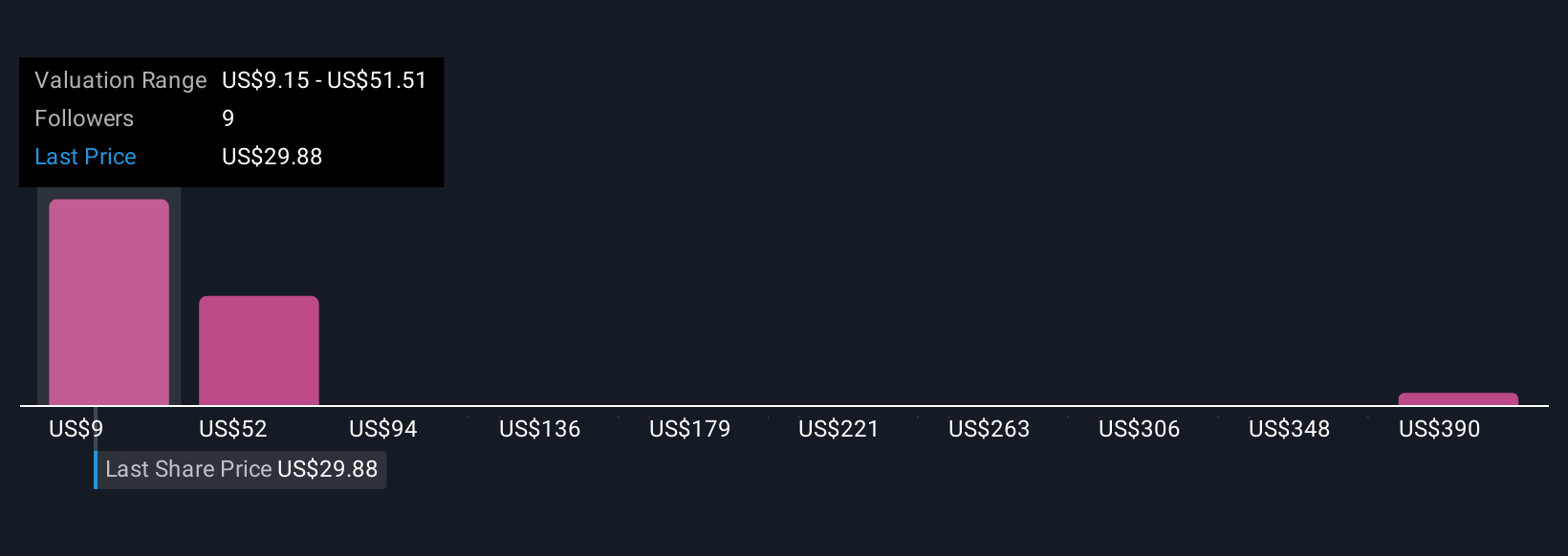

But if operational issues return, investors could face renewed uncertainty around cash flow and future launches. Firefly Aerospace's shares are on the way up, but they could be overextended by 19%. Uncover the fair value now.Exploring Other Perspectives

Explore 5 other fair value estimates on Firefly Aerospace - why the stock might be worth less than half the current price!

Build Your Own Firefly Aerospace Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Firefly Aerospace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Firefly Aerospace research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Firefly Aerospace's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FLY

Firefly Aerospace

Operates as a space and defense technology company and provides mission solutions for national security, government, and commercial customers.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success