- United States

- /

- Electrical

- /

- NasdaqCM:FLUX

Benign Growth For Flux Power Holdings, Inc. (NASDAQ:FLUX) Underpins Stock's 27% Plummet

The Flux Power Holdings, Inc. (NASDAQ:FLUX) share price has softened a substantial 27% over the previous 30 days, handing back much of the gains the stock has made lately. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

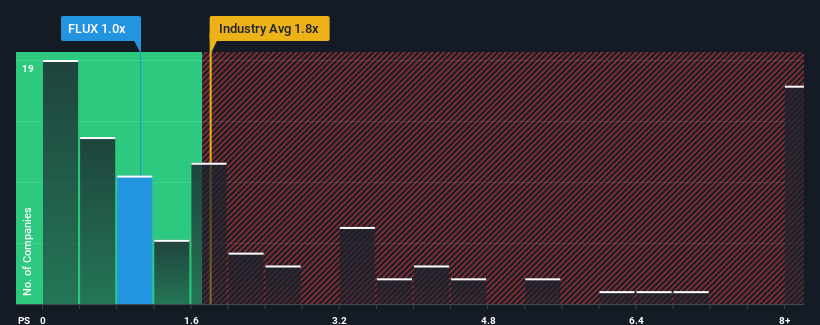

Following the heavy fall in price, Flux Power Holdings may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 5x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Flux Power Holdings

How Has Flux Power Holdings Performed Recently?

Recent times haven't been great for Flux Power Holdings as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Flux Power Holdings.Is There Any Revenue Growth Forecasted For Flux Power Holdings?

Flux Power Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Although pleasingly revenue has lifted 189% in aggregate from three years ago, notwithstanding the last 12 months. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 28% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 35% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Flux Power Holdings' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Flux Power Holdings' P/S Mean For Investors?

The southerly movements of Flux Power Holdings' shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Flux Power Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You need to take note of risks, for example - Flux Power Holdings has 4 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you're unsure about the strength of Flux Power Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:FLUX

Flux Power Holdings

Through its subsidiary, designs, develops, manufactures, and sells lithium-ion energy storage solutions in North America.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives