- United States

- /

- Electrical

- /

- NasdaqGS:FLNC

Fluence Energy, Inc. (NASDAQ:FLNC) Stock Rockets 26% But Many Are Still Ignoring The Company

Fluence Energy, Inc. (NASDAQ:FLNC) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 18% over that time.

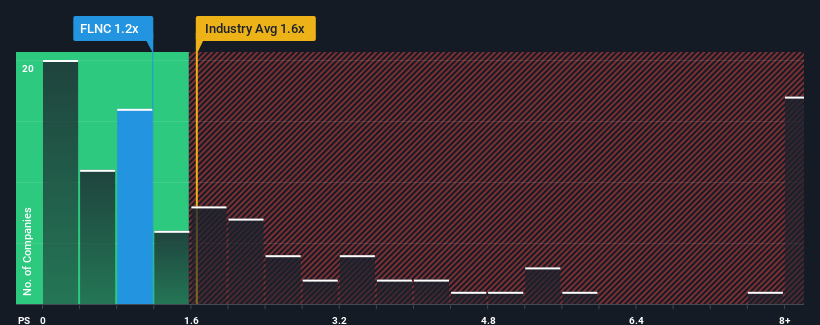

Although its price has surged higher, you could still be forgiven for feeling indifferent about Fluence Energy's P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in the United States is also close to 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Fluence Energy

What Does Fluence Energy's Recent Performance Look Like?

Recent times haven't been great for Fluence Energy as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Fluence Energy will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Fluence Energy?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Fluence Energy's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.9%. Pleasingly, revenue has also lifted 193% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 34% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 27% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that Fluence Energy's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Fluence Energy's P/S

Fluence Energy appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Fluence Energy's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 1 warning sign for Fluence Energy you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FLNC

Fluence Energy

Through its subsidiaries, provides energy storage and optimization software for renewables and storage applications in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives