- United States

- /

- Machinery

- /

- NasdaqGS:FELE

Should Franklin Electric's (FELE) $125 Million Debt Issuance Shape Investor Views on Financial Flexibility?

Reviewed by Sasha Jovanovic

- On September 26, 2025, Franklin Electric Co., Inc. issued US$125 million in 5.01% senior notes due 2032 under Private Shelf Agreements, with proceeds allocated to refinance debt and support working capital.

- This move, following second quarter earnings that exceeded analyst expectations, highlights the company's aim to strengthen its financial flexibility alongside operational efficiency.

- We'll now examine how this new debt issuance could impact Franklin Electric's investment narrative, especially in terms of enhanced financial flexibility.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Franklin Electric Investment Narrative Recap

Franklin Electric appeals to investors who believe in the long-term value of infrastructure innovation and recurring demand for water and fuel management solutions. The recent issuance of US$125 million in senior notes primarily targets refinancing and working capital, which does not materially alter the company’s core short-term catalyst: capitalizing on global water infrastructure investment cycles. However, the key risk, ongoing margin pressure from cyclical end-markets and product mix shifts, remains unchanged by this financing move.

Among recent developments, Franklin Electric’s second quarter 2025 results stand out, with earnings exceeding analyst expectations. This improved operational efficiency is relevant for monitoring how new capital infusions, like the recent note issuance, could enhance the company’s stability and responsiveness as it pursues higher-margin opportunities and works to offset sector volatility.

On the other hand, investors should also watch for ongoing risks tied to...

Read the full narrative on Franklin Electric (it's free!)

Franklin Electric's outlook anticipates $2.4 billion in revenue and $259.0 million in earnings by 2028. This is based on a projected 5.4% annual revenue growth rate and an $80.3 million increase in earnings from the current $178.7 million.

Uncover how Franklin Electric's forecasts yield a $108.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

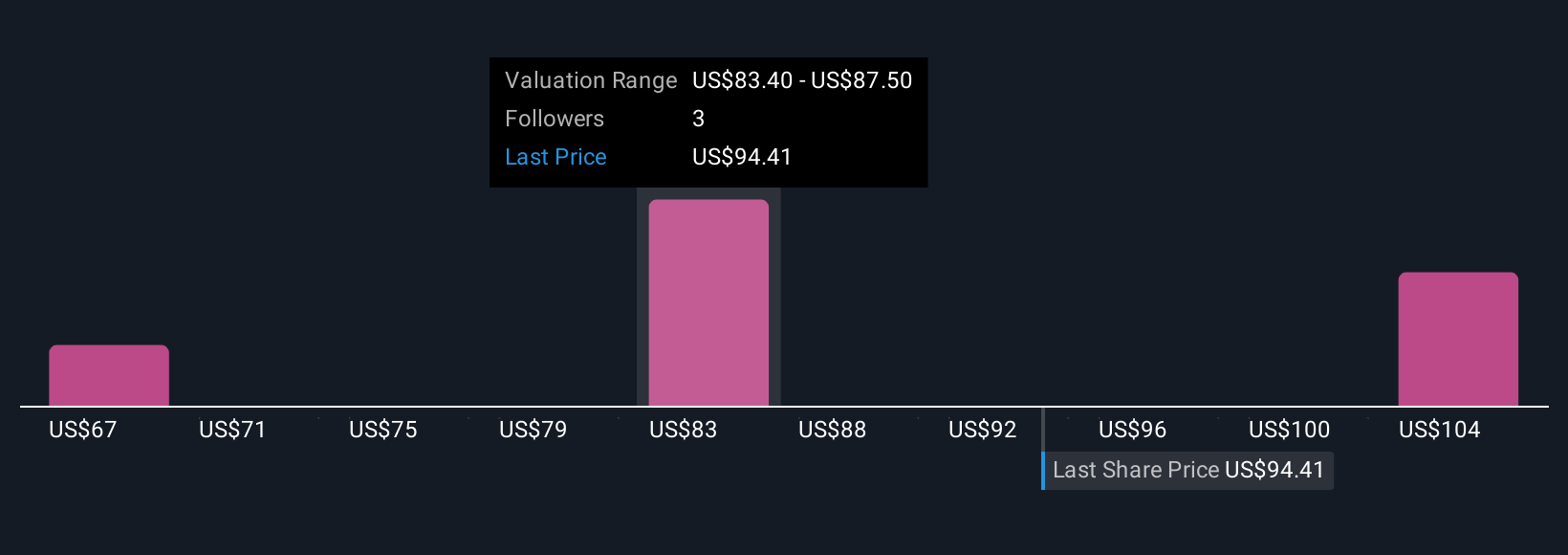

Three members of the Simply Wall St Community estimated Franklin Electric’s fair value between US$67 and US$108 per share. As opinions vary widely, remember that margin volatility due to cyclical end-markets may impact returns in ways not captured by consensus outlooks.

Explore 3 other fair value estimates on Franklin Electric - why the stock might be worth as much as 12% more than the current price!

Build Your Own Franklin Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Franklin Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Franklin Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Franklin Electric's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FELE

Franklin Electric

Designs, manufactures, and distributes water and fuel pumping systems in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives