- United States

- /

- Machinery

- /

- NasdaqGS:FELE

Here's Why Franklin Electric (NASDAQ:FELE) Can Manage Its Debt Responsibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Franklin Electric Co., Inc. (NASDAQ:FELE) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Franklin Electric

What Is Franklin Electric's Debt?

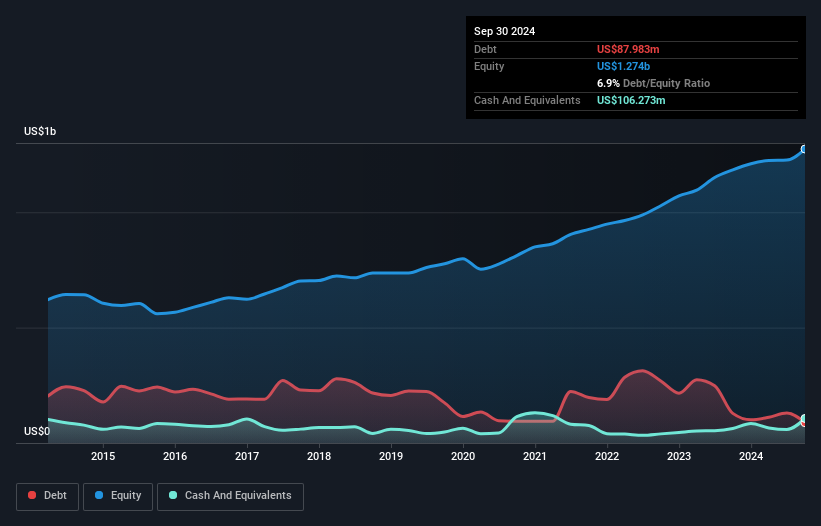

You can click the graphic below for the historical numbers, but it shows that Franklin Electric had US$88.0m of debt in September 2024, down from US$128.4m, one year before. But it also has US$106.3m in cash to offset that, meaning it has US$18.3m net cash.

How Healthy Is Franklin Electric's Balance Sheet?

We can see from the most recent balance sheet that Franklin Electric had liabilities of US$393.2m falling due within a year, and liabilities of US$140.2m due beyond that. Offsetting this, it had US$106.3m in cash and US$272.0m in receivables that were due within 12 months. So its liabilities total US$155.1m more than the combination of its cash and short-term receivables.

Of course, Franklin Electric has a market capitalization of US$4.44b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Despite its noteworthy liabilities, Franklin Electric boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Franklin Electric saw its EBIT drop by 8.1% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Franklin Electric's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Franklin Electric has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Franklin Electric produced sturdy free cash flow equating to 62% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Franklin Electric has US$18.3m in net cash. So we are not troubled with Franklin Electric's debt use. We'd be motivated to research the stock further if we found out that Franklin Electric insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FELE

Franklin Electric

Designs, manufactures, and distributes water and fuel pumping systems worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives