- United States

- /

- Electrical

- /

- NasdaqGM:FCEL

FuelCell Energy (FCEL): Evaluating Fair Value After Sector Surge and AI-Powered Growth Narrative

Reviewed by Kshitija Bhandaru

FuelCell Energy, a leading developer of industrial fuel cell platforms, has seen its stock price surge as Wall Street reacts to two key developments. Excitement is building as bullish sentiment lifts shares across the hydrogen space, largely sparked by analyst moves on Plug Power.

See our latest analysis for FuelCell Energy.

This latest burst of momentum for FuelCell Energy stock is part of a larger wave sweeping through the hydrogen space, fueled by upbeat analyst calls and renewed faith in the sector’s long-term potential. Over the short term, FuelCell’s rally reflects more than just sector hype. It builds on last quarter’s standout revenue growth and optimism about the company’s role powering future data centers for AI. Even after this surge, the company’s 1-year total shareholder return remains close to flat. This suggests that while enthusiasm is returning, long-term investors are still waiting for more convincing gains.

If the recent buzz in clean energy has you curious, you may want to discover fast growing stocks with high insider ownership next.

With shares up sharply in a matter of weeks, the question now is whether FuelCell Energy is still trading below its true value or if the market has already priced in every prospect for future growth. Could there still be a real buying opportunity here?

Most Popular Narrative: 38% Overvalued

FuelCell Energy’s fair value according to the most followed narrative comes in at $7.38, while the last close was $10.21. This sets the stage for a deeper look at the underlying drivers and challenges shaping the company’s future potential as priced today.

The partnership with Diversified Energy to deliver up to 360 megawatts to data centers in Virginia, West Virginia, and Kentucky is anticipated to drive significant revenue growth as it positions FuelCell Energy at the forefront of powering AI and high-performance computing sectors.

Ready to dig below the headlines? The most popular narrative behind this price tag is anything but conservative. There is a bold assumption hidden in its forecast—a leap in both revenue and profit margins that would put FuelCell Energy in the same league as top industry names. Curious how these optimistic expectations stack up against reality? The full breakdown spills the numbers that could make or break this valuation.

Result: Fair Value of $7.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and heavy reliance on new partnerships could quickly undermine the bullish narrative if projects encounter delays or if cost reductions fall short.

Find out about the key risks to this FuelCell Energy narrative.

Another View: What About Sales Ratios?

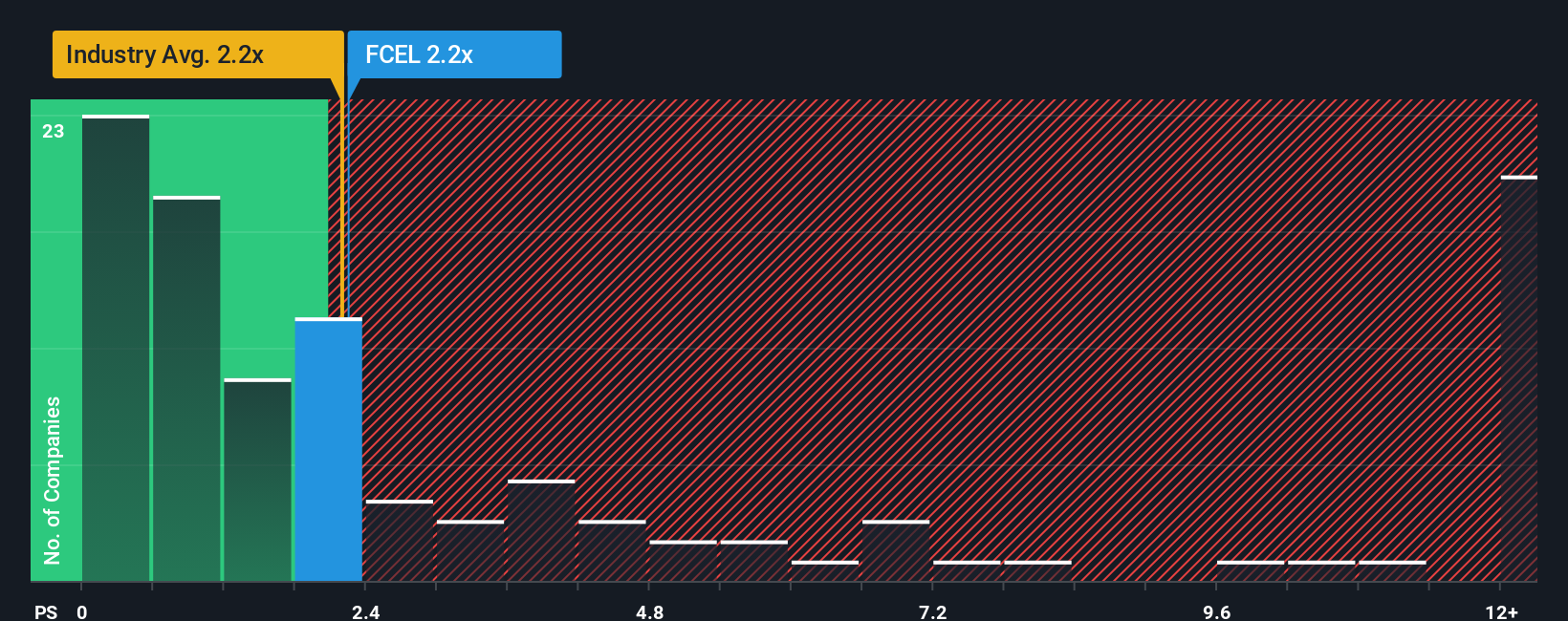

Looking at FuelCell Energy from another perspective, its price-to-sales ratio matches the U.S. Electrical industry average at 2.2 times sales, but it is significantly higher than the fair ratio of 0.5 times sales. Compared to similar peers, valuation risk appears elevated if expectations do not materialize as anticipated. Could the market move closer to that fair ratio?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own FuelCell Energy Narrative

If you think the story should go in a different direction or want to test your own analysis, building your own narrative takes just a few minutes. Do it your way.

A great starting point for your FuelCell Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the market and uncover opportunities others miss by putting the Simply Wall Street Screener to work for you. There is always a smarter move to make.

- Tap into the explosive growth of smart healthcare by checking out these 32 healthcare AI stocks, promising real innovation in AI-powered medicine and diagnostics.

- Target long-term passive income streams and see which companies offer outsized yields with these 19 dividend stocks with yields > 3% that are built to last.

- Seize your chance to gain early access to sectors transforming finance and security through these 78 cryptocurrency and blockchain stocks, making waves in the decentralized economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FCEL

FuelCell Energy

Manufactures and sells stationary fuel cell and electrolysis platforms that decarbonize power and produce hydrogen.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives