- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

Is Fastenal’s Slide an Opportunity After Its 9.9% Monthly Drop in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Fastenal stock right now? It's a good question, and plenty of investors are wrestling with it. After all, Fastenal has had a remarkable run over the last few years: up 98.9% in the past 3 years and 114.8% in the last 5. However, the last month has been rough, with the stock sliding 9.9% and a 7.3% dip just in the last week. Even with these recent hiccups, it’s still showing an impressive 19.4% year-to-date gain and is 11.3% higher than it was a year ago. Market sentiment seems to be shifting, as investors rethink the company’s future growth trajectory in light of broader market developments, supply chain recovery, and changing industrial demand.

Given all of this, it’s no wonder people are asking what’s built into Fastenal’s price and whether there’s more upside left. The professional rating systems we use add a point to a company’s “value score” for each of six ways it appears undervalued. Fastenal scores a 0 out of 6, not undervalued by any of those traditional checks. But are these methods the best way to judge value, or is there a more insightful approach? Let’s break down those classic valuation checks and then get to the method that might actually tell us more about Fastenal’s true potential.

Fastenal scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Fastenal Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and then discounting those future amounts back to their present value using an appropriate discount rate. This process aims to capture the true intrinsic value of a business based on its ability to generate cash for shareholders over time.

For Fastenal, the DCF model uses a two-stage free cash flow to equity approach. The company's latest twelve-month free cash flow stands at $990 Million. Analysts have provided detailed forecasts for the next five years, showing steady growth, with Simply Wall St extrapolating those projections out an additional five years. By 2029, Fastenal's free cash flow is expected to reach $1.42 Billion and continue increasing annually thereafter based on estimated growth rates.

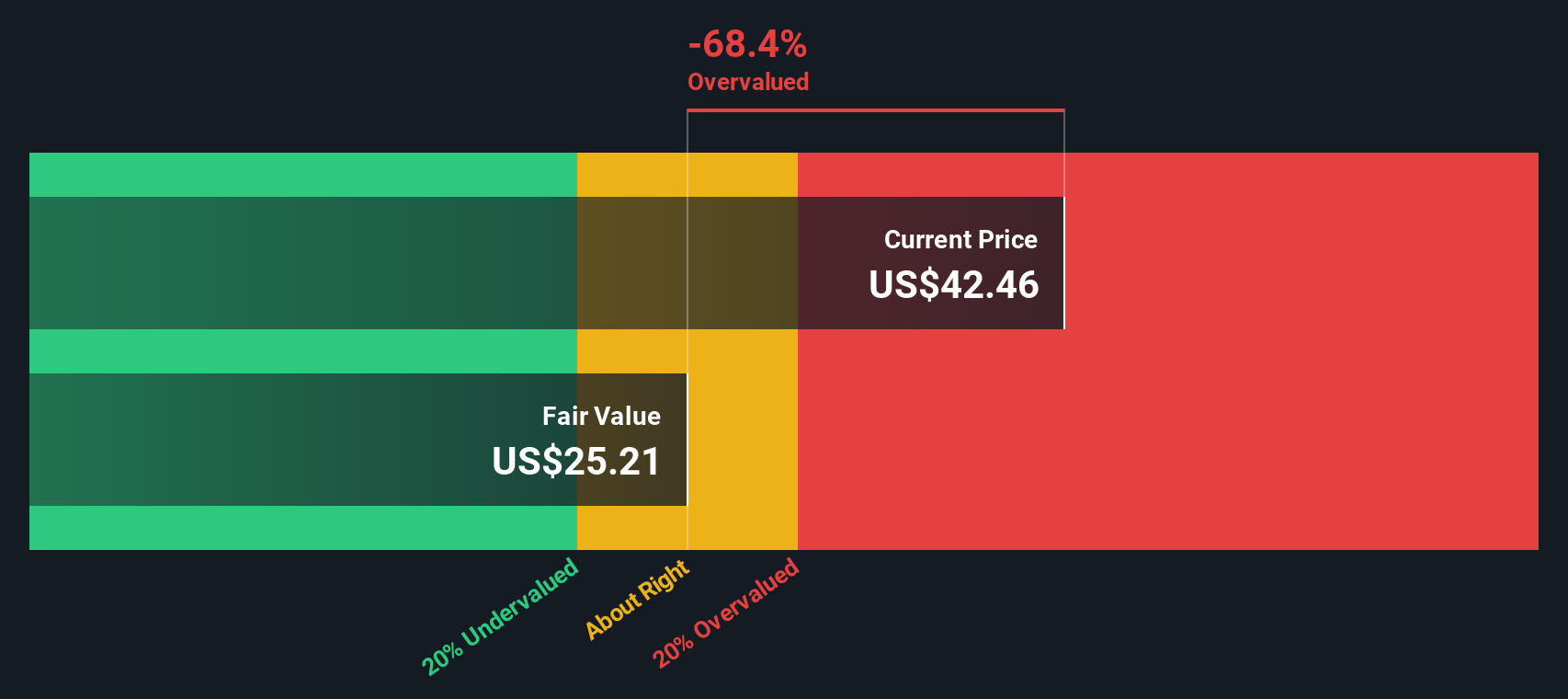

After discounting all these future cash flows to today's dollars, the DCF model calculates Fastenal's intrinsic fair value at $25.21 per share. Since the current share price is nearly 68.4% higher than this DCF estimate, the stock appears substantially overvalued according to this method of analysis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fastenal may be overvalued by 68.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fastenal Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Fastenal. It tells investors how much they are paying for each dollar of earnings the company generates. Because Fastenal has a consistent earning record, the PE ratio is a relevant way to assess whether the stock price reflects its actual earnings power.

Growth expectations and risk both play a major role in what is considered a “normal” or “fair” PE ratio. A business expected to grow earnings quickly or with lower-than-average risk can reasonably command a higher PE, while slower growth or greater risk should mean a lower multiple.

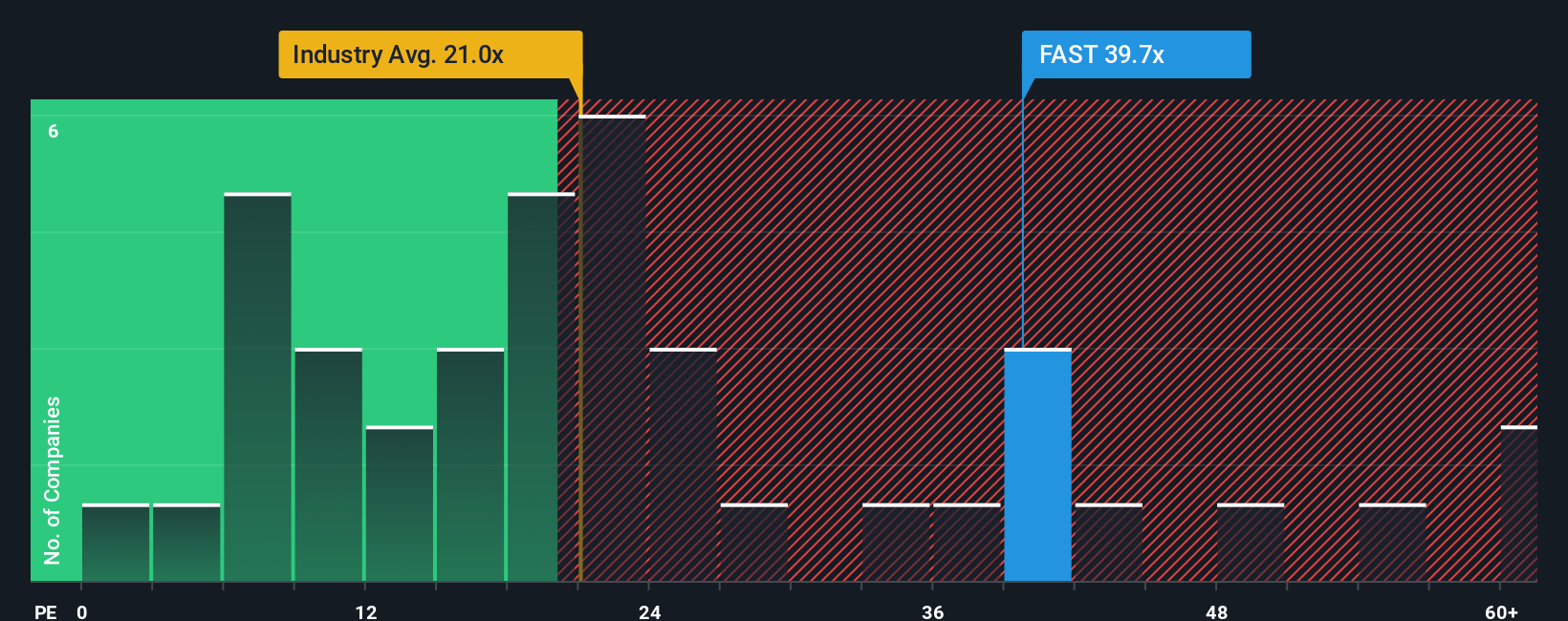

Fastenal's current PE ratio sits at 39.7x, which is well above the average for both its peers (21.0x) and the broader Trade Distributors industry (also 21.0x). While this might signal overvaluation based on standard comparisons, Simply Wall St also calculates a “Fair Ratio” for each company that goes beyond simple averages. The Fair Ratio for Fastenal is 25.9x, reflecting factors like its strong profits, growth profile, industry trends, and market cap.

Comparing these two figures offers a more nuanced view than basic peer or industry comparisons. The Fair Ratio method accounts for Fastenal's specific risks and growth prospects, so it provides a more tailored valuation anchor than a one-size-fits-all benchmark. In Fastenal’s case, however, the actual PE (39.7x) remains significantly above the company’s Fair Ratio (25.9x), suggesting that even after adjusting for its qualities, the stock is trading at a premium.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fastenal Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Think of a Narrative as your story behind the numbers. It is the perspective you bring to Fastenal’s future, such as how you expect its managed inventory tech or digital expansion will drive revenue, what you believe about future margins, and ultimately the fair value you assign the stock.

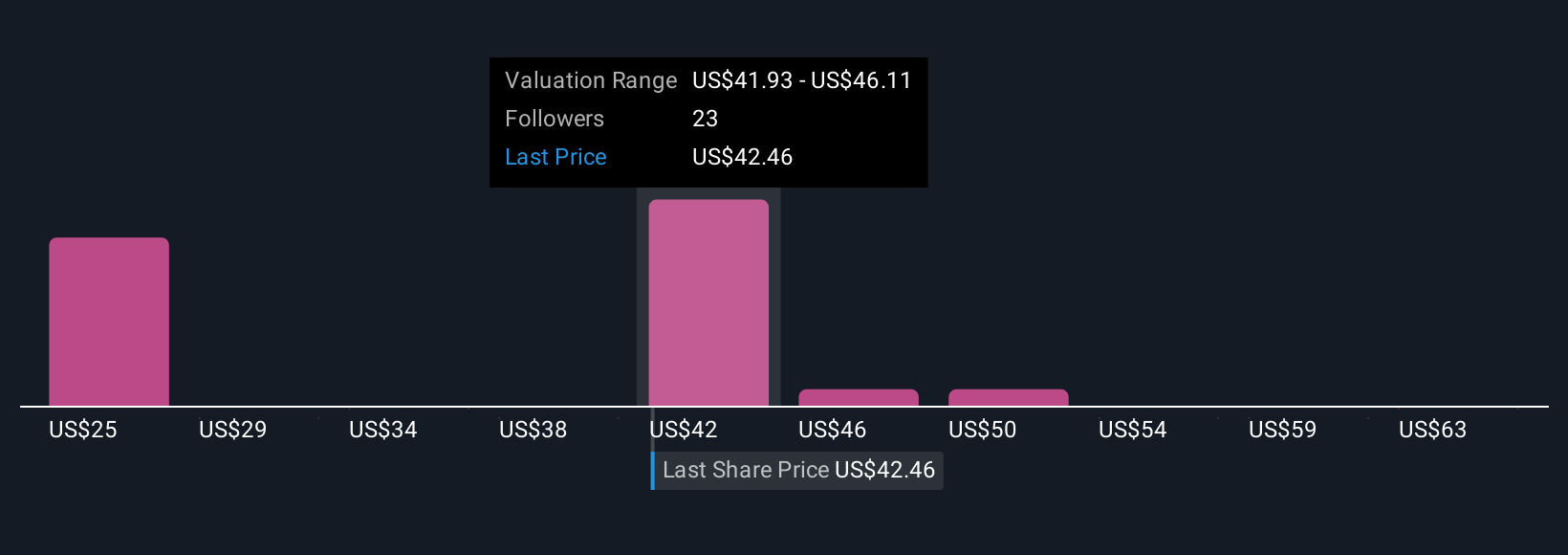

Narratives make investing more approachable by connecting your reasoning to a financial forecast and a fair value. This approach makes it clear how your view compares with others and the current price. On Simply Wall St’s Community page, millions of investors are already using Narratives to outline their scenarios, test assumptions, and compare when to buy or sell based on whether their fair value is above or below today’s share price.

Narratives are dynamic and automatically update when new news or results arrive, so your outlook adapts as the facts change. For example, with Fastenal, some investors are bullish, forecasting transformative supply chain gains and targeting a price as high as $53.00. Others see margin challenges and project a fair value closer to $29.50. Narratives let you build, update, and act on your perspective as the story unfolds.

Do you think there's more to the story for Fastenal? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives