- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

Is Fastenal’s (FAST) Revenue Growth Signaling Sustainable Gains Amid Ongoing Demand Uncertainty?

Reviewed by Sasha Jovanovic

- Fastenal Company recently reported third quarter 2025 earnings, highlighting revenue growth to US$2,133.3 million and net income of US$335.5 million, alongside a declared US$0.22 per share dividend for shareholders of record as of October 28, 2025.

- Management pointed out that gains were achieved through market share expansion and improved cost efficiency despite subdued industrial demand and ongoing uncertainty from tariffs.

- We'll assess how revenue and earnings growth, alongside management’s cautious demand outlook, may affect Fastenal’s investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Fastenal Investment Narrative Recap

To invest in Fastenal, you need to believe in the company’s ability to sustain revenue and earnings growth by expanding market share and improving operational efficiency even when industrial demand is soft. The latest earnings report shows solid growth and effective cost controls, but ongoing tariff uncertainty and cautious outlook from management keep external demand risk firmly in the spotlight. The reported lack of share buybacks in the recent quarter is not material to the main story, as reinvestment and operational priorities remain at the forefront. Instead, attention turns to Fastenal’s continued sales and net income growth, numbers that reinforce its push into digital channels and supply chain resilience, supporting its case for future expansion. On the flip side, investors should be aware of the ongoing pressure from tariffs and global trade tensions, particularly as they ...

Read the full narrative on Fastenal (it's free!)

Fastenal's outlook forecasts $9.9 billion in revenue and $1.6 billion in earnings by 2028. This calls for 8.5% annual revenue growth and an increase of $0.4 billion in earnings from the current $1.2 billion level.

Uncover how Fastenal's forecasts yield a $44.35 fair value, a 4% upside to its current price.

Exploring Other Perspectives

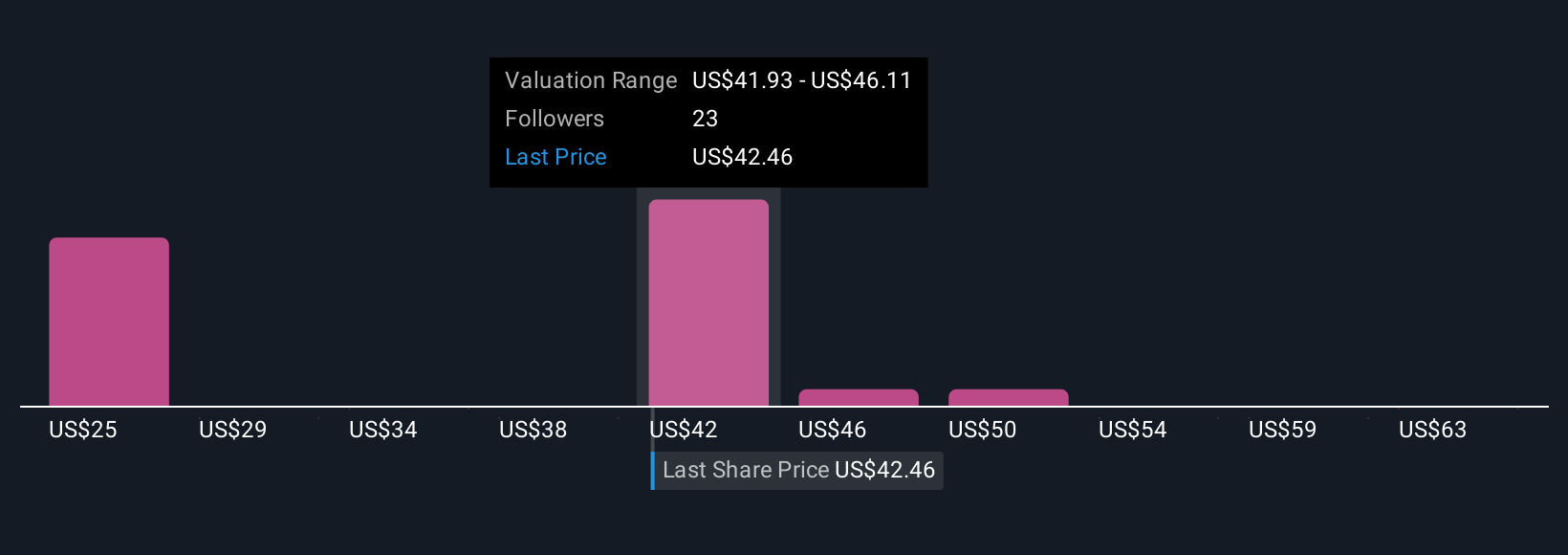

Ten Simply Wall St Community members estimate Fastenal’s fair value from US$25.14 to US$67. Supply chain and tariff risks highlighted in recent results may shape how you interpret these divergent views.

Explore 10 other fair value estimates on Fastenal - why the stock might be worth 41% less than the current price!

Build Your Own Fastenal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fastenal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fastenal's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives