- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

Fastenal (NasdaqGS:FAST) Declares US$0.22 Dividend Following Two-For-One Stock Split

Reviewed by Simply Wall St

Fastenal (NasdaqGS:FAST) recently announced a dividend of $0.22 per share to be paid in August, following a two-for-one stock split effective in May 2025. Over the past quarter, Fastenal's stock price increased by 7%, aligning closely with the broader market's upward movement over the past year. The stock split and dividend declaration likely bolstered investor confidence, adding weight to Fastenal's performance. Despite a flat market over the last week, Fastenal's adjustments in shareholder returns and enhanced stock liquidity through the stock split could help sustain investor interest and align with anticipated earnings growth trends.

We've spotted 1 weakness for Fastenal you should be aware of.

Fastenal's recent dividend announcement and planned stock split are strategic moves that could positively impact both investor sentiment and the company's operational outlook. The emitted confidence through these initiatives may enhance Fastenal's narrative by reinforcing investor trust as they aim to increase their digital and managed inventory capabilities, potentially driving efficiency gains and expanded revenue streams. Over the longer-term, Fastenal's shares have delivered a robust total return of 122.98% over the past five years, demonstrating significant growth compared to the stock's recent minor fluctuations. In the context of the last year, Fastenal has outperformed the US Trade Distributors industry, which saw a 12.1% return.

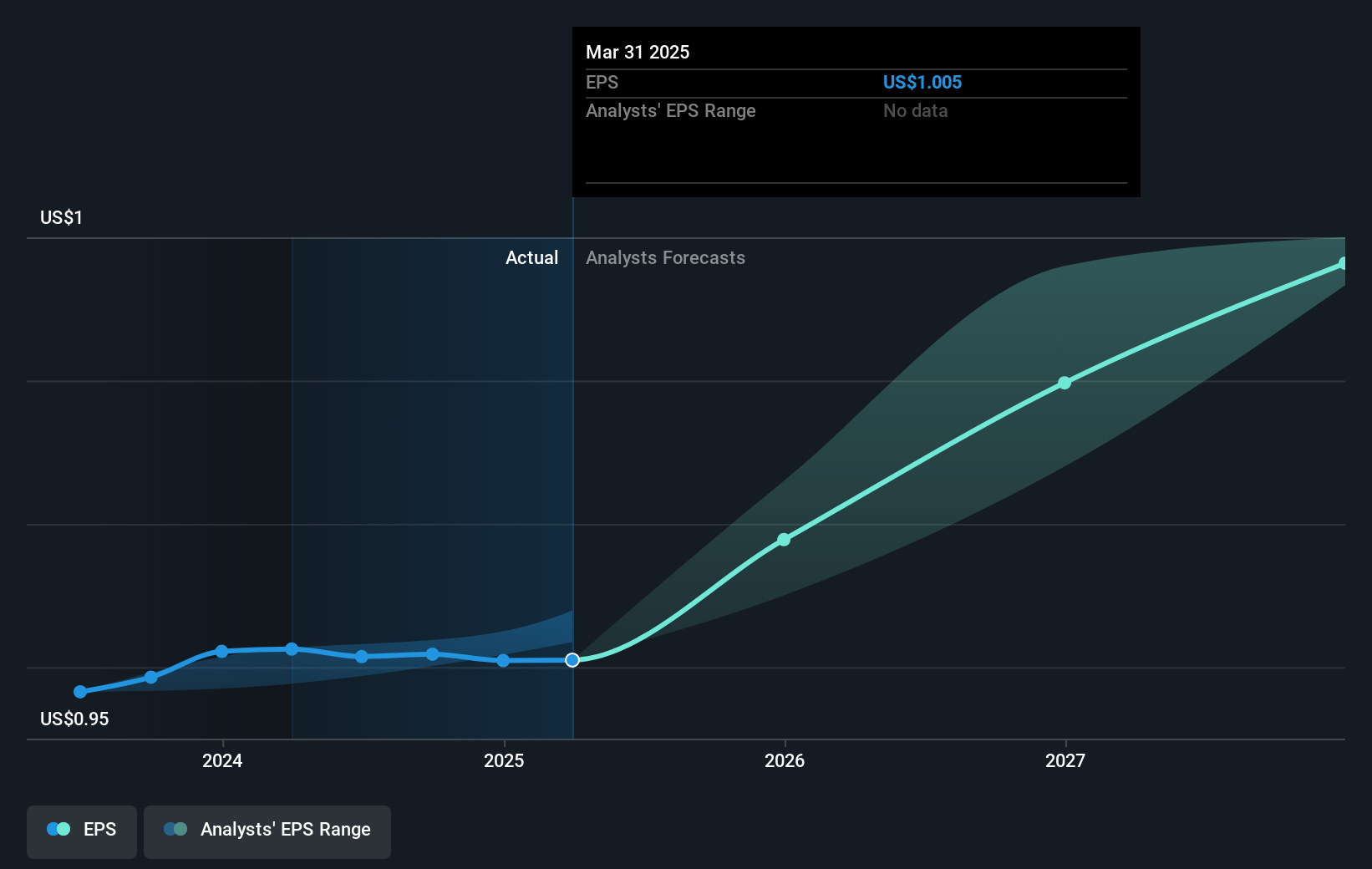

The dividend and stock split could positively resonate with revenue and earnings forecasts, providing additional leverage as the company seeks to grow its digital presence and diversify supply chains. Analysts forecast revenue growth at 7.8% per year, with earnings projected to reach US$1.5 billion by May 2028. However, the current share price of US$78.50 presents a slight discount compared to the consensus price target of US$75.28. This relative parity suggests that analysts view the stock as fairly valued based on anticipated future growth. Nevertheless, potential fluctuations in trade dynamics and cost pressures may pose challenges, emphasizing the need for Fastenal to execute its strategic initiatives effectively.

Examine Fastenal's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives