- United States

- /

- Electrical

- /

- NasdaqCM:EOSE

Eos Energy Enterprises (EOSE): Valuation Insights After $1 Billion Financing and Expansion-Driven Cash Boost

Reviewed by Simply Wall St

Eos Energy Enterprises just closed over $1 billion in new financing through a mix of convertible notes and equity. This gives the company more cash, reduces its debt, and increases its capacity for expansion as energy storage demand grows.

See our latest analysis for Eos Energy Enterprises.

The financing news comes amid a remarkable run in Eos Energy Enterprises' share price, which has gained over 156% year-to-date and nearly doubled in the last 90 days alone. Recent equity and convertible note offerings, along with strategic warrants issued to the Department of Energy, have increased liquidity and reinforced confidence in Eos’s ambitious expansion plans. While short-term volatility persists, the company’s one-year total shareholder return of 426% highlights strong long-term momentum as investors consider its role in the growing energy storage sector.

If Eos’s turnaround has you rethinking your strategy, now's a great chance to broaden your view and discover fast growing stocks with high insider ownership

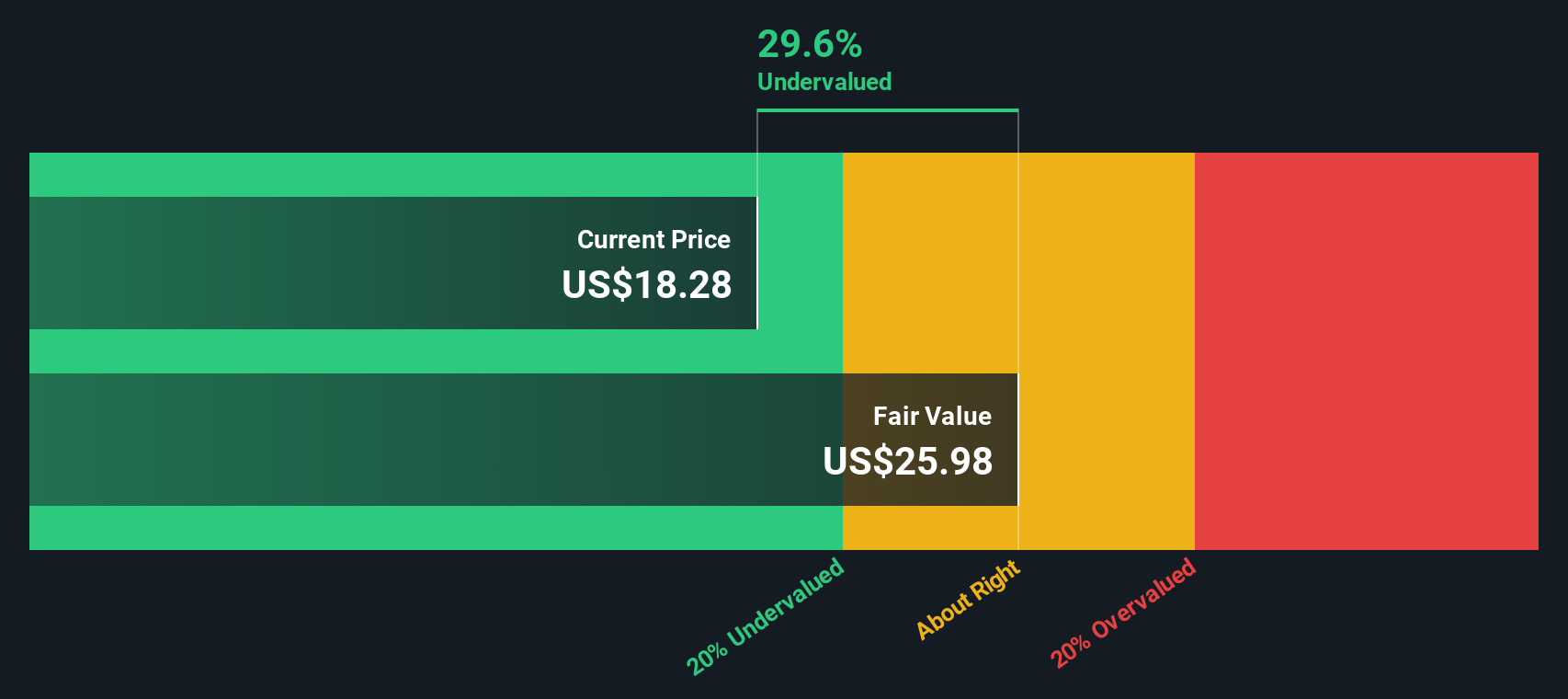

With shares rallying and a major influx of capital improving its outlook, the key question for investors is whether Eos Energy Enterprises remains undervalued, or if the stock’s remarkable gains reflect all its future potential. Is this a fresh buying opportunity, or has the market already priced in the next phase of growth?

Most Popular Narrative: 6.6% Undervalued

Eos Energy Enterprises' most popular narrative suggests a fair value of $15.21 per share, over 6% above the last close of $14.21. The stage is set for debate as investors weigh rapid growth prospects against ongoing execution risks.

Recent supply agreements and strategic collaborations are viewed as strong indicators of Eos Energy securing major, multi-year growth opportunities, particularly in meeting robust demand from sectors such as data centers and grid infrastructure.

Want to know why this story points to a valuation above the current price? The focus is a high-stakes forecast that combines revenue expansion and optimistic profit margins, metrics that could influence Eos Energy’s future. Find out how analysts run the numbers to arrive at a fair value that balances optimism and caution. Click and see what’s behind these bold calls.

Result: Fair Value of $15.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operating losses and delays in turning orders into revenue could quickly challenge the current growth outlook and put pressure on future valuations.

Find out about the key risks to this Eos Energy Enterprises narrative.

Another View: Discounted Cash Flow Model

While analysts see Eos Energy Enterprises as slightly undervalued based on profit projections and price targets, our DCF model presents a less optimistic perspective. According to this method, the stock trades above its estimated fair value, which suggests there may be valuation risk if high growth and margin assumptions do not fully materialize. Which scenario will play out as Eos scales up?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eos Energy Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eos Energy Enterprises Narrative

If you have a different perspective or want to run your own numbers, you can craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Eos Energy Enterprises research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your investments and don’t miss the opportunities that the smartest investors are watching right now. Simply Wall Street’s tools put them at your fingertips.

- Accelerate your search for tomorrow’s leading tech with these 25 AI penny stocks and target companies pushing the boundaries of artificial intelligence.

- Unlock the power of steady income streams as you review these 15 dividend stocks with yields > 3% offering impressive yields over 3% for financial peace of mind.

- Pinpoint unique growth stories at the intersection of finance and innovation by scanning these 81 cryptocurrency and blockchain stocks shaping the next chapter in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eos Energy Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EOSE

Eos Energy Enterprises

Designs, develops, manufactures, and markets energy storage solutions for utility-scale, microgrid, and commercial and industrial applications in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026