- United States

- /

- Electrical

- /

- NasdaqCM:EOSE

Eos Energy Enterprises (EOSE): Reassessing Valuation After Its $458 Million Follow-On Equity Offering

Reviewed by Simply Wall St

Eos Energy Enterprises (EOSE) just raised about $458 million through a follow on equity offering of roughly 35.9 million common shares at $12.78, a move that immediately puts dilution and growth plans in focus.

See our latest analysis for Eos Energy Enterprises.

The fresh capital raise lands after a volatile run, with the latest share price at $13.55, a 90 day share price return of 84.6 percent and a 1 year total shareholder return of 356.23 percent, signaling strong but risk aware momentum.

If this kind of high risk growth story has your attention, it might be a good time to explore fast growing stocks with high insider ownership for other potential standouts.

With the stock already up sharply and trading only modestly below analyst targets, the capital raise forces a key question for investors: Is Eos still mispriced, or is the market already baking in years of growth?

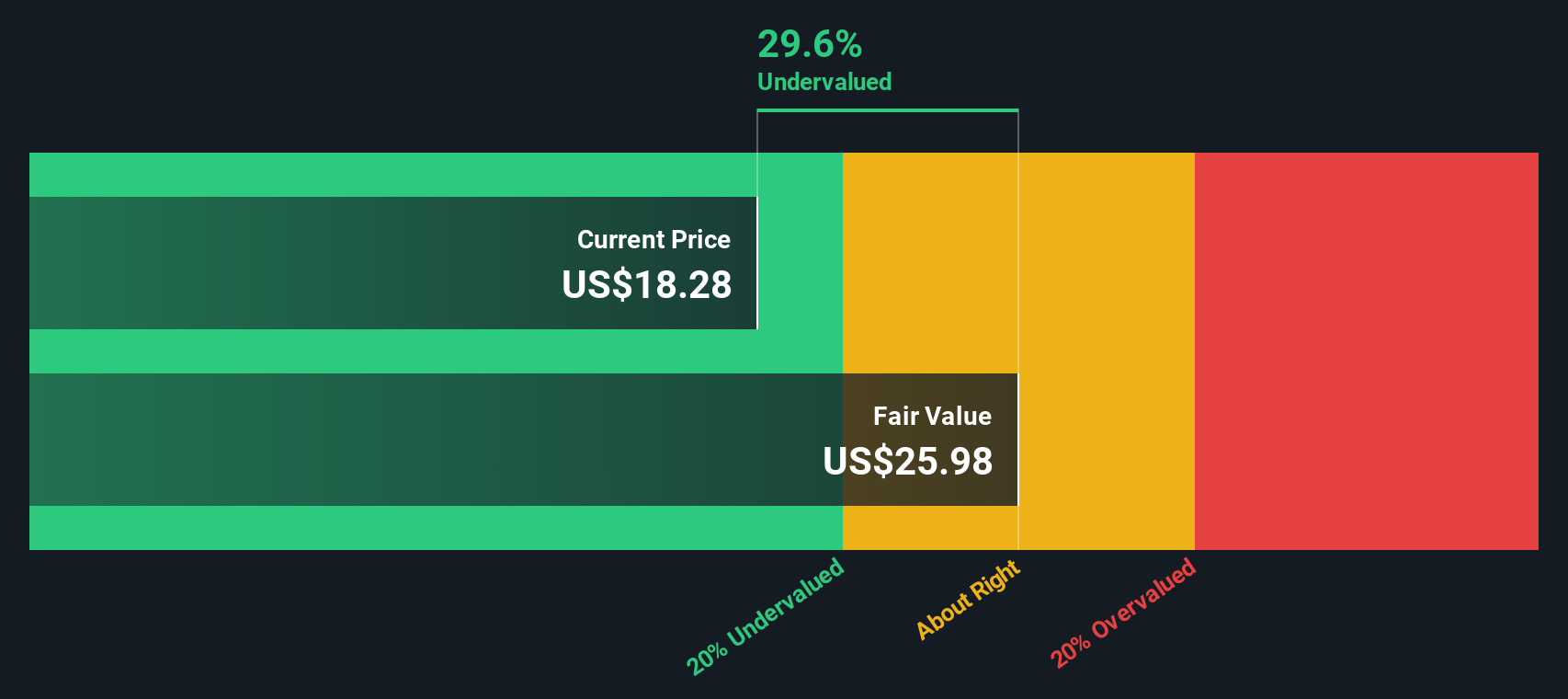

Most Popular Narrative Narrative: 17.5% Undervalued

With the most followed narrative placing fair value above the last close at $13.55, the offering now sits against an already optimistic backdrop.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, up from -1.6x today. This future PE is lower than the current PE for the US Electrical industry at 33.0x.

Want to see what kind of revenue surge and margin flip could justify that future earnings multiple? The narrative leans on aggressive scaling and profitability assumptions. Curious how bold those projections really are? Read on to see the full valuation blueprint behind this pricing gap.

Result: Fair Value of $16.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on Eos clearing key hurdles, including proving its technology at scale and avoiding further dilution if heavy cash burn persists.

Find out about the key risks to this Eos Energy Enterprises narrative.

Another Lens on Value

Our SWS DCF model is less upbeat than the narrative crowd, pointing to a fair value of $9.83 versus today’s $13.55. This suggests the shares may be overvalued if cash flows ramp more slowly than anticipated. Which story do you think will win out: momentum or math?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eos Energy Enterprises for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eos Energy Enterprises Narrative

If you want to dig into the numbers yourself or challenge these assumptions, you can spin up a custom view in just minutes, Do it your way.

A great starting point for your Eos Energy Enterprises research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next edge by scanning tailored stock ideas from our screeners so you are not late to any potential opportunities.

- Explore overlooked growth potential in markets others may ignore by scanning these 3573 penny stocks with strong financials for financially resilient names hiding in plain sight.

- Focus on long-term trends in automation and machine learning by reviewing these 25 AI penny stocks that are involved with these technologies.

- Identify quality businesses trading below their cash flow metrics through these 916 undervalued stocks based on cash flows and compare prices with fundamental data.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eos Energy Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EOSE

Eos Energy Enterprises

Designs, develops, manufactures, and markets energy storage solutions for utility-scale, microgrid, and commercial and industrial applications in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026