- United States

- /

- Building

- /

- NasdaqGS:AAON

Insider Favorites: AAON And Two More Leading Growth Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a significant surge following the recent easing of trade tensions between the U.S. and China, major indices like the Dow Jones Industrial Average and Nasdaq Composite have seen notable gains. In this buoyant environment, growth companies with high insider ownership can be particularly appealing to investors, as they often signal strong confidence from those who know the business best and can offer potential resilience amidst broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.1% | 39.6% |

| Duolingo (NasdaqGS:DUOL) | 14.3% | 39.9% |

| Astera Labs (NasdaqGS:ALAB) | 15.3% | 43.4% |

| FTC Solar (NasdaqCM:FTCI) | 32.2% | 61.8% |

| AST SpaceMobile (NasdaqGS:ASTS) | 13.5% | 60.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.1% | 65.1% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Clene (NasdaqCM:CLNN) | 19.4% | 67.3% |

| BBB Foods (NYSE:TBBB) | 16.2% | 28.9% |

| Upstart Holdings (NasdaqGS:UPST) | 12.5% | 102.6% |

Here we highlight a subset of our preferred stocks from the screener.

AAON (NasdaqGS:AAON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAON, Inc., along with its subsidiaries, specializes in the engineering, manufacturing, marketing, and selling of air conditioning and heating equipment across the United States and Canada, with a market cap of approximately $8.16 billion.

Operations: The company's revenue segments are comprised of Basx at $237.24 million, AAON Oklahoma at $818.91 million, and AAON Coil Products at $248.90 million.

Insider Ownership: 17.3%

Earnings Growth Forecast: 25.8% p.a.

AAON is positioned for robust growth with its earnings forecast to increase by 25.8% annually, outpacing the US market. Despite recent insider selling, AAON's strategic innovations in HVAC technology, including advancements in their Alpha Class heat pumps, underscore their commitment to industry leadership and electrification trends. The company recently reaffirmed its financial guidance for 2025 with anticipated sales growth in the mid- to high teens and maintained gross margins. Additionally, AAON's ongoing share repurchase program reflects strong confidence in its future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of AAON.

- In light of our recent valuation report, it seems possible that AAON is trading beyond its estimated value.

Enovix (NasdaqGS:ENVX)

Simply Wall St Growth Rating: ★★★★★★

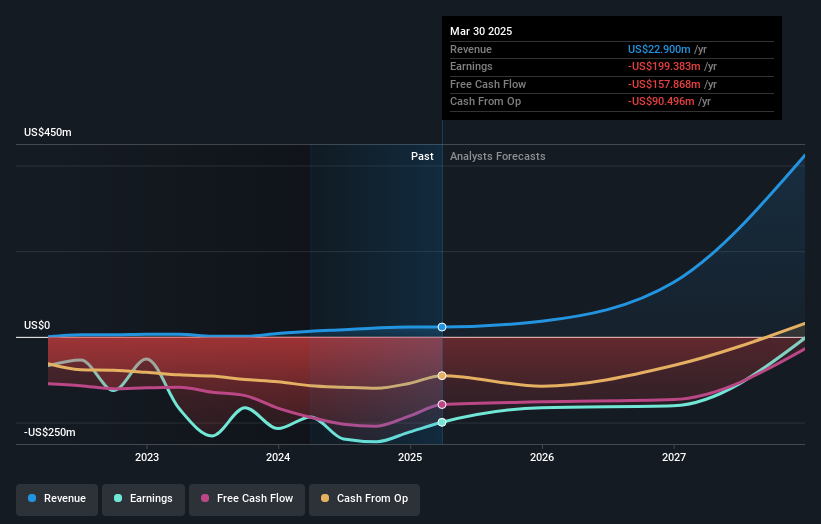

Overview: Enovix Corporation designs, develops, and manufactures lithium-ion battery cells both in the United States and internationally, with a market cap of approximately $1.26 billion.

Operations: The company generates revenue primarily from its Batteries / Battery Systems segment, amounting to $22.90 million.

Insider Ownership: 12.1%

Earnings Growth Forecast: 58.4% p.a.

Enovix demonstrates potential for growth, with revenue expected to increase by 46.6% annually, surpassing US market averages. The company is forecasted to achieve profitability within three years, indicating above-average market growth. Recent insider activity shows more shares bought than sold over the past three months, albeit not in large volumes. Despite a highly volatile share price recently, Enovix's strategic direction and new CFO appointment may bolster its financial leadership and operational stability.

- Click to explore a detailed breakdown of our findings in Enovix's earnings growth report.

- According our valuation report, there's an indication that Enovix's share price might be on the expensive side.

Hut 8 (NasdaqGS:HUT)

Simply Wall St Growth Rating: ★★★★★☆

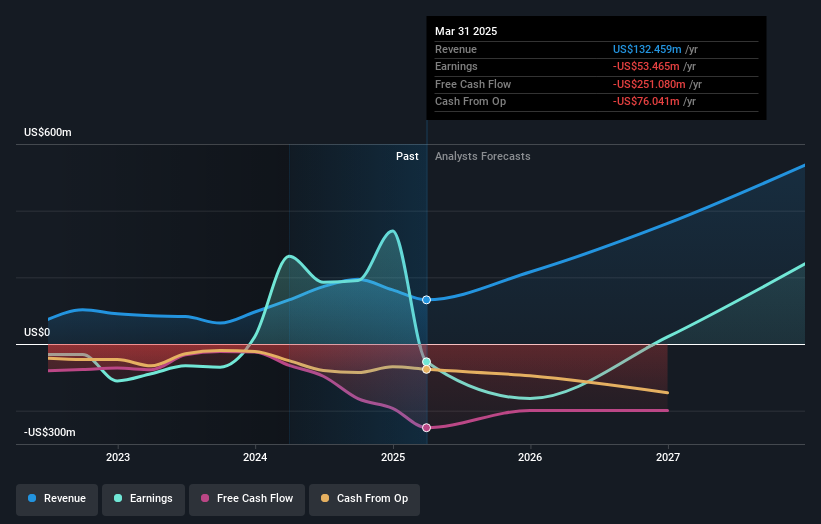

Overview: Hut 8 Corp. is a vertically integrated operator of energy infrastructure and Bitcoin miners in North America, with a market cap of approximately $1.45 billion.

Operations: The company's revenue segments include Power generating $46.83 million and Digital Infrastructure contributing $20.99 million.

Insider Ownership: 10.5%

Earnings Growth Forecast: 58.4% p.a.

Hut 8's revenue is forecast to grow at 43.8% annually, significantly outpacing the US market average of 8.4%. Despite recent volatility in its share price and a substantial net loss of US$133.89 million in Q1 2025, Hut 8's strategic expansion through American Bitcoin Corp. positions it for potential growth in industrial-scale Bitcoin mining. The company has not experienced significant insider trading activity recently and expects to achieve profitability within three years, surpassing average market growth projections.

- Get an in-depth perspective on Hut 8's performance by reading our analyst estimates report here.

- The analysis detailed in our Hut 8 valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Access the full spectrum of 194 Fast Growing US Companies With High Insider Ownership by clicking on this link.

- Searching for a Fresh Perspective? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives