- United States

- /

- Diversified Financial

- /

- NYSE:PAY

3 Growth Companies With Insider Ownership Up To 35%

Reviewed by Simply Wall St

As the major U.S. stock indexes, including the Dow Jones Industrial Average, continue to close higher amid investor optimism despite a decline in private employment, market attention turns to growth companies with significant insider ownership. In today's environment, where economic indicators are mixed and interest rate decisions loom large, stocks with high insider ownership can be appealing as they often signal confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 23.3% | 73.5% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Here Group (HERE) | 36.1% | 38.8% |

| Credo Technology Group Holding (CRDO) | 10.4% | 28.0% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 131.7% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 11.9% | 29.0% |

| AppLovin (APP) | 27.5% | 27.3% |

Let's uncover some gems from our specialized screener.

Rumble (RUM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rumble Inc. operates video sharing platforms and cloud services across the United States, Canada, and internationally, with a market cap of approximately $2.58 billion.

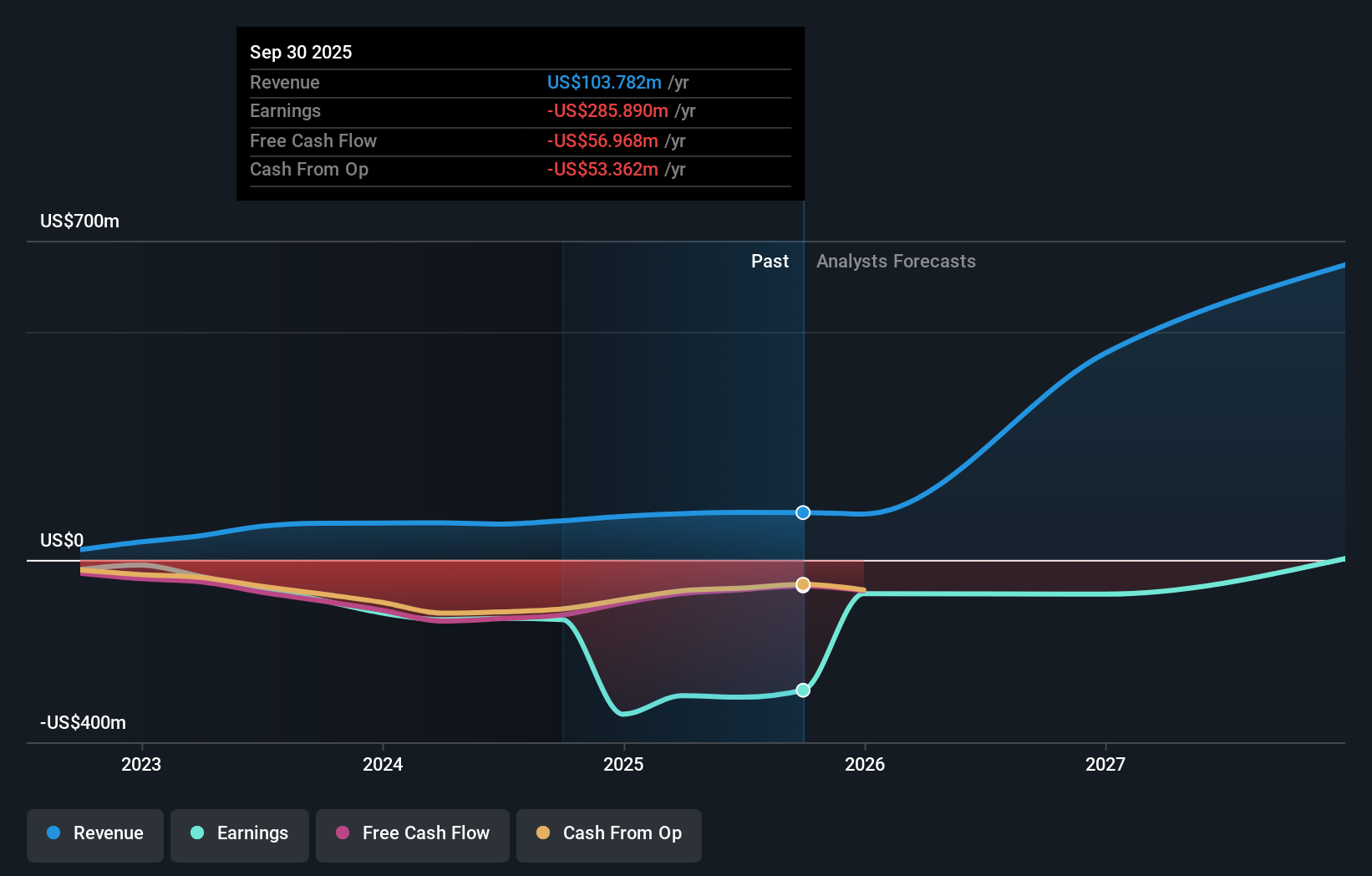

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, amounting to $103.78 million.

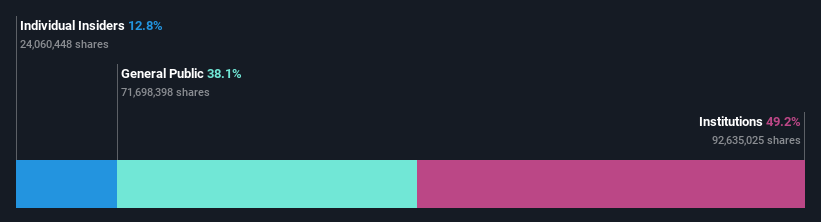

Insider Ownership: 35.9%

Rumble has demonstrated significant growth potential with a forecasted revenue increase of 52.5% annually, outpacing the US market average. Despite past shareholder dilution, the company is expected to achieve profitability within three years. Recent strategic partnerships, such as with Perplexity and the Cleveland Browns, enhance its technological infrastructure and content discoverability. The company's recent earnings report shows a reduced net loss compared to last year, indicating progress toward financial stability amidst high insider ownership.

- Click here to discover the nuances of Rumble with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Rumble is priced higher than what may be justified by its financials.

Enovix (ENVX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enovix Corporation designs, develops, and manufactures lithium-ion battery cells both domestically and internationally, with a market cap of approximately $1.75 billion.

Operations: The company generates revenue from its lithium-ion battery and battery systems segment, totaling $30.27 million.

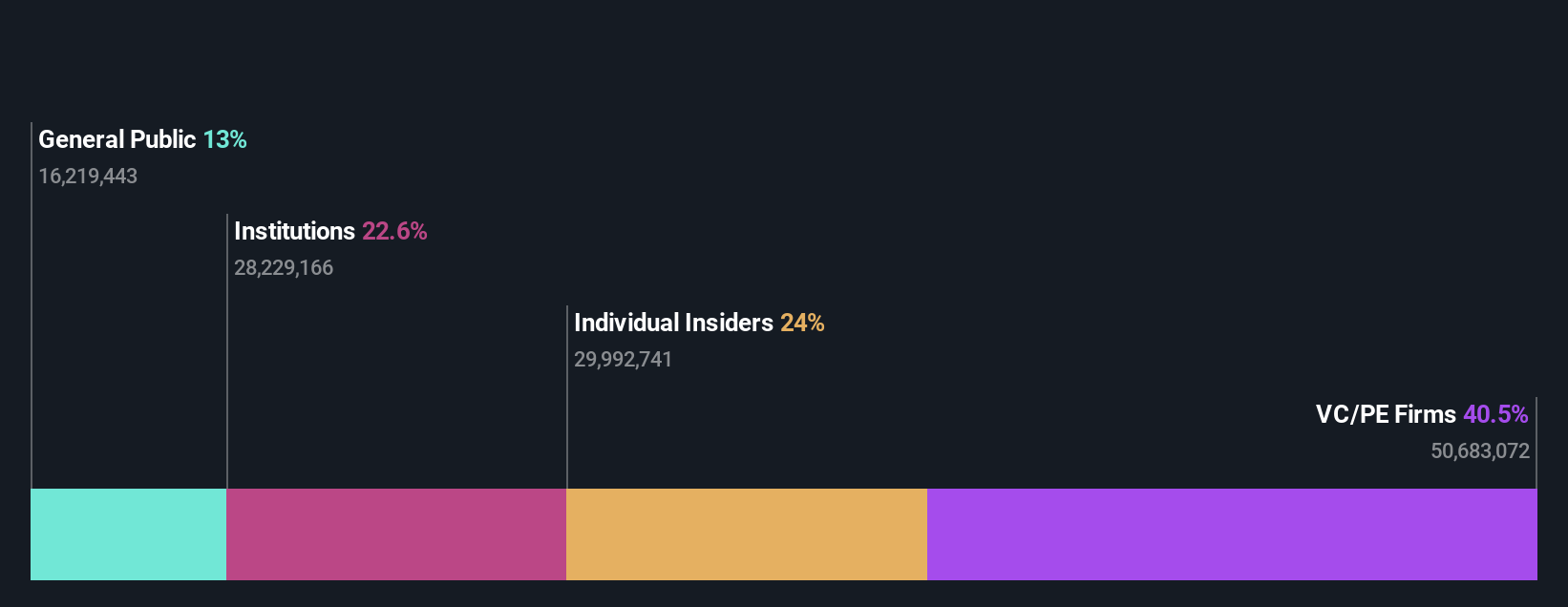

Insider Ownership: 11.3%

Enovix is positioned for substantial growth, with revenue expected to increase by 43.6% annually, surpassing the US market average. Despite a net loss of US$53.71 million in Q3 2025, sales nearly doubled from the previous year to US$7.99 million. The company anticipates profitability within three years and has repurchased shares worth US$58.29 million recently, reflecting confidence in its future prospects amidst high insider ownership and recent financing activities totaling $300 million through convertible notes.

- Navigate through the intricacies of Enovix with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Enovix's shares may be trading at a premium.

Paymentus Holdings (PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. offers cloud-based bill payment technology and solutions both in the United States and internationally, with a market cap of $4.35 billion.

Operations: The company generates revenue from services provided to financial companies, amounting to $1.12 billion.

Insider Ownership: 28.7%

Paymentus Holdings is experiencing robust growth, with earnings projected to rise by 28.1% annually, outpacing the US market average. Recent Q3 results show sales of US$310.74 million, up from US$231.57 million last year, and net income of US$17.74 million compared to US$14.43 million a year ago. The company forecasts full-year revenue between $1.173 billion and $1.178 billion, supported by strong insider ownership and participation in key fintech conferences this quarter.

- Dive into the specifics of Paymentus Holdings here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Paymentus Holdings is trading beyond its estimated value.

Taking Advantage

- Gain an insight into the universe of 201 Fast Growing US Companies With High Insider Ownership by clicking here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAY

Paymentus Holdings

Provides cloud-based bill payment technology and solutions in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026