- United States

- /

- Aerospace & Defense

- /

- NasdaqGM:EH

EHang Holdings (NasdaqGM:EH) Valuation in Focus After CRBC Global Alliance and Africa Pilotless Flight Showcase

Reviewed by Simply Wall St

Most Popular Narrative: 28.8% Undervalued

The prevailing narrative suggests that EHang Holdings is significantly undervalued, implying the stock's current price has not fully accounted for its projected growth, technological edge, and strategic momentum.

Significant advancements in battery R&D, such as solid-state battery integration and partnerships aimed at improving flight range, safety, and eco-friendliness, strengthen EHang's differentiation in green air mobility. This aligns with growing regulatory and societal demands for carbon reduction, which should drive both sales volumes and the ability to command higher margins due to performance leadership.

Want to know what sets this valuation apart from the crowd? Hint: future profitability and relentless growth targets are baked right into the calculations. What bold expectations are hidden beneath the surface that justify calling this stock undervalued? The answer may surprise you.

Result: Fair Value of $23.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, EHang’s concentrated exposure to China and costly R&D investments could challenge the pace of global growth. This may potentially dampen enthusiasm around its bullish outlook.

Find out about the key risks to this EHang Holdings narrative.Another View: What About Market Ratios?

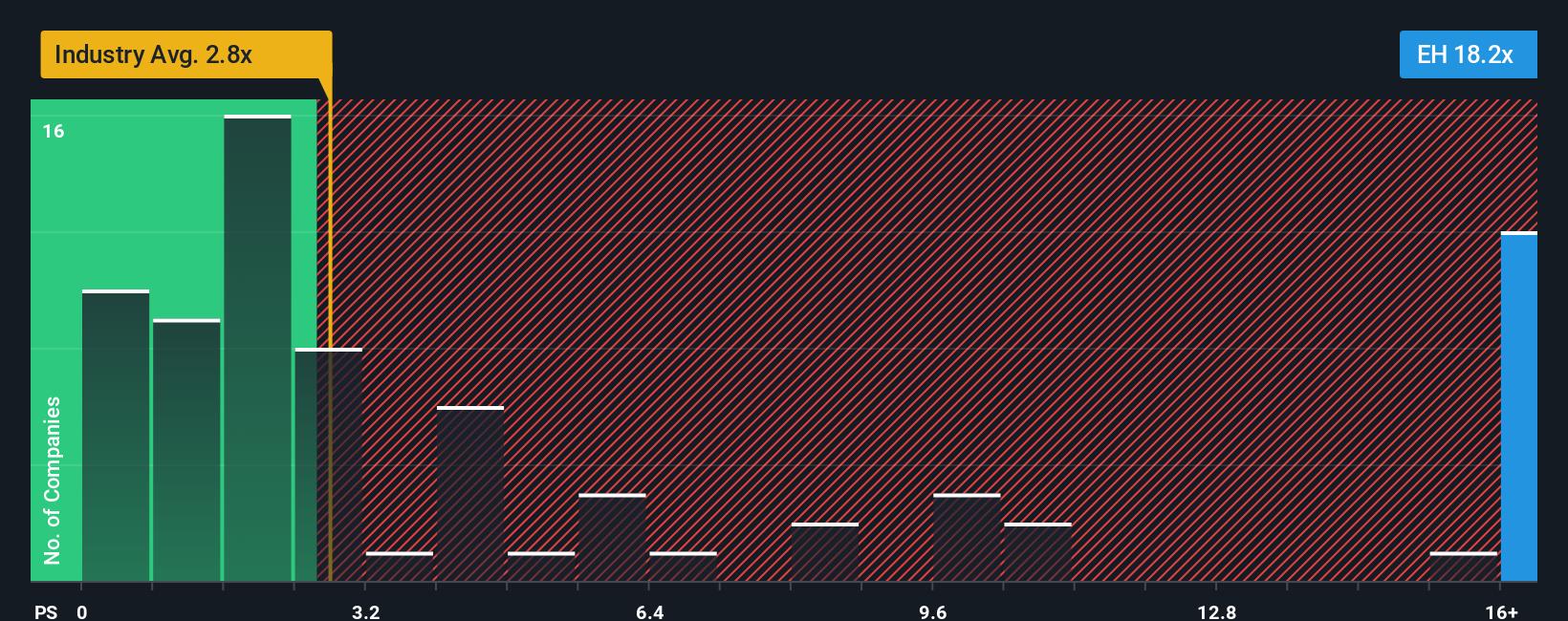

While the current narrative points to EHang being undervalued based on growth expectations, a look at how the market is pricing the company relative to its industry presents a different perspective. By this measure, EHang appears expensive. Which approach reveals the real value?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding EHang Holdings to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own EHang Holdings Narrative

If you see things differently or want to dig deeper into the numbers, you can easily build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EHang Holdings.

Looking for more investment ideas?

Miss out on new opportunities and you could be leaving serious gains on the table. Find hidden gems, income plays, or tomorrow’s leaders with just a few clicks.

- Tap into the rise of next-generation computing by browsing the quantum computing stocks. Breakthroughs in speed and processing power are reshaping entire industries.

- Capture high yields and steady returns with the dividend stocks with yields > 3%. This is your shortcut to companies offering strong, reliable dividend payouts above 3%.

- Seize the chance for value growth by starting your search with the undervalued stocks based on cash flows. Here you will find stocks overlooked by the market but packed with potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EHang Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EH

EHang Holdings

Operates as an urban air mobility (UAM) technology platform company in the People’s Republic of China, East Asia, West Asia, North America, South America, West Africa, and Europe.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives