- United States

- /

- Trade Distributors

- /

- NasdaqGS:DXPE

Assessing DXP Enterprises After a 133% Rally and Strong 2025 Market Momentum

Reviewed by Bailey Pemberton

Thinking of what to do with DXP Enterprises? You are not alone, especially after the stock's year-to-date return has soared by 47.4%. In fact, anyone who has held this stock for the past year has enjoyed a remarkable 133.5% climb, and the gains are even more impressive over longer horizons, with the five-year total return standing at a staggering 620.0%. It is no wonder investors are buzzing about whether DXP has more room to run or if the easy money has already been made.

Recent price moves have given some investors renewed confidence, while others are starting to wonder if the risk profile has shifted. Over the past 30 days, the stock posted a steady 1.4% total return, echoing the positive momentum seen for much of 2024. Some of this optimism has been supported by favorable market developments affecting industrial distributors like DXP, even though there have not been major headlines to drive a dramatic re-rating.

Of course, past performance only tells part of the story. If you are considering adding to your position or trimming your exposure, it helps to take a clear-eyed look at valuation. By the numbers, DXP Enterprises racks up a 2 out of 6 on our valuation score, which means it appears undervalued in just two key metrics out of six used to assess fair value.

Up next, let us break down how these valuation checks work and what they signal about DXP's current price. And stay tuned, because after reviewing traditional valuation methods, we will touch on a perspective that many investors overlook when sizing up a stock's real worth.

DXP Enterprises scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: DXP Enterprises Discounted Cash Flow (DCF) Analysis

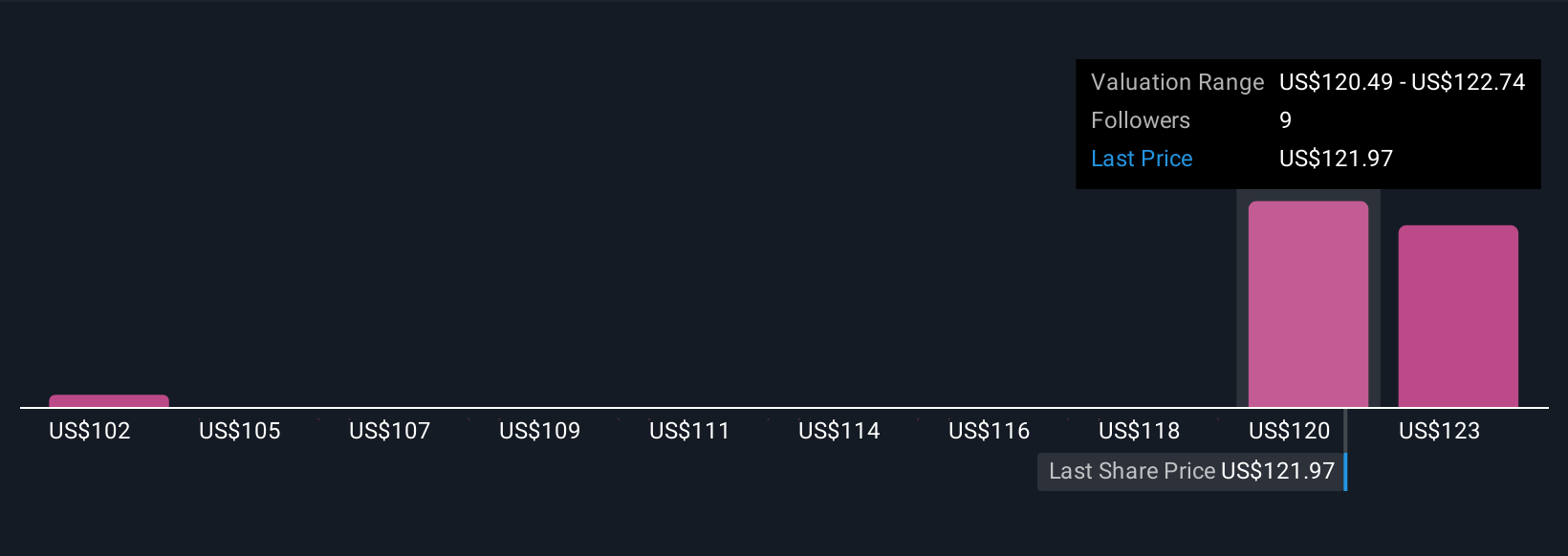

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and discounting them back to today’s dollars. For DXP Enterprises, the latest DCF assessment uses the "2 Stage Free Cash Flow to Equity" process, projecting both near-term and longer-term company performance.

Currently, DXP generates free cash flow of $56.27 million. Analysts expect this figure to nearly double over the next few years, reaching $110 million by 2027. Because analyst estimates rarely cover the entire next decade, projections out to 2035 are extrapolated, with DXP’s free cash flow estimated to rise to $143.84 million in that year. All amounts are reported in U.S. dollars, matching the company’s listed share price.

Based on the DCF model, the intrinsic value of DXP Enterprises is estimated at $122.21 per share. Compared to the recent market price, this model suggests the stock is about 1.8% overvalued. This places it very close to fair value. DCF analysis here indicates the stock is trading almost exactly at what you would expect given its cash flow outlook.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out DXP Enterprises's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

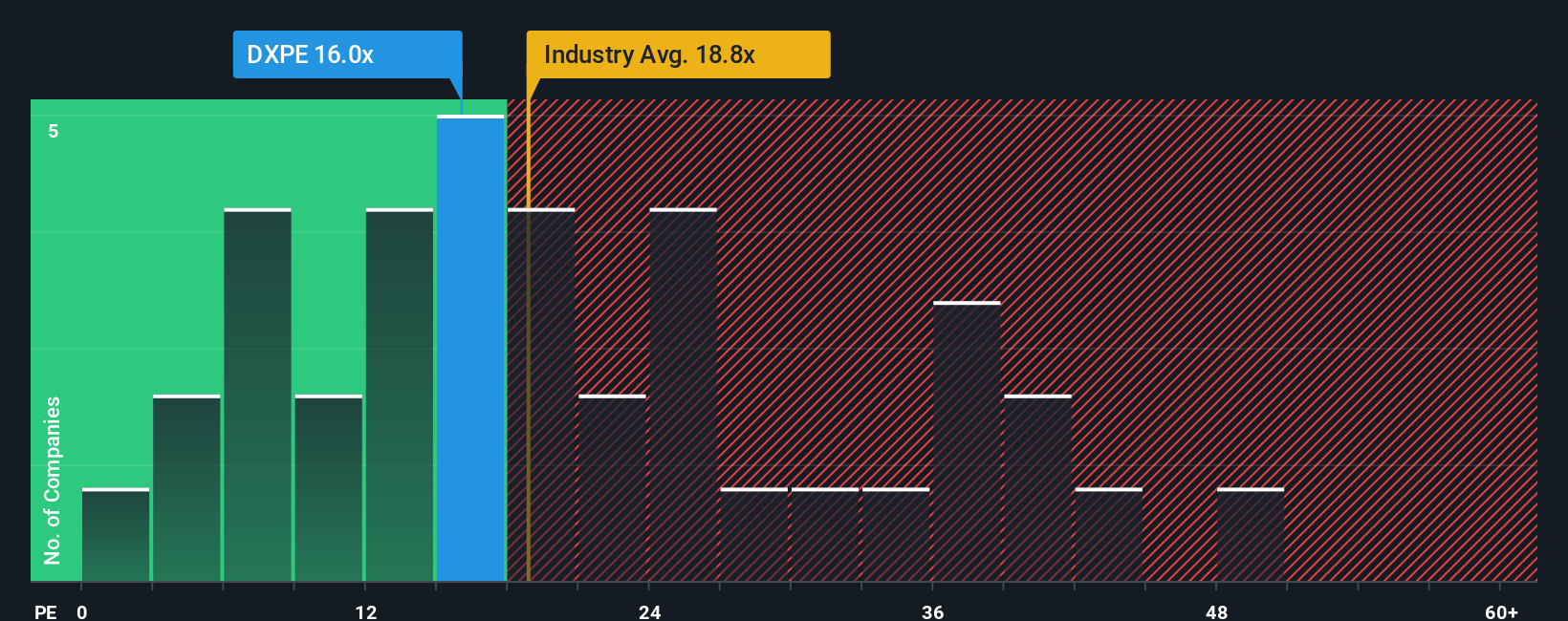

Approach 2: DXP Enterprises Price vs Earnings

For established, profitable companies like DXP Enterprises, the Price-to-Earnings (PE) ratio is a classic tool for gauging whether the stock is sensibly priced. This metric links a company’s share price to its earnings, painting a quick picture of how much investors are willing to pay for each dollar of profit.

The “right” PE depends on how fast a company is expected to grow and how risky its earnings are. Generally, firms with solid growth prospects and lower risks deserve a higher PE, while those facing headwinds or uncertainty typically trade at lower multiples.

DXP Enterprises currently trades at 22.6x earnings, nearly matching both its peer average (22.9x) and the broader Trade Distributors industry average (22.4x). While it might seem in line with the crowd, Simply Wall St’s proprietary Fair Ratio offers a more tailored benchmark. This Fair Ratio for DXP is 24.9x, which accounts for its earnings growth, margins, business risks, industry backdrop, and market cap. These are factors often missed when just looking at plain averages.

Because this Fair Ratio is so close to DXP’s actual PE, it suggests the stock is neither stretched nor unusually cheap given its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DXP Enterprises Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are a simple but powerful tool that let you tell the story you believe about a company, connecting your expectations for future revenue, earnings, and margins to your view of fair value, all backed by clear numbers and logic.

Unlike traditional metrics, Narratives link a company's big-picture story to a detailed financial forecast, so you can see how your beliefs about the business translate into a fair value and compare that directly to the current price. Narratives are easy to use and available on Simply Wall St’s Community page, which millions of investors use to share their perspectives and track how the story changes over time.

This means you get a dynamic view that updates automatically as new information, such as earnings releases or fresh news, comes in, making it easier to decide when to buy or sell. For example, with DXP Enterprises, some community members believe that digital sales and e-commerce will drive above-industry growth and have a fair value near $125 per share, while others see risks from energy dependence or rising costs and think the fair value is much lower.

By exploring these Narratives, you can quickly spot whose story best fits your own insight and make smarter, more confident investment decisions.

Do you think there's more to the story for DXP Enterprises? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXPE

DXP Enterprises

Engages in distributing maintenance, repair, and operating (MRO) products, equipment, and services in the United States, Canada, and internationally.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives