- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS): Evaluating Valuation After Momentum Pauses Following Strong Year-to-Date Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Leonardo DRS.

After a strong rally throughout the year, momentum for Leonardo DRS has softened in recent days, with the 1-year total shareholder return still standing at an impressive 47% and the share price well above where it started 2024. Investors seem to be pausing to reassess after a healthy run rather than souring on the company. This may set the stage for renewed interest if fundamentals remain solid.

Curious what else is attracting attention in the sector? Check out other investors’ top picks with our aerospace and defense stock screener: See the full list for free.

With strong returns and modest growth projections, the question for investors now is whether Leonardo DRS is trading below its true value or if the market has already accounted for its future prospects. Could this be a smart entry point, or is caution warranted?

Most Popular Narrative: 9.4% Undervalued

Leonardo DRS’s last close of $44.39 sits below the most widely followed narrative’s fair value of $49, suggesting there may be more upside if expectations hold. This sets up a sharp focus on whether bullish industry catalysts can drive continued earnings growth, or if sentiment has gotten ahead of fundamentals.

Anticipated increases in U.S. and allied defense budgets, with substantial front-loaded funding and new NATO commitments, are expected to drive persistent and potentially accelerating demand for advanced defense technologies. This positions Leonardo DRS for strong multiyear revenue growth and increasing backlog. The company's strategic alignment with national priorities, including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities, sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years.

Want to know the financial engine behind this optimistic price target? The entire narrative leans on ambitious profit expansion and a bold vision for sector-leading margins. What surprising growth rates power the fair value? Find out which numbers are moving the needle in this most popular narrative. See what’s driving the optimism.

Result: Fair Value of $49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent raw material supply issues or reliance on large U.S. government contracts could quickly shift the outlook and reduce investor enthusiasm.

Find out about the key risks to this Leonardo DRS narrative.

Another View: High Multiple Signals Caution

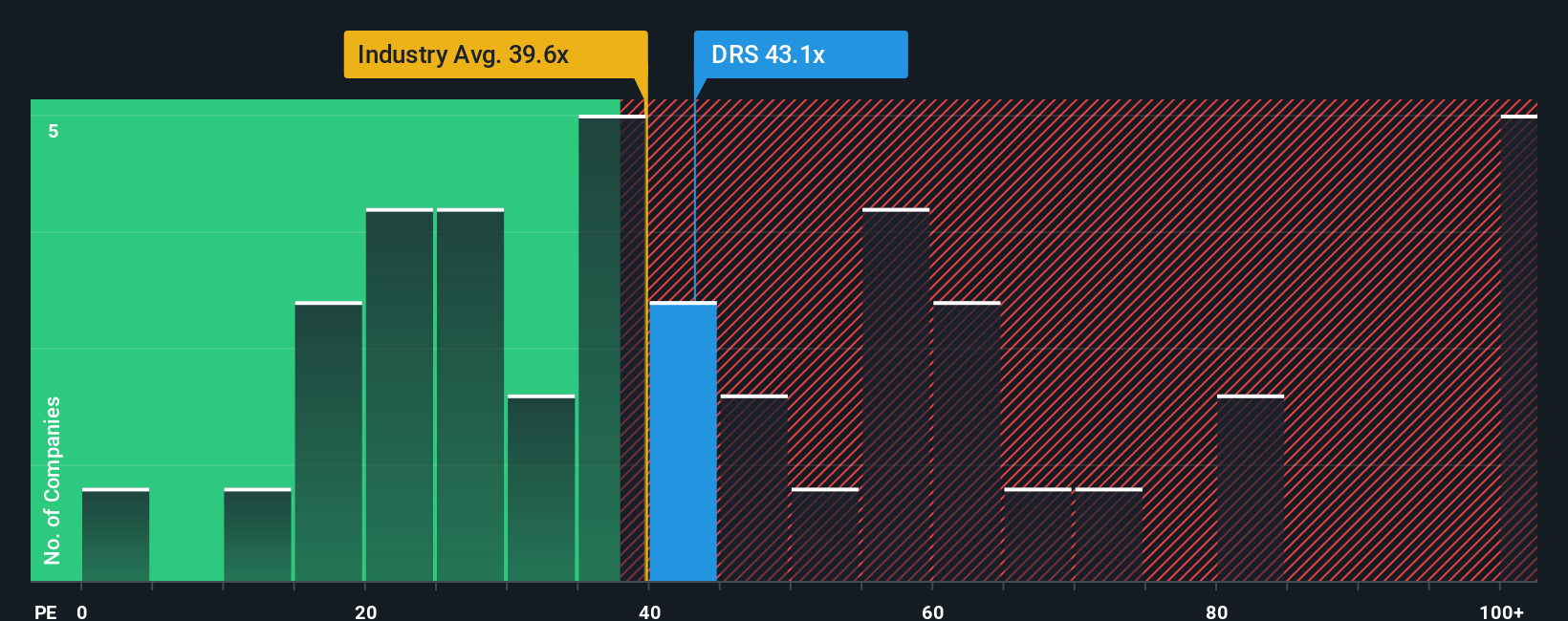

While analyst forecasts point to further upside, our comparison of Leonardo DRS’s current price-to-earnings ratio reveals a different story. At 47.3x, the company trades at a sizable premium to both the industry (39.1x) and peer average (36.5x), and is well above its fair ratio of 27.3x. This gap highlights increased valuation risk if the business does not deliver on its ambitious growth plans. Could the share price be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Leonardo DRS Narrative

If you have your own perspective or prefer digging into the data yourself, creating your own narrative takes just a couple minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for More Investment Ideas?

If you want to stay ahead, don’t stop with just one opportunity. Make your next move and explore strategies newer investors often overlook with these hand-picked ideas:

- Target standout companies with hidden value by scanning these 896 undervalued stocks based on cash flows for businesses the market may be overlooking right now.

- Collect reliable income with ease by checking out these 19 dividend stocks with yields > 3% featuring stocks offering yields over 3% and solid financials to support steady payouts.

- Tap into game-changing innovation and invest early by searching these 24 AI penny stocks for companies at the forefront of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives