- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS): Assessing Valuation Following Major U.S. Army Win and Strategic Product Innovations

Reviewed by Simply Wall St

Leonardo DRS (DRS) caught investor attention this week after landing a new U.S. Army contract to develop advanced vehicle power kits, along with forging a teaming arrangement to deliver an innovative self-propelled howitzer system in the U.S. market.

See our latest analysis for Leonardo DRS.

After a year packed with contract wins and innovative product launches, Leonardo DRS has outpaced many defense peers. Its share price return is up a substantial 25% year-to-date, and long-term shareholders are sitting on a remarkable 44% total return over the past year. Momentum has cooled slightly in recent months; however, strong demand and a growing order backlog continue to support positive sentiment for the stock overall.

If the surge in defense tech piques your interest, now is a perfect time to explore leaders across aerospace and military innovation with our See the full list for free.

With shares up sharply and analysts projecting further upside, the question now is whether Leonardo DRS remains undervalued amid this wave of innovation or if the market has already accounted for future growth prospects.

Most Popular Narrative: 17.3% Undervalued

With shares closing at $40.53 and the most widely followed narrative targeting a fair value of $49, there is a sharp difference between market price and perceived potential. The narrative supports this premium with a combination of sector tailwinds, business catalysts, and bullish assumptions that set DRS apart from its peers.

The company's strategic alignment with national priorities, including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities, sets the stage for premium contract awards and program expansions, benefiting both revenue and net margins over the next several years.

Want to know what aggressive growth targets are behind this optimistic outlook? The narrative hinges on rising earnings, expanding margins, and a future profit multiple more typical of industry disruptors. Ready to see the numbers that fuel this bullish fair value?

Result: Fair Value of $49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing raw material constraints and the company’s heavy reliance on government contracts could quickly alter the outlook and put pressure on future earnings growth.

Find out about the key risks to this Leonardo DRS narrative.

Another View: What Do Market Ratios Say?

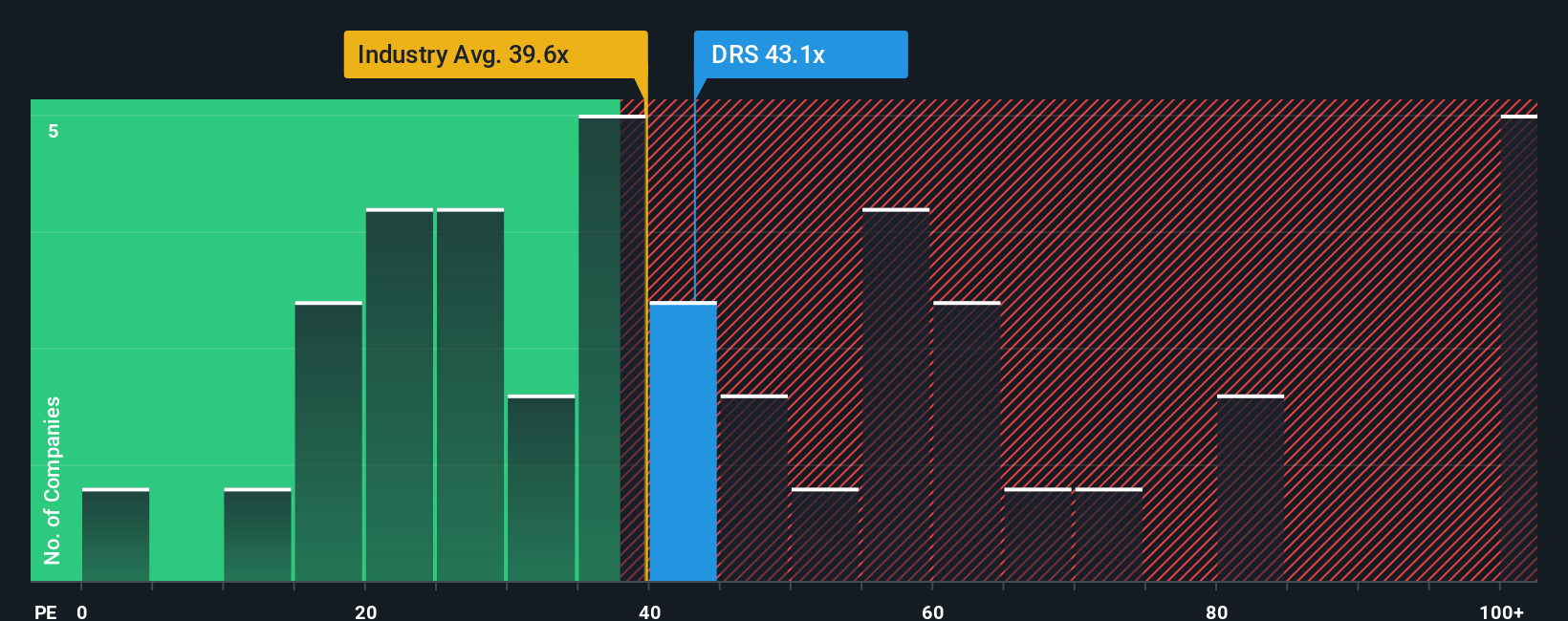

While analyst narratives project upside, market ratios tell a more cautious story. Currently, the stock trades at roughly 43 times earnings, which is notably higher than both the industry average of 38x and the peer group average of 41x. This is also well above the fair ratio of 27.1x. This premium suggests investors expect exceptional growth; however, it also raises questions about how much risk is involved in paying for future results.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Leonardo DRS Narrative

If you want to weigh the evidence firsthand or craft an outlook that fits your own perspective, you can easily build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for More Smart Investment Ideas?

Don’t limit your potential returns to just a handful of stocks. Expand your horizon by targeting unique opportunities and trends you might have missed elsewhere.

- Unlock the power of artificial intelligence companies when you tap into these 27 AI penny stocks, driving automation, innovation, and transformative growth in the tech sector.

- Start building a portfolio with reliable cash flow by checking out these 17 dividend stocks with yields > 3%, offering solid yields and consistent payout records.

- Ride the wave of digital transformation with direct access to these 80 cryptocurrency and blockchain stocks, benefiting from major blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives