- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS): A Fresh Look at Valuation After Launching Next-Gen AI Tactical Display Systems

Reviewed by Simply Wall St

Leonardo DRS (DRS) just rolled out its next-generation AI-powered Ground Vehicle Architecture Smart Display systems, known as Rugged Smart Displays - Ground (RSD-G). This launch is more than just an incremental upgrade. The systems come packed with advanced tactical computing, giving ground combat vehicles a significant boost in performance, connectivity, and real-time battlefield awareness. For investors, this event signals how Leonardo DRS is putting innovation at the heart of its strategy, aligning closely with the growing importance of AI and modernization needs in the defense technology sector.

The company’s product announcement arrives as recent momentum in the stock has shifted. Leonardo DRS is up 50% over the past year, even as shares have dipped 11% over the past 3 months. That kind of trajectory suggests investors are weighing long-term growth aspirations against the shorter-term effects of product cycle timing and broader market conditions. With annual revenue and net income both growing in the past year, this step into advanced AI-enabled battlefield systems may nudge sentiment and drive a new phase for the company going forward.

With solid gains in the rearview and a high-profile innovation just launched, is Leonardo DRS trading at a bargain that investors should seize, or has the market already factored in tomorrow’s growth?

Most Popular Narrative: 16% Undervalued

The prevailing narrative sees Leonardo DRS as undervalued by 16% based on its future financial potential and sector tailwinds.

The company's strategic alignment with national priorities, including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities, positions it for premium contract awards and program expansions. This is expected to benefit both revenue and net margins over the next several years.

Ready to discover why analysts believe DRS has more upside ahead? The foundation of this narrative is built around ambitious multi-year growth targets and a hefty future profit multiple that most companies never achieve. Want to unravel which bold financial forecasts are supporting this price target? Dive deeper for the surprising assumptions fueling this perceived discount.

Result: Fair Value of $49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing raw material shortages and heavy reliance on government contracts could limit margin growth and affect the company’s upbeat outlook.

Find out about the key risks to this Leonardo DRS narrative.Another View: Do Market Fundamentals Tell a Different Story?

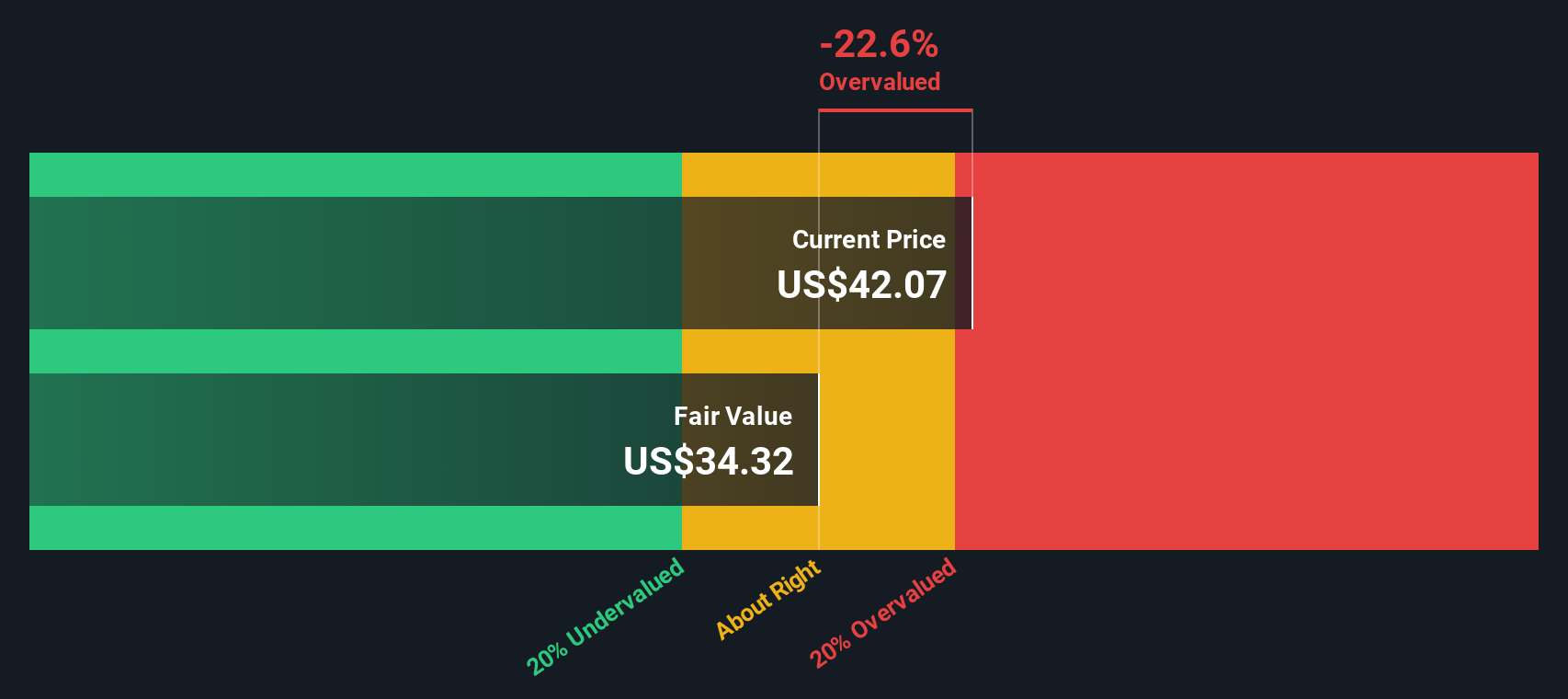

Looking through another lens, our DCF model suggests Leonardo DRS may be trading above its fair value. This challenges the notion of a bargain. Can these models really capture all the risks and upside ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Leonardo DRS Narrative

If you have a different perspective or want to see where your own analysis leads, you’re always free to generate your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for More Investment Ideas?

Why stop with one winning opportunity? The stock market is packed with under-the-radar gems and sector standouts just waiting for you to take notice. Explore smarter options and hand-pick the ideas that fit your investment style. There is no reason to leave potential gains on the table.

- Unlock tomorrow’s tech potential by scanning the innovators transforming AI into real-world profits with AI penny stocks.

- Spot undervalued market leaders primed for a comeback and seize chances others are missing using undervalued stocks based on cash flows.

- Capture powerful payouts and steady growth from companies offering attractive yields through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives