- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Is Index Reclassification Reshaping the Investment Case for Leonardo DRS (DRS)?

Reviewed by Simply Wall St

- On June 30, 2025, Leonardo DRS was added to multiple major Russell indexes, including the Russell 1000 Growth and Value, Russell 3000 Value, and others, while being simultaneously removed from the Russell 2000 and related growth and dynamic indexes.

- This broad shift in index membership reflects the company's changing market capitalization and could drive shifts in institutional investor holdings due to index-tracking fund rebalancing.

- We'll examine how Leonardo DRS's significant index reclassifications may impact its investment narrative and future institutional ownership patterns.

Leonardo DRS Investment Narrative Recap

Shareholders in Leonardo DRS need to be confident in the company’s ability to capture defense modernization and technology opportunities amid demand for advanced military platforms. The recent broad shift in Russell index membership highlights Leonardo DRS’s rising market capitalization, but does not materially alter the most important short-term catalyst: defense contract momentum and ongoing modernization projects, while the major risk remains potential supply chain challenges with critical materials and any changes in government defense spending.

Among the latest announcements, Leonardo DRS’s $41 million contract win to deliver combat management system hardware for the U.S. Navy stands out for its relevance to ongoing product demand and core growth catalysts like air defense and naval modernization. This type of contract reflects continued customer trust and supports the company’s position in key military upgrade cycles.

However, compared to contract wins and growth drivers, the possibility of sudden shifts in budget priorities or supply disruptions is an issue investors should be aware of...

Read the full narrative on Leonardo DRS (it's free!)

Leonardo DRS' narrative projects $4.0 billion revenue and $343.7 million earnings by 2028. This requires 6.2% yearly revenue growth and a $109.7 million earnings increase from $234.0 million today.

Uncover how Leonardo DRS' forecasts yield a $41.73 fair value, a 12% downside to its current price.

Exploring Other Perspectives

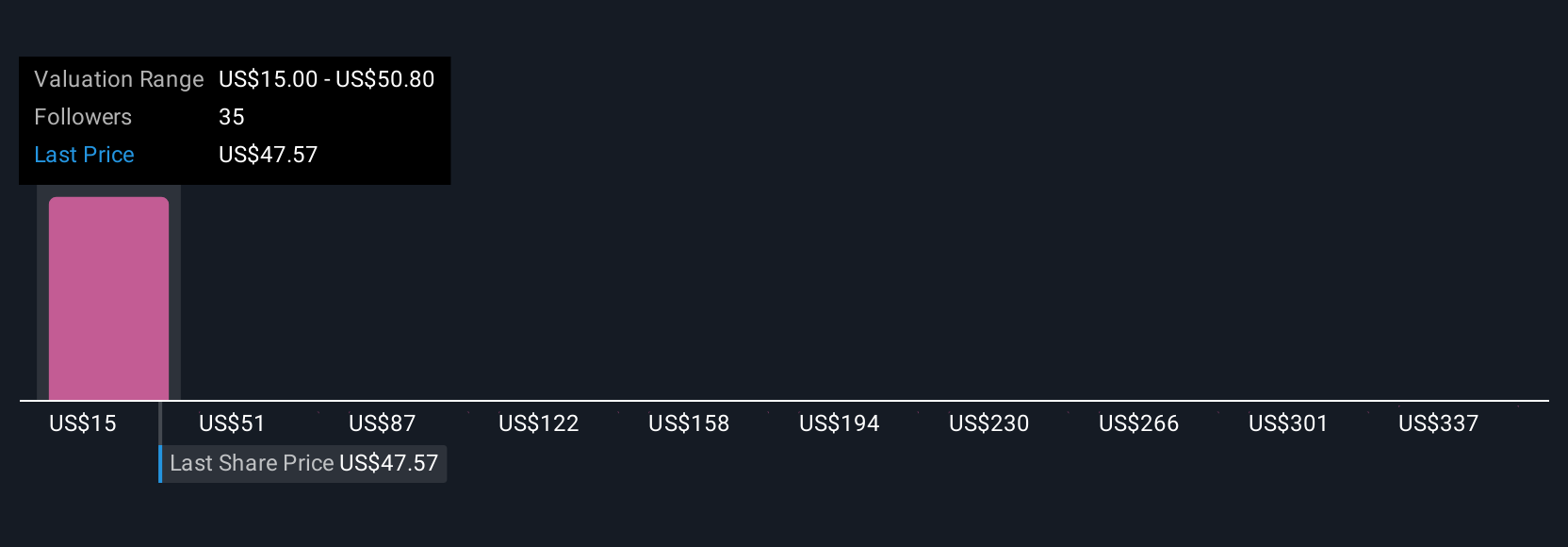

Fair value estimates from 9 Simply Wall St Community members span from US$15 up to US$372.97 per share. Your own view may differ, especially given the company’s continued reliance on sole-source suppliers for critical materials and how that could affect long-term margins and growth expectations.

Build Your Own Leonardo DRS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leonardo DRS research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Leonardo DRS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leonardo DRS' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives