- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Can Leonardo DRS (DRS) Sustain Its Innovation Momentum Amid New Army Contracts and Partnerships?

Reviewed by Sasha Jovanovic

- In the past week, Leonardo DRS, Inc. announced several milestone developments, including a U.S. Army contract award for prototype Vehicle Integrated Power Kits, the launch of its SAGEcore AI-enabled software platform for battlefield operations, and a teaming agreement with KNDS to bring the CAESAR Self-Propelled Howitzer to the U.S. defense market.

- These initiatives highlight Leonardo DRS’s ability to secure sizable new military programs and rapidly introduce advanced technologies that address the evolving needs of connected, multi-domain operations.

- We'll examine how the Army contract for scalable vehicle-based power solutions could shape Leonardo DRS's outlook for defense modernization awards.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Leonardo DRS Investment Narrative Recap

Leonardo DRS appeals to investors who are confident in the long-term growth of advanced defense technologies driven by US and allied military modernization, but must also recognize the risks tied to defense spending cycles and potential margin pressures from supply chain costs. This week’s VIPK prototype contract strengthens the company’s exposure to short-term award catalysts; however, margin headwinds from tightening raw material supplies and government budget timing remain the main risks and are not materially reduced by these announcements.

Of the recent news, the US Army’s award for Vehicle Integrated Power Kits stands out, as it aligns with DRS’s core expertise in delivering vehicle-based, mission-critical power solutions, a key area for near-term modernization wins. While this development supports future revenue opportunity, it does not directly affect longer-term exposure to US budget cycles or the complex supply dynamics challenging cost control.

But even with new contracts in hand, investors should watch for signs that ongoing supply constraints could...

Read the full narrative on Leonardo DRS (it's free!)

Leonardo DRS is projected to reach $4.1 billion in revenue and $351.1 million in earnings by 2028. This outlook assumes annual revenue growth of 6.6% and represents a $101.1 million earnings increase from current earnings of $250.0 million.

Uncover how Leonardo DRS' forecasts yield a $49.00 fair value, a 21% upside to its current price.

Exploring Other Perspectives

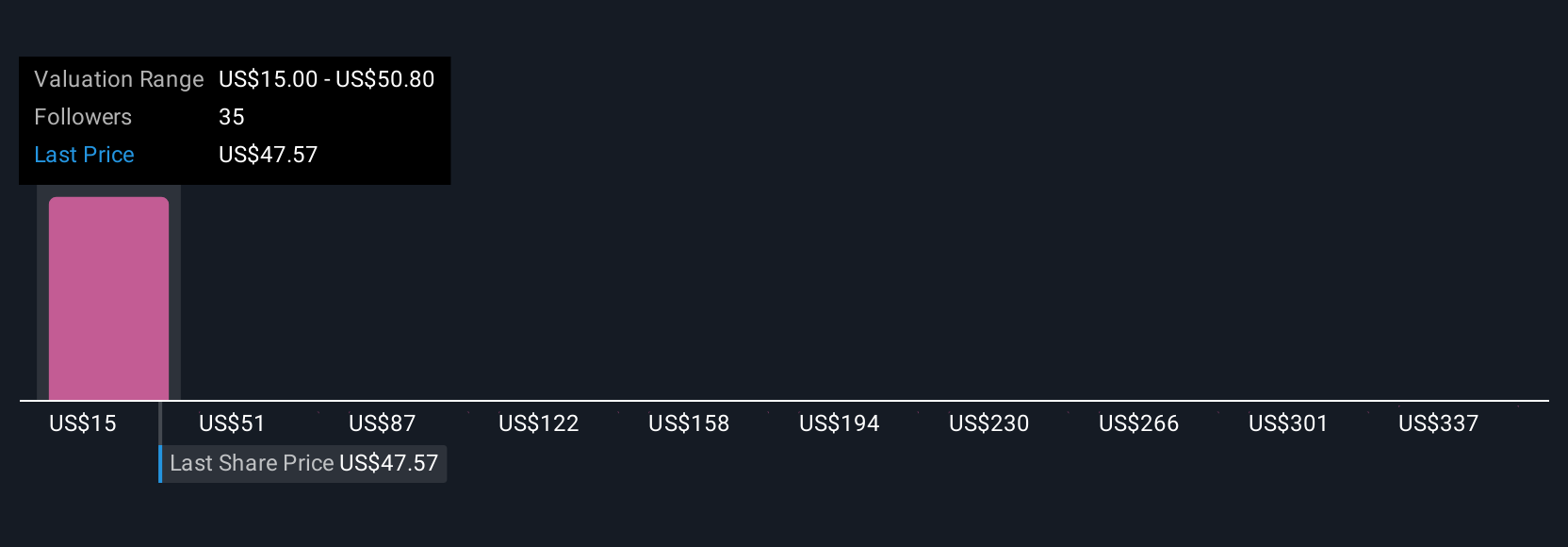

Simply Wall St Community members provided eight fair value estimates for Leonardo DRS ranging from US$15 to US$372.97 per share. With current contract wins fueling optimism, the wide spectrum of expectations reflects uncertainty around persistent margin pressures and future budget decisions, explore how the community’s varied outlooks may inform your own view.

Explore 8 other fair value estimates on Leonardo DRS - why the stock might be worth less than half the current price!

Build Your Own Leonardo DRS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leonardo DRS research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Leonardo DRS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leonardo DRS' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives