- United States

- /

- Electrical

- /

- NasdaqCM:DFLI

Investors Don't See Light At End Of Dragonfly Energy Holdings Corp.'s (NASDAQ:DFLI) Tunnel And Push Stock Down 25%

To the annoyance of some shareholders, Dragonfly Energy Holdings Corp. (NASDAQ:DFLI) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 96% loss during that time.

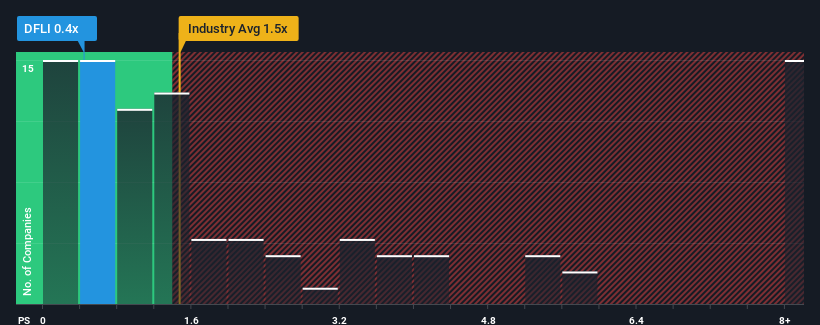

After such a large drop in price, Dragonfly Energy Holdings' price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Dragonfly Energy Holdings

What Does Dragonfly Energy Holdings' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Dragonfly Energy Holdings' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dragonfly Energy Holdings.How Is Dragonfly Energy Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Dragonfly Energy Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. Still, the latest three year period has seen an excellent 57% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 30% each year as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 67% per year growth forecast for the broader industry.

With this in consideration, its clear as to why Dragonfly Energy Holdings' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Dragonfly Energy Holdings' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Dragonfly Energy Holdings maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 5 warning signs we've spotted with Dragonfly Energy Holdings (including 1 which is potentially serious).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DFLI

Dragonfly Energy Holdings

Engages in the manufacturing and sale of deep cycle lithium-ion batteries for recreational vehicles, marine vessels, solar and off-grid residence industries, and industrial and energy storage markets.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives