- United States

- /

- Machinery

- /

- NasdaqGS:CVGI

Commercial Vehicle Group, Inc. (NASDAQ:CVGI) Might Not Be As Mispriced As It Looks After Plunging 29%

To the annoyance of some shareholders, Commercial Vehicle Group, Inc. (NASDAQ:CVGI) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

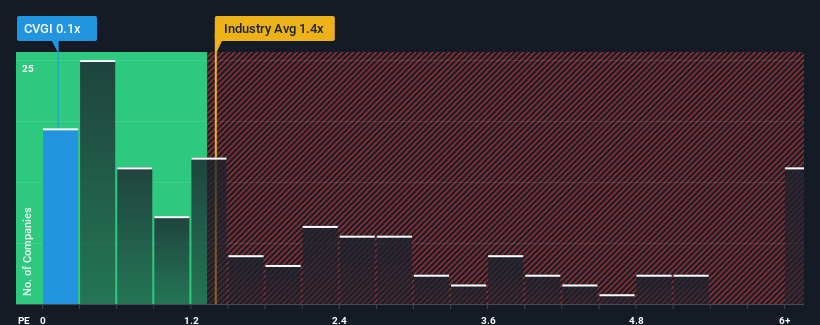

Following the heavy fall in price, considering around half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Commercial Vehicle Group as an solid investment opportunity with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Commercial Vehicle Group

What Does Commercial Vehicle Group's P/S Mean For Shareholders?

Commercial Vehicle Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Commercial Vehicle Group.How Is Commercial Vehicle Group's Revenue Growth Trending?

In order to justify its P/S ratio, Commercial Vehicle Group would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.9%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 1.3% as estimated by the three analysts watching the company. That's shaping up to be similar to the 0.8% growth forecast for the broader industry.

In light of this, it's peculiar that Commercial Vehicle Group's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Commercial Vehicle Group's P/S Mean For Investors?

Commercial Vehicle Group's recently weak share price has pulled its P/S back below other Machinery companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Commercial Vehicle Group's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Commercial Vehicle Group is showing 3 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Commercial Vehicle Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CVGI

Commercial Vehicle Group

Together its subsidiaries, provides systems, assemblies, and components to the vehicle market and electric vehicle markets; and manufactures customized products in the United States, Mexico, China, the United Kingdom, the Czech Republic, Ukraine, Morocco, Thailand, India, Australia, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives