- United States

- /

- Building

- /

- NasdaqGS:CSTE

Caesarstone Ltd.'s (NASDAQ:CSTE) Business And Shares Still Trailing The Industry

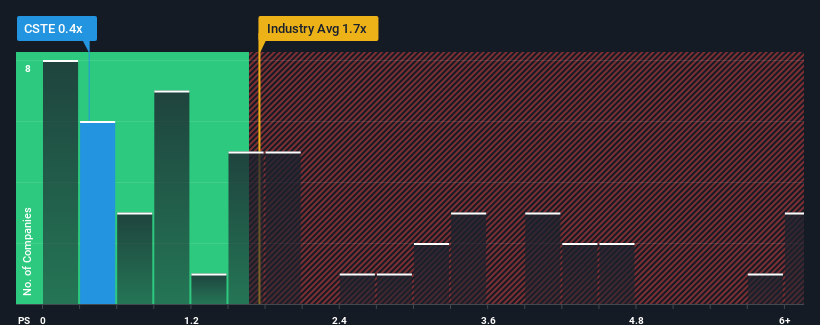

You may think that with a price-to-sales (or "P/S") ratio of 0.4x Caesarstone Ltd. (NASDAQ:CSTE) is a stock worth checking out, seeing as almost half of all the Building companies in the United States have P/S ratios greater than 1.7x and even P/S higher than 4x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Caesarstone

What Does Caesarstone's Recent Performance Look Like?

Caesarstone could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Caesarstone will help you uncover what's on the horizon.How Is Caesarstone's Revenue Growth Trending?

In order to justify its P/S ratio, Caesarstone would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 5.3% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 4.7% as estimated by the two analysts watching the company. With the industry predicted to deliver 7.0% growth, that's a disappointing outcome.

With this information, we are not surprised that Caesarstone is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's clear to see that Caesarstone maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Caesarstone's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Caesarstone with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSTE

Caesarstone

Designs, develops, manufactures, and sells engineered stone and porcelain products under Caesarstone and other brands in the United States, Canada, Latin America, Australia, Asia, Europe, the Middle East and Africa, and Israel.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives