- United States

- /

- Biotech

- /

- NasdaqGM:BNR

Burning Rock Biotech Leads The Charge With 2 Other US Penny Stocks

Reviewed by Simply Wall St

As the U.S. markets continue to enjoy a post-election rally, with major indices like the S&P 500 and Dow Jones Industrial Average reaching new record highs, investors are exploring diverse opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, remain a relevant investment area despite their somewhat outdated terminology. These stocks can offer growth potential at lower price points when backed by strong financials and solid fundamentals, providing intriguing opportunities for investors looking beyond the usual market giants.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8479 | $5.86M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.91 | $590.24M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $161.01M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.65 | $2.03B | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $2.10 | $4.09M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2723 | $9.41M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.50 | $131.24M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $97.13M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $86.74M | ★★★★☆☆ |

Click here to see the full list of 748 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Burning Rock Biotech (NasdaqGM:BNR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Burning Rock Biotech Limited focuses on developing and selling cancer therapy selection tests in the People's Republic of China, with a market cap of $34.47 million.

Operations: No specific revenue segments have been reported for Burning Rock Biotech Limited.

Market Cap: $34.47M

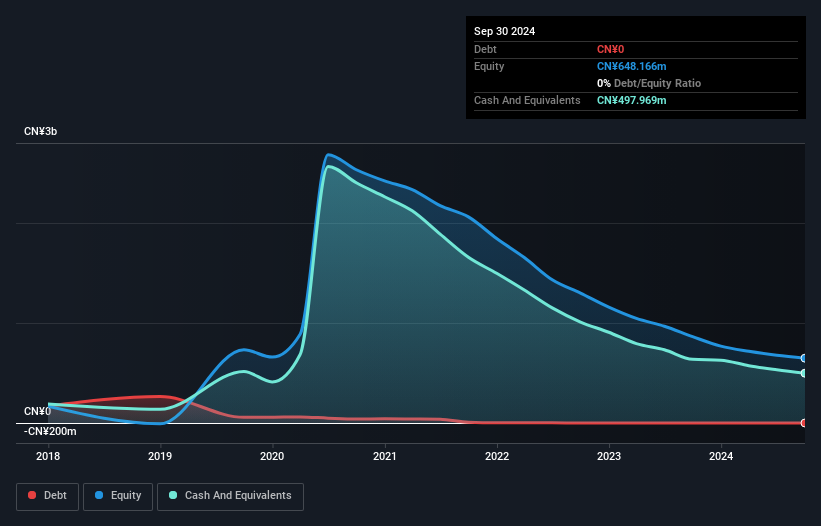

Burning Rock Biotech, with a market cap of US$34.47 million, is navigating challenges typical for penny stocks. The company remains unprofitable and pre-revenue, but it benefits from a seasoned management team averaging 8.7 years in tenure and is debt-free. Recent strategic advancements include the approval of their LungCure CDx by China's NMPA, marking significant progress in precision oncology solutions for lung cancer. Despite delisting from the London Stock Exchange due to low trading volumes, its Nasdaq listing remains active. Executive changes indicate ongoing adjustments within its financial leadership structure amidst these developments.

- Click to explore a detailed breakdown of our findings in Burning Rock Biotech's financial health report.

- Gain insights into Burning Rock Biotech's historical outcomes by reviewing our past performance report.

Caesarstone (NasdaqGS:CSTE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Caesarstone Ltd. designs, develops, manufactures, and markets engineered stone and other materials under the Caesarstone brand across various regions including the United States, Canada, Latin America, Australia, Asia, Europe, the Middle East and Africa, and Israel with a market cap of $150.24 million.

Operations: The company generates $508.64 million in revenue from its building products segment.

Market Cap: $150.24M

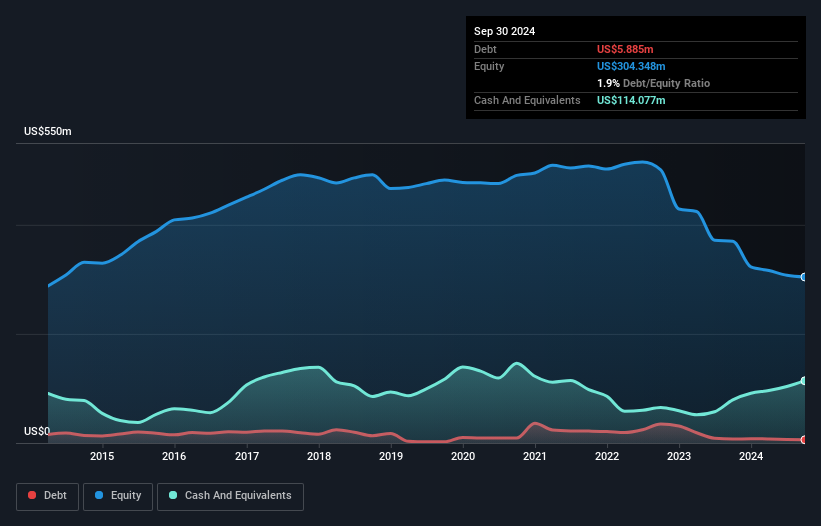

Caesarstone Ltd., with a market cap of US$150.24 million, faces challenges typical of penny stocks, including unprofitability and a negative return on equity at -21.45%. Despite this, the company maintains strong liquidity with short-term assets of US$345.2 million exceeding both its long-term liabilities and debt levels, which are well covered by operating cash flow. The board and management team are experienced, averaging 3.9 and 2.8 years in tenure respectively, providing stability amid financial struggles such as rising debt-to-equity ratios over five years and declining earnings growth by 67.9% annually over the same period.

- Navigate through the intricacies of Caesarstone with our comprehensive balance sheet health report here.

- Gain insights into Caesarstone's outlook and expected performance with our report on the company's earnings estimates.

Butler National (OTCPK:BUKS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Butler National Corporation, with a market cap of $96.94 million, operates in the aerospace industry by designing, engineering, manufacturing, and servicing a variety of aerostructures and aircraft components across North America and internationally.

Operations: The company's revenue is derived from its Gaming segment ($38.82 million), Aircraft Avionics ($2.44 million), Aircraft Modifications ($26.68 million), and Special Mission Electronics ($13.06 million).

Market Cap: $96.94M

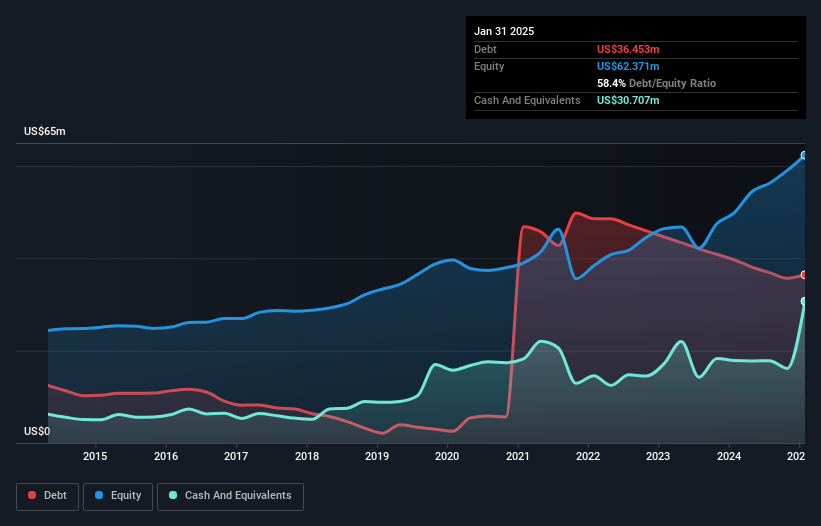

Butler National Corporation, with a market cap of US$96.94 million, shows promising financial metrics for a penny stock. The company's net profit margin has improved significantly to 17.3%, and its return on equity is high at 24.9%. Earnings have grown by an impressive 192.2% over the past year, surpassing industry averages, while short-term assets exceed both long-term and short-term liabilities comfortably. Despite these strengths, Butler National's management team and board lack experience with average tenures of 1.5 and 0.8 years respectively, which could pose challenges in strategic decision-making moving forward.

- Click here to discover the nuances of Butler National with our detailed analytical financial health report.

- Gain insights into Butler National's past trends and performance with our report on the company's historical track record.

Make It Happen

- Embark on your investment journey to our 748 US Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burning Rock Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BNR

Burning Rock Biotech

Primarily develops and sells cancer therapy selection tests in the People's Republic of China.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives