- United States

- /

- Aerospace & Defense

- /

- NasdaqCM:BYRN

How Slower Expected Revenue Growth Will Impact Byrna Technologies (BYRN) Investors

Reviewed by Sasha Jovanovic

- Byrna Technologies is set to announce its latest quarterly earnings, with analysts projecting US$28.2 million in revenue and closely watching for signs of growth moderation compared to the very large increase reported in the same quarter last year.

- The sustained attention from analysts and the market comes as Byrna is expected to post a much slower year-over-year revenue growth, highlighting a shift in momentum for the less-lethal weapons company.

- We will examine how investor anticipation for slower expected revenue growth may impact Byrna’s future investment prospects and narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Byrna Technologies Investment Narrative Recap

To own Byrna Technologies, you must have conviction in the long-term potential for less-lethal personal security products, particularly as the company scales newer, higher-margin offerings. The latest news of a projected slowdown in revenue growth beneath last year’s exceptional surge does little to change the most important near-term catalyst, adoption of the new Compact Launcher, while the biggest risk remains cost pressures from shifting a majority of its supply chain to the U.S.

One recent milestone supporting this growth thesis is the operational launch of Byrna’s new U.S.-based ammunition facility, now capable of producing up to 8 million rounds annually. This addition is intended to strengthen supply reliability and potentially support higher sales volumes as demand for the Compact Launcher and related products grows.

On the flip side, investors should be mindful of emerging risks tied to increasing U.S. production costs and what that could mean for margins if...

Read the full narrative on Byrna Technologies (it's free!)

Byrna Technologies' narrative projects $198.0 million in revenue and $22.8 million in earnings by 2028. This requires a 24.1% yearly revenue growth rate and a $8.0 million earnings increase from current earnings of $14.8 million.

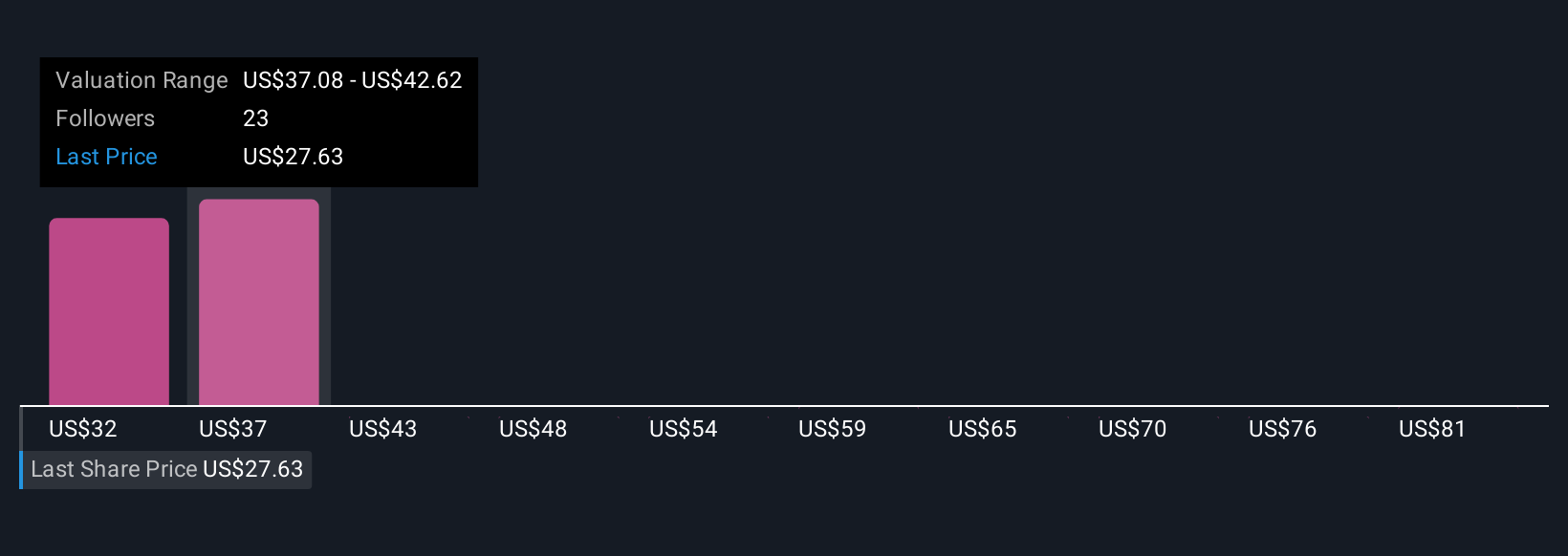

Uncover how Byrna Technologies' forecasts yield a $38.50 fair value, a 70% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community range from US$31.60 to US$86.95 per share. While opinions differ, many participants are watching how higher U.S. sourcing costs might affect Byrna’s ability to sustain its expanding margins, reminding you to consider multiple angles before forming your own view.

Explore 5 other fair value estimates on Byrna Technologies - why the stock might be worth just $31.60!

Build Your Own Byrna Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Byrna Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Byrna Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Byrna Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Byrna Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BYRN

Byrna Technologies

A less-lethal self-defense technology company, develops, manufactures, and sells less-lethal personal security solutions in the United States, South Africa, Europe, South America, Asia, and Canada.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives