- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

3 Stocks Estimated To Be Trading At Discounts Up To 44.4%

Reviewed by Simply Wall St

In the midst of a U.S. government shutdown, major stock indices like the S&P 500 and Nasdaq have reached new record highs, reflecting a resilient market despite economic uncertainties. With this backdrop, identifying undervalued stocks becomes crucial as investors seek opportunities that may be trading at significant discounts relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.85 | $13.68 | 49.9% |

| Trade Desk (TTD) | $49.32 | $96.49 | 48.9% |

| SLM (SLM) | $27.40 | $53.70 | 49% |

| Northwest Bancshares (NWBI) | $12.31 | $24.41 | 49.6% |

| NeuroPace (NPCE) | $10.14 | $20.05 | 49.4% |

| Investar Holding (ISTR) | $23.01 | $44.92 | 48.8% |

| Glaukos (GKOS) | $83.19 | $161.44 | 48.5% |

| First Commonwealth Financial (FCF) | $16.85 | $32.97 | 48.9% |

| First Busey (BUSE) | $23.08 | $45.30 | 49% |

| Alnylam Pharmaceuticals (ALNY) | $460.65 | $896.00 | 48.6% |

Let's review some notable picks from our screened stocks.

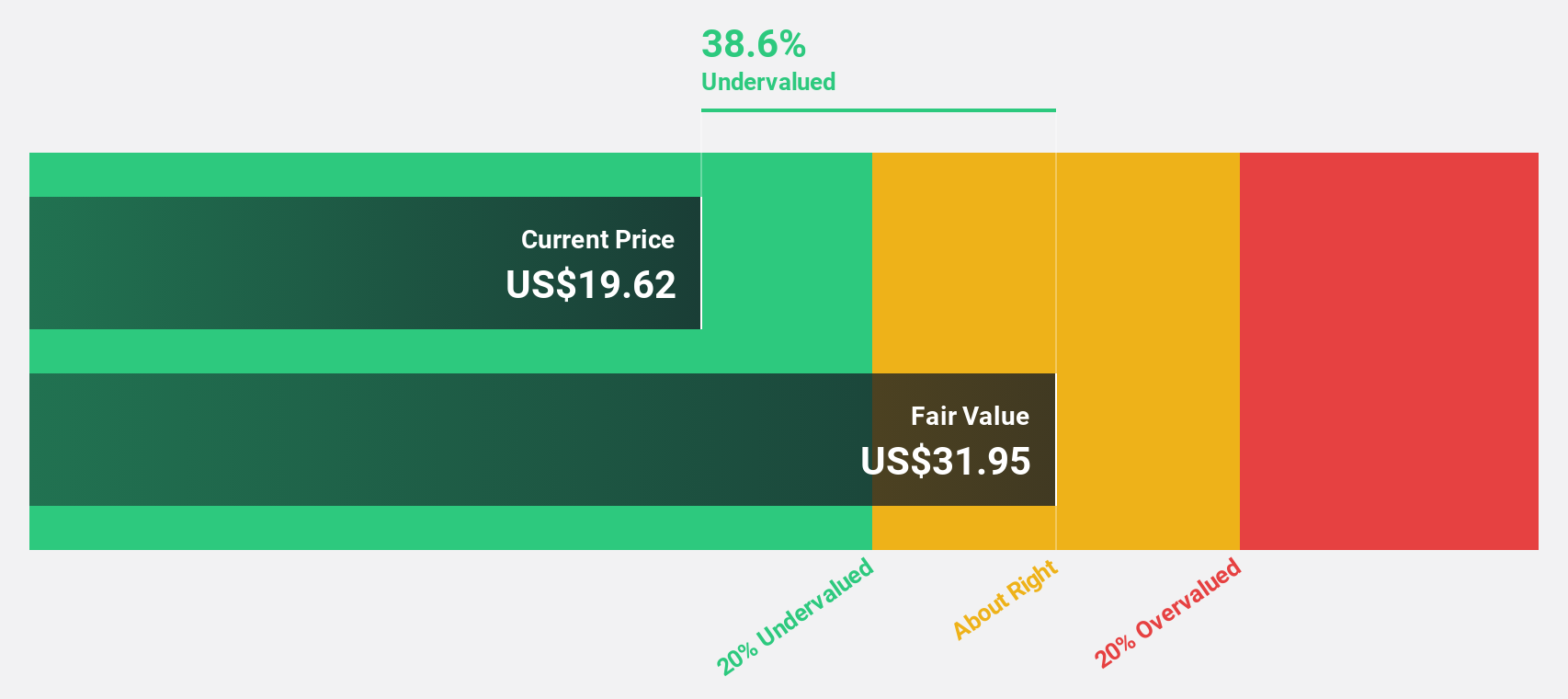

Byrna Technologies (BYRN)

Overview: Byrna Technologies Inc. is a less-lethal self-defense technology company that develops, manufactures, and sells personal security solutions across multiple continents, with a market cap of $503.12 million.

Operations: The company generates revenue of $103.53 million from its Aerospace & Defense segment, focusing on less-lethal personal security solutions.

Estimated Discount To Fair Value: 29.5%

Byrna Technologies is trading at US$22.48, significantly below its estimated fair value of US$31.88, suggesting it may be undervalued based on cash flows. Recent earnings show strong growth with net income rising to US$4.09 million for the first half of 2025 from US$2.09 million a year ago, supported by revenue increases and strategic board appointments enhancing brand and market execution capabilities in security sectors.

- Insights from our recent growth report point to a promising forecast for Byrna Technologies' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Byrna Technologies.

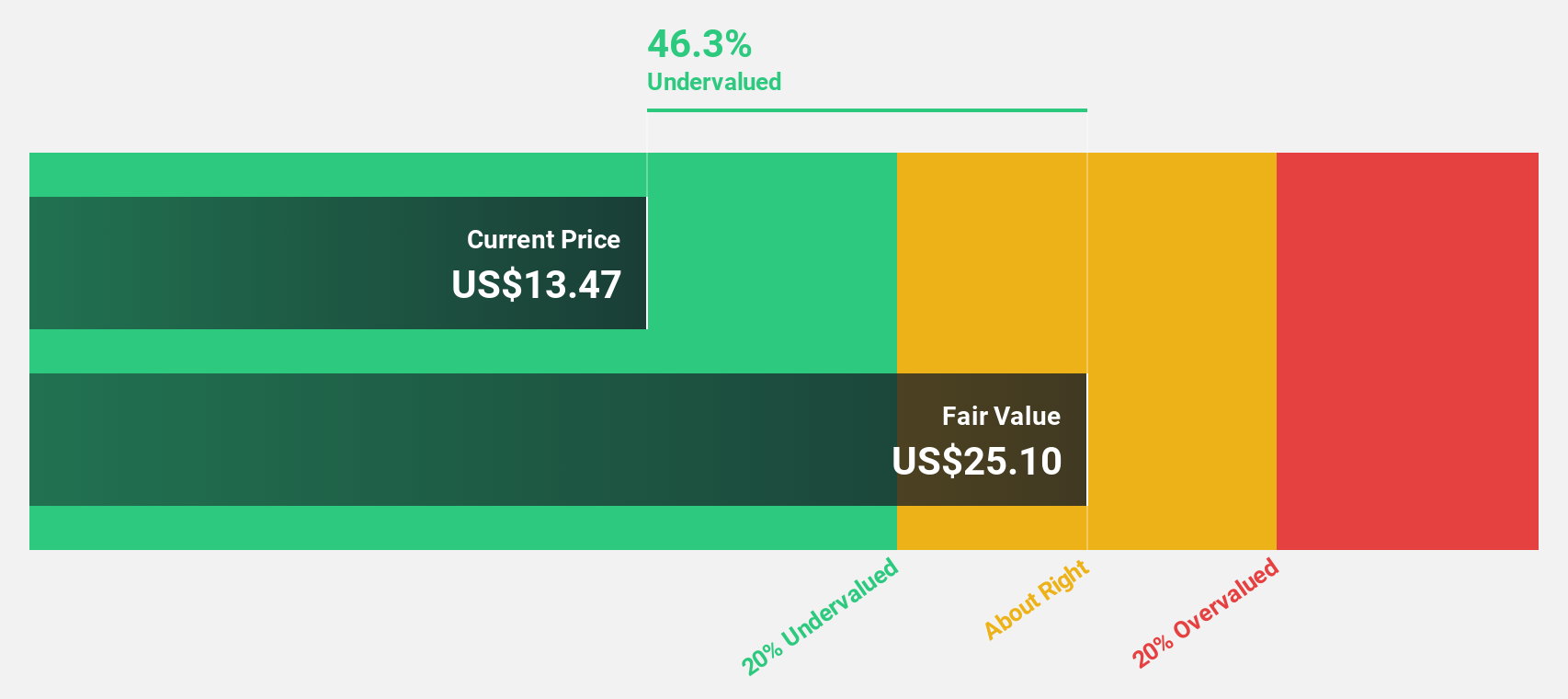

Gilat Satellite Networks (GILT)

Overview: Gilat Satellite Networks Ltd. provides satellite-based broadband communication solutions across Israel, the United States, Peru, and internationally, with a market cap of $836.60 million.

Operations: The company's revenue segments include $42.36 million from operations in Peru, with an additional segment adjustment of $307.38 million.

Estimated Discount To Fair Value: 44%

Gilat Satellite Networks is trading at US$13.91, well below its estimated fair value of US$24.84, indicating potential undervaluation based on cash flows. The company recently secured over $7 million in orders for SATCOM terminals from the U.S. Army and a $25 million agreement with Peru's Pronatel, boosting its revenue base. Despite large one-off items impacting results, earnings are projected to grow significantly faster than the broader U.S. market rate.

- Our growth report here indicates Gilat Satellite Networks may be poised for an improving outlook.

- Get an in-depth perspective on Gilat Satellite Networks' balance sheet by reading our health report here.

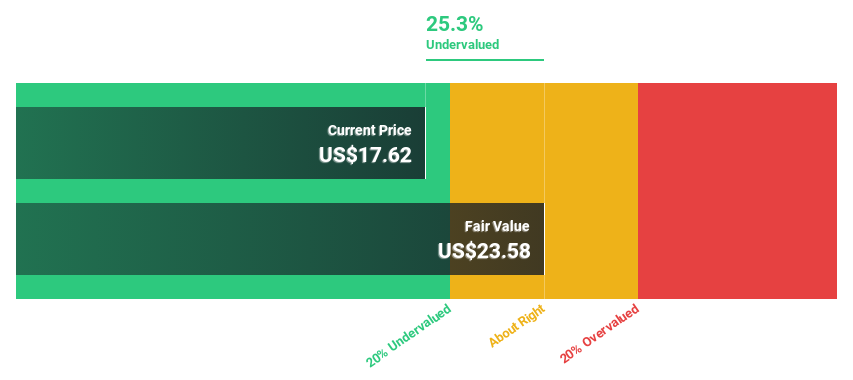

SolarEdge Technologies (SEDG)

Overview: SolarEdge Technologies, Inc. designs, develops, manufactures, and sells DC optimized inverter systems for solar PV installations across various international markets and has a market cap of approximately $2.20 billion.

Operations: Revenue Segments (in millions of $): SolarEdge Technologies generates revenue through its DC optimized inverter systems for solar PV installations across the United States, Germany, the Netherlands, Italy, the rest of Europe, and other international markets.

Estimated Discount To Fair Value: 44.4%

SolarEdge Technologies, priced at US$38.62, is significantly undervalued compared to its fair value estimate of US$69.42. Despite a volatile share price and ongoing net losses, the company's revenue is projected to grow faster than the U.S. market average at 14.5% annually. Recent strategic expansions in manufacturing and partnerships for solar technology and EV infrastructure highlight its potential for future profitability, with earnings expected to improve substantially over the next three years.

- According our earnings growth report, there's an indication that SolarEdge Technologies might be ready to expand.

- Unlock comprehensive insights into our analysis of SolarEdge Technologies stock in this financial health report.

Turning Ideas Into Actions

- Investigate our full lineup of 203 Undervalued US Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives